Which Credit Cards Offer Priority Pass Membership? Let’s Compare Them.

Priority Pass membership is a coveted benefit in the points and miles game. In fact, I’d wager that it’s nearly taken for granted that people in the “travel hacking” hobby maintain a Priority Pass membership. Yes, many cards offer this benefit, but they’re not all created equal. Let’s look at how they stack up and see not only which credit cards offer Priority Pass membership but which one is the most valuable.

What is Priority Pass?

Priority Pass is a global lounge network that gives members access to over 1200 airport lounges worldwide. Priority Pass membership is offered as a credit card benefit on a bunch premium travel cards. The value of Priority Pass benefits vary based on the specific credit card’s rules and whether you’re flying with guests.

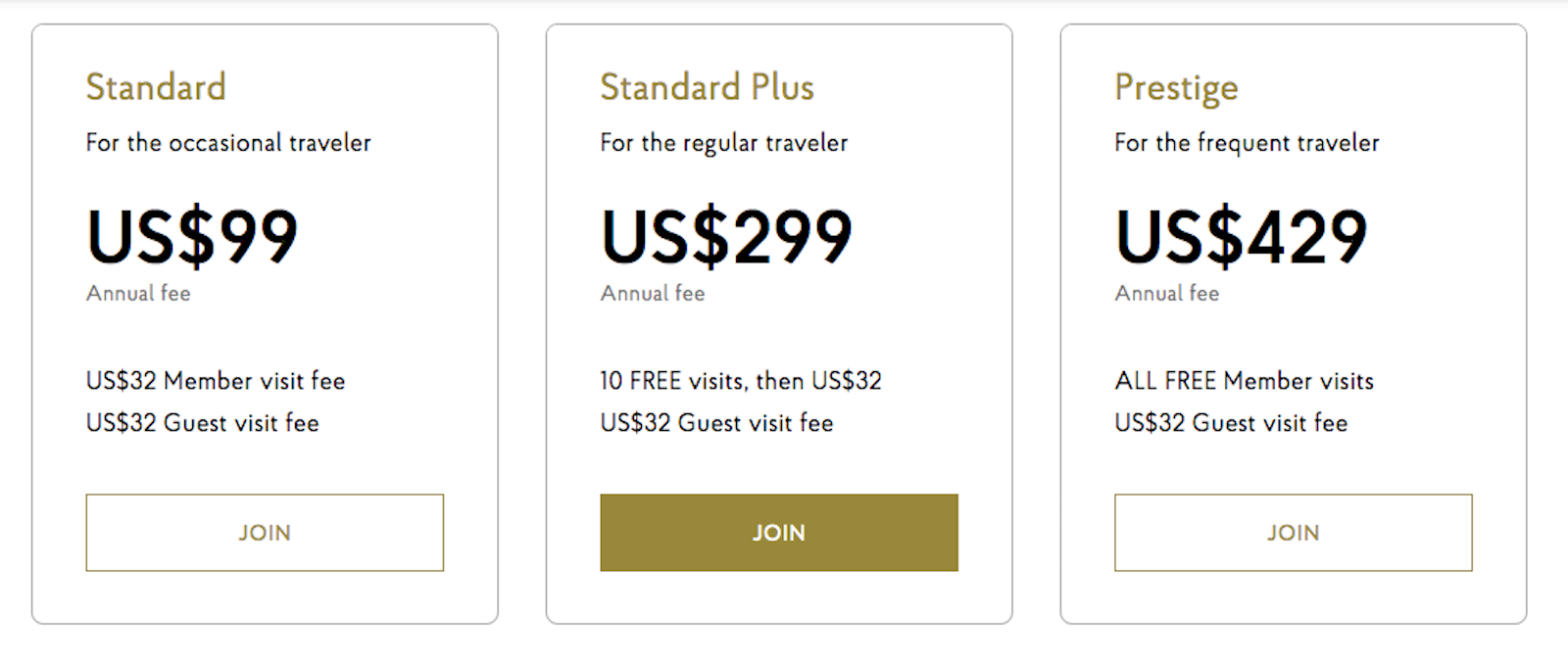

Priority Pass Membership is also available for purchase on their official site. The Priority Pass membership prices are steep and don’t let you bring in guests. However, you can get free food, drinks, a quieter space to wait for your flight, and free wifi. I hope you see why this is a coveted benefit.

