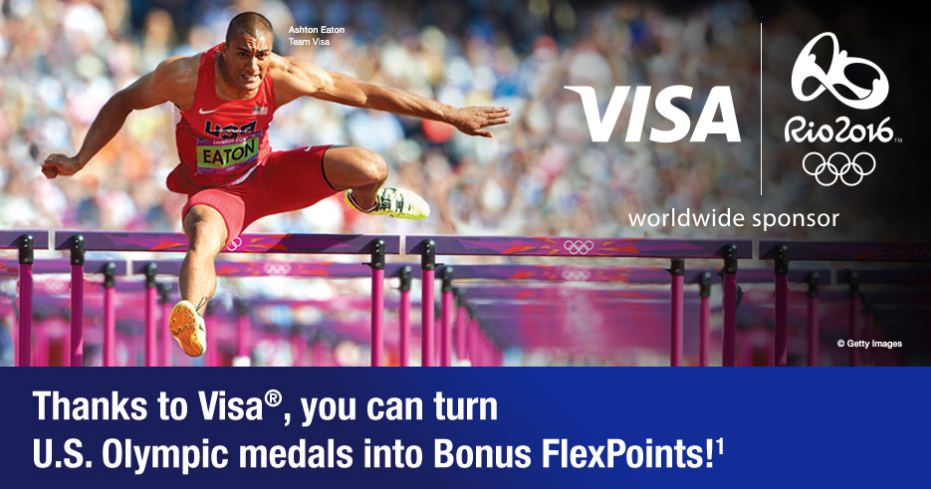

US Bank FlexPerks Olympic Bonus 2016

U.S. Bank is an official partner of the Olympics and because of their partnership they often run promotions coinciding with the games. This year is no different and beginning yesterday they started offering an Olympic bonus on two of their cards. Let’s take a look.

The Offer

Apply for the U.S. Bank FlexPerks® Travel Rewards Visa Card or FlexPerks Business Edge™ Travel Card between 8/1/2016 and 9/3/2016, then, upon approval, make a purchase with your new card by 9/30/2016 – and you could earn Bonus FlexPoints for every medal Team USA wins at the Rio 2016 Olympic Games, courtesy of Visa!

Sign-Up Bonus

During the promotional period, both of these cards have a sign-up bonus of 20,000 FlexPoints after $2K spend in 4 months.

Olympic Bonus

In addition to the sign-up bonus, the Olympic bonus is based on the U.S. team’s medal count. Bonus points are awarded as follows:

- Each Gold medal earns 200 bonus points

- Each Silver medal earns 100 bonus points

- Each Bronze medal earns 50 bonus points

Key Terms

- Offer valid to new U.S. Bank FlexPerks Travel Rewards Visa Signature and U.S. Bank FlexPerks® Business Edge Travel Rewards Visa Card applicants who apply at any participating U.S. Bank branch location, call 24-hour banking or apply online at flexperks.com/visapromo between August 1, 2016, and September 3, 2016.

- Applicants must be approved for either the FlexPerks Travel Rewards Visa Signature or FlexPerks Business Edge Travel Rewards card and make a minimum of one net purchase to the Account Owner’s individual account by September 30, 2016, to receive the Visa Rio Bonus FlexPoints.

- The awarded amount of bonus FlexPoints will be based upon the results of the Rio 2016 Olympic Games.

- The Visa Rio Bonus FlexPoints are in addition to the one-time enrollment bonus FlexPoints offer and are not contingent on meeting a spend threshold.

Analysis

The normal offer on these cards gives the same 20K bonus points, however it requires $3,500 in spend. So not only do you get the Olympic Bonus, but you also have a lower spend threshold. Additionally, the Olympic bonus could mean a 50%+ increase in the normal sign-up bonus when all is said and done.

For example, here is what you would earn hypothetically based on the London 2012 medal count:

- 49 Gold = 9,200 FlexPoints

- 29 Silver = 2,900 FlexPoints

- 29 Bronze = 1,450 FlexPoints

- Total Bonus = 13,550

In that scenario, the 33,550 combined bonus is a 68% increase over the normal 20K bonus. I think it is pretty safe to say that given past medal counts, you should earn at least 10,000 bonus FlexPoints which is a great deal, especially considering the decreased spending threshold.

Also, remember that FlexPoints are worth up to 2 cents each when redeemed for travel. Potentially, this sign-up bonus could be worth up to $600 or more. Of course FlexPerks isn’t the simplest program to learn, so I recommend understanding it before making a decision. Frequent Miler has a good post on how to maximize redemptions.

Personal or Business

Since you can get the bonus on either the personal or business card, here are some key features of each.

U.S. Bank FlexPerks® Travel Rewards Visa Card

- 1X FlexPoints per dollar on normal purchases.

- 2X FlexPoints on the category you spend the most on (at gas stations, grocery stores or airlines) and at most cell phone service providers during each billing cycle.

- 3X FlexPoints on qualifying charitable donations.

- No foreign transaction fees.

- $49 annual fee. (Waived the first year.)

- 12 complimentary Gogo inflight WiFi passes.

You can find the terms of this promotion and an application on the Olympic Promo Page.

FlexPerks Business Edge™ Travel

- 1X FlexPoints for every $1 of eligible net purchases charged to your Card.

- 2X FlexPoints for every net $1 spent at gas stations, office supply stores or airlines – whichever you spend most on each monthly billing cycle – and at most cell phone service providers.

- 3X FlexPoints for your charitable donations.

- $25 Airline Allowance offers reimbursement for up to $25 per air travel award ticket toward baggage fees or in-flight food and drinks.

- Receive a credit for your $55 annual fee back to your account if $24,000 or more in net purchases posts to your company’s account within your 12-month annual statement year.

- No Foreign Transaction Fees.

- $55 annual fee. (Waived the first year.)

You can find the terms of this promotion and an application on the Olympic Promo Page.

Conclusion

Since I do not have the FlexPerks Travel Rewards Visa and since U.S. Bank is underrepresented in my credit card portfolio, I think I’ll pick one up given the overall value of the bonus and the reduced spending threshold. Plus, it will no doubt make me more interested in the Olympics since every medal means more points! Go Team USA!

How long does it take for the olympic promo points to post after first purchase?

Does anybody have experience applying for both personal and business cards at the same time? Will it result in a single hard pull?

Where on the promo app page is the field to enter the referral code located? (I completed and saved the application but didn’t submit yet as I didn’t find it)

Can you get the bonus on both cards (personal and business)? My wife presently already has the personal card, and I closed mine a couple of years ago. We both have businesses, so can we get the signup bonus for the business card, having (had) the personal card? I called up USBank to ask, and they couldn’t find the promo at all.

If I’ve had the visa before, can I still get the sign up bonus?

The personal card is churnable I believe, however U.S. Bank is strict and the terms do say, “Offer valid to new U.S. Bank FlexPerks Travel Rewards Visa Signature and U.S. Bank FlexPerks® Business Edge Travel Rewards Visa Card applicants.” Hard to tell how that would be enforced.

I think you can use a referral for this too…do you know how many points those pay out?

I believe the referral is 5K points and I believe it will work, but I would be careful considering the promo page says you must apply through that specific app link. That may not be enforced, but it could be.

I think you can just add the person’s referral code filling out the promo app

Thanks. Good to know!

Do you know where on the promo app page this field is located?