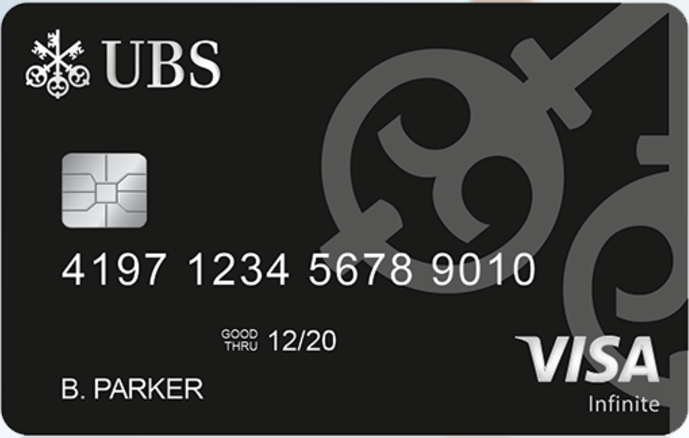

New Luxury Credit Card from UBS

UBS today announced that it will launch a new premium product. The UBS Visa Infinite credit card will become available on May 27. Keeping up with Chase, Amex and US Bank, this will also be a metal credit card and it is designed to meet the luxury lifestyle needs of high and ultra-high-net-worth clients as per the press release.

The UBS Visa Infinite credit card replaces the current UBS Preferred Visa Signature credit card with no change in the $495 annual card fee. Existing UBS Preferred Visa Signature credit card clients will automatically receive the UBS Visa Infinite credit card.

Travel Benefits

The card will have some of the usual perks we’ve seen on premium cards

Priority Pass Select

The Priority Pass Select offers access to over 1,000 participating airport lounges worldwide. Membership is required to access participating lounges. To request your complimentary membership card, visit ubs.com/prioritypassselect. The pass gives you unlimited access.

$250 Airline Fee Credit

This is a nice benefit that offsets the annual fee quite a bit, but it only applies to one selected airline. Qualifying Airline Purchases must be charged to a UBS Visa Infinite credit card and may vary by airline. UBS and Visa rely on airlines to submit the correct information for these transactions. Enroll in this benefit by calling us at 888-762-1232 or call collect 201-352-5257 when outside the U.S.

Visa Infinite Discount Air Benefit

Save $100 on domestic airfare with your UBS Visa Infinite credit card. Offer valid on purchase of between 2 and 5 U.S. domestic roundtrip coach tickets per reservation when purchased through www.VisaDiscountAir.com/ubs.

$100 Credit for Global Entry/TSA Pre✓

$100 statement credit per card every four years in connection with the Global Entry program application fee.

$500 Any Airport Club statement credit

You are eligible for a statement credit of up to $500 if your total spending on your card was $50,000 or greater during either the current calendar year-to-date or the prior calendar year. You may claim the credit only once for each year in which you qualify for a credit. If you do not claim the credit in a year, it will not carry over into subsequent years.

I don’t think many people will be able to reach the $50K requirement.

12 Complimentary Gogo in-flight Wi-Fi sessions

12 complimentary Inflight Wi-Fi Passes will be available to you at no additional cost after you complete the online enrollment. Passes are valid for 12 months from the date you register your card for this benefit. Any unused Passes at the end of the 12 month period will expire.

Enrollment is required at visa.gogoair.com/UBS prior to flying; registration is not available in flight.

Other Travel Benefits

- Primary insurance coverage on car rentals

- No foreign purchase transaction fees

- 24/7 concierge service

- ATM rebates, up to $10 each

- Access to Visa Luxury Hotel Collection

Sign-Up Bonus

Based on the press release, the card comes with a 50,000 points sign-up bonus, or 25,000. Most likely the 50K bonus is just a temporary promo for the launch. To get the bonus you need to spend $3,000 in spend in the first 3 months. Must apply by December 31, 2017.

Earning and Redemptions

UBS Visa Infinite credit card clients earn 3x points on commercial air travel, 2x points on gas and groceries and 1 point on all other eligible purchases. There’s no cap on how many points you can earn.

The best redemption is on airfare, where you get a maximum value of up to 1.8 cents per reward point.

You can redeem 25,000 rewards points for one ticket up to $350 or 50,000 rewards points for one ticket up to $900 on any commercial airline. Tickets must be booked through UBS and charged to your UBS Visa Infinite credit card.

Once your purchase is complete, applicable rewards points per ticket will be deducted from your account and a credit posted to your credit card account for the ticket price.

For tickets costing more than $350 or $900, you must pay the difference using additional rewards points at a rate of 5,000 points for any additional cost of up to $50 of ticket value. Additional payments may be made only in increments of 5,000 points.

The bad part about redeeming for airfare is that you must cover the full cost of ticket with rewards points.

Other redemption options are statement credit for 1cpp or paying for the annual fee at 1.4cpp.

Applying for the Card

The UBS Visa Infinite credit card will become available on May 27. You can check out the card page at ubs.com/visainfinite but must apply by calling 888-762-1232. I’m not sure if online application will be available. Furthermore, there might be restrictions on who can apply since it’s stated that the card is targeting ultra-high-net-worth clients. We’ll know more in a few days.

Conclusion

This is clearly an attempt to compete with all the new premium cards we’ve seen enter the market in the last year. The card comes with some decent benefits but nothing that really stands out. Most people will probably have Priority Pass and Global Entry/TSA PreCheck already and $500 airport club statement is unrealistic. You get $250 airline fee credit and a the $100 Visa Infinite discount, but you’re paying a $495 annual fee that is not waived the first year. The bonus definitely makes it worth it the first year, but I’m not it is worth it for many after that.