Alliant 2.5% Cashback Visa Adds $10K Monthly Limit

Alliant Credit Union offers the Alliant Cashback Visa Signature Credit Card that earns 3% cashback on all purchases for the first year and 2.5% after that. That earning rate puts this card well above other options for non-bonused spending. There’s are many cards that offer 2% earning, but an extra 1% for a year and 0.5% after that can make a huge difference for big spenders.

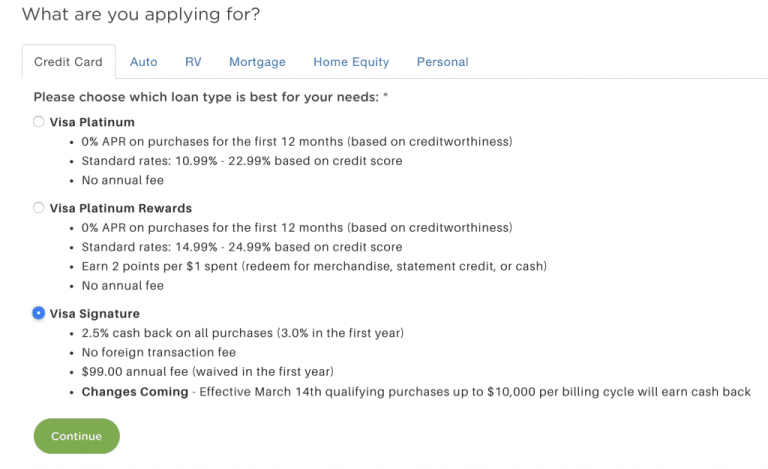

Now Alliant is making some negative changes. It is adding a limit to the cashback that you can earn with this card. Starting March 14th, only qualified purchases up to $10,000 per billing cycle will earn cashback. Here’s the notice that you will see when logged in and applying for the card:

Looks like this is for new applications for now, but it will likely apply to existing cardholders as well. For people that are spending way above that threshold, this is a big hit. The card comes with a $99 annual fee after the first year, but with enough spend it is still well worth it. Even with the new limitation it makes sense to use the card for non bonused spend