$1,000! Highest Ever Bonus for Capital One Spark Cash Visa Business Card

Capital One has two increased bonuses for the Spark Cash Visa Business Card. You can get either a $750 bonus or a $1,000 bonus, but they both come with high spending requirements. Let’s take a look at the details.

$1,000 Bonus

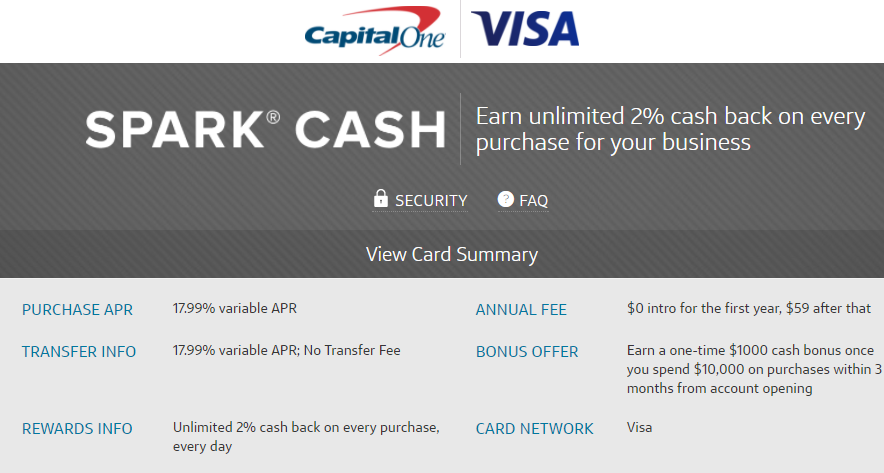

Earn a one-time $1000 cash bonus once you spend $10,000 on purchases within 3 months from account opening.

$0 intro for the first year, $59 after that

$750 Bonus

Earn a one-time $750 cash bonus once you’ve spent $7,500 on purchases within the first 3 months from account opening.

$0 intro for the first year, $95 after that

Analysis

There’s two issues with these offers. The first being that Capital One pull from all three credit bureaus when you apply for a credit card. You could freeze Experian or Transunion and they will still approve you with only two pulls. That’s a little more acceptable, but still the fact that Capital One business cards report to personal report will make this card undesirable for those with 5/24 worries.

Then there’s the spending requirement. You need to spend either $10K or $7.5K, depending on which offer you’re going for. That’s a lot of spending to be done in three months. So keep that in mind before applying and make sure you have the means to complete it.

Now on to the good part, the bonus. A $1,000 signup bonus is rare for a credit card. That bonus basically gives you 10% back on $10K spending. On top of that, the card earns 2% cashback everywhere, so you will be earning 12% on all your spending for a total bonus of $1,200. And the annual fee is waived for the first year.

Conclusion

This is the best offer we have seen for the Spark Cash Visa Business Card. If you can handle the high spending requirement and are not worried about the credit pulls, then you should definitely apply. There’s no expiration date, but I doubt this offer will last long.

HT: Doctor of Credit

[…] cash bonuses are about as good as it gets, besides that $1000 offer from Capital One. Travel rewards credit cards offer multiple sign up bonuses for more than 50,000 […]

What about shutdown risk for aggressive spending in those first three months?

I just had a colleague who had his account shutdown for:

“We have observed activity on your account that is not consistent with our expectations of usage for commercial or small business purposes. “

Shut down from Capital One?

They hit me with a shutdown, my first ever. SOBs waited until i was over $9,300 to shut me down. It sucked losing out on the $1,000 bonus, but it was almost as bad to waste $9,300 of spend on 2% cash back.

card reports on personal scores making it worthless to those who want chase cards 5/24…. that is big omission from the article!!

That’s true. I thought I had mentioned it when talking about the credit bureaus. I’ll update. Thanks!

Do you know if this $1000 is a statement credit or a check? I’d much rather have a check.

Actually it’s better as statement credit. Rebates are not taxable. A check comes as taxable interest like the high yield interest which reports on 1099-INT

Wrong. Not taxable as a check either.