Which Credit Cards Offer Priority Pass Membership?

The simple answer is “many”, but not all memberships are created equal. How many times in a year can you visit? Which places can you visit – only the lounges, or the restaurants and spas also? Can you bring in guests? These are important things to consider when evaluating which credit cards have Priority Pass membership.

It’s important to note that Priority Pass doesn’t just offer access to VIP lounges at airports but also offers access to restaurants in some airports (ex: you and 2 guests each get $27 to spend at this restaurant) or Airport Minute Suites (sleep/shower here for an hour as a ‘visit’). Some types of membership don’t allow you to access these. Let’s rank these from the top to the bottom in terms of value of the membership.

The Ritz-Carlton Rewards Visa

In my eyes, this is the best Priority Pass membership in terms of value. Here’s what it offers, all included in your membership for the $450 annual fee:

- Unlimited Priority Pass visits per year

- Can bring unlimited guests (subject to limits of the lounge you’re visiting)

- Can visit all Priority Pass facilities

- Authorized Users on the card can also enroll for a membership

- This card is no longer available for applicants though.

Barclays Mastercard Black & Mastercard Gold Cards

I lumped the Barclays Mastercard Black and Barclays Mastercard Gold together because they offer the same type of membership. They offer the 2nd best value of all Priority Pass memberships (they are second because of the higher $495 annual fee). This is a terrible card overall though unless you get the fee waived as an active military member.

- Unlimited Priority Pass visits per year

- Can bring unlimited guests (subject to limits of the lounge you’re visiting)

- Can visit all Priority Pass facilities

- Authorized Users on the card can also enroll for a membership

Citi Prestige

Th Citi Prestige card has a unique feature that your guest limit doesn’t apply to immediate family.

- Unlimited Priority Pass visits per year

- Can bring 2 guests OR all immediate family members traveling with you

- Can visit all Priority Pass facilities

- Authorized Users on the card can also enroll for a membership

Click Here to compare travel rewards credit cards

Chase Sapphire Reserve

For most people new to this hobby, the Chase Sapphire Reserve is probably your introduction to Priority Pass. Here are the details of your membership:

- Unlimited Priority Pass visits per year

- Can bring 2 guests and then pay after that (usually $27)

- Can visit all Priority Pass facilities

- Authorized Users on the card can also enroll for a membership

- Learn More

American Express Platinum Card

There are multiple types of the American Express Platinum card (such as the Schwab version), but they all offer the same benefits.

- Unlimited Priority Pass visits per year

- Can bring 2 guests and then pay after that (usually $27)

- Can only visit Priority Pass lounges, not the restaurants, etc.

- Authorized Users on the card can also enroll for a membership

- Check to see if you are targeted for the 100K welcome offer.

American Express Business Platinum Card

Coming in just behind the personal version is the American Express Business Platinum by way of a slightly higher annual fee, the membership to Priority Pass is the same.

- Unlimited Priority Pass visits per year

- Can bring 2 guests and then pay after that (usually $27)

- Can only visit Priority Pass lounges, not the restaurants, etc.

- Authorized Users on the card can also enroll for a membership

- Limited time 100K welcome offer

City National Bank Crystal Visa Infinite (after January 1, 2020)

As we recently covered, the Priority Pass membership on the CNB Crystal Visa Infinite will take a nosedive in value on January 1. The annual fee will stay at $400, but you can no longer bring unlimited guests. You can add authorized users who can get their own membership, but rumors are swirling the AU cards will start costing more after January 1, also. With its new restrictions, I rank this membership lower than others.

- Unlimited Priority Pass visits per year

- Each guest costs $32

- Can visit all Priority Pass facilities

- Authorized Users can enroll for a membership (up to 2 users)

American Express Hilton Aspire

The American Express Hilton Aspire’s $450 annual fee is lower, but the benefits are reducing as we move down the line. This is the first card where the Authorized Users can’t get their own membership and can only enter as your guest.

- Unlimited Priority Pass visits per year

- Can bring 2 guests and then pay after that (usually $27)

- Can only visit Priority Pass lounges, not the restaurants, etc.

- Authorized Users cannot enroll for a membership

- The Hilton Aspire may be the best all around premium perks card out there.

American Express Marriott Bonvoy Brilliant

The American Express Marriott Bonvoy Brilliant was a toss-up with the Hilton Aspire, because the benefits and the fee are the same ($450). I put it below the Aspire because the Hilton Aspire is the better card overall.

- Unlimited Priority Pass visits per year

- Can bring 2 guests and then pay after that (usually $27)

- Can only visit Priority Pass lounges, not the restaurants, etc.

- Authorized Users cannot enroll for a membership

American Express Hilton Honors Business

The American Express Hilton Honors Business card was a toss-up with the Hilton Surpass, because the benefits and the fee are the same ($95). I put it above the Surpass because it does not count towards Chase 5/24 status when applying.

- 10 Priority Pass visits per year

- There are no free guests; guests use one of your vists

- Can only visit Priority Pass lounges, not the restaurants, etc.

- Authorized Users cannot enroll for a membership

- Learn More

American Express Hilton HHonors Surpass

Similar to the Hilton business card, the American Express Surpass card’s Priority Pass benefits are reduced compared to the premium cards. Less areas to visit and less overall visits. Although this may be the best set up for families.

- 10 Priority Pass visits per year

- There are no free guests; guests use one of your vists

- Can only visit Priority Pass lounges, not the restaurants, etc.

- Authorized Users cannot enroll for a membership

- Learn More

U.S. Bank Altitude Reserve

Yes, the number of “people in the door” per year on this membership is higher than the Hilton business card and the Hilton Surpass, but the annual fee to get that is 4x higher. Which makes the overall value lower.

- 4 Priority Pass visits per year

- 4 guests allowed per visit (restaurants often limit the guests to 2)

- Can visit all Priority Pass facilities

- Authorized Users cannot enroll for a membership

Final Thoughts on Which Credit Cards Offer Priority Pass Membership

Not all memberships are created equal. You need to compare the value against the price paid. If you’re going to be using it constantly, you will probably need an unlimited membership. If you mostly fly with a family member who has a membership, you don’t need it as much. A handful of visits on a card of your own will probably do the trick. Do you want/plan to use the restaurant feature? How many guests do you usually have with you?

Compare these things and then compare them against the annual fee on the card that offers the membership type you want. Unfortunately, the Ritz-Carlton Rewards card is no longer open for applications. The Mastercard Black & Mastercard Gold aren’t great cards for this hobby (note: no welcome offer of any kind, high annual fees). So what’s the best membership available for someone applying today? Probably the Citi Prestige.

[…] be that guy – I found this very convenient and very would have been useful to me yesterday article detailing all the different Priority Passes after I had finished my own […]

Thanks Ryan! Can the AU get PP as well? The card is pretty much the only option remaining for all the Visa Infinite benefits, including $100 Visa flight discount.

I didn’t see anything in the info for the card benefits that said authorized users get reduced benefits, but I also didn’t see anything that confirms the AU can get the membership. Never hurts to just ask them, since there’s no confirmation of yes or no in what I read.

If you have a Marriott Bonvoy Boundless card, I believe you can product change to the Ritz Carlton card. If you’re able to product change, will you be able to get the Priority Pass privileges as you laid out above?

Yes, you would have the card, and I believe all of the benefits function as normal. You need to have the Marriott for at least 12mo before you can product change to the Ritz-Carlton card. Wouldn’t hurt to send a secure message to Chase acting if you get all the same benefits as normal on the card after product change. It not only confirms it, but it’s better than a phone call: you have something in writing.

Nice post! Any idea on the UBS Visa Infinite card?

It includes unlimited access, and you can add 24 authorized users for free, but I can’t find any info on the guest allowances. I’m not super familiar with this card, since it doesn’t offer any kind of sign-up bonus anymore, so that’s the extent of my knowledge on it. Tons of perks, no bonus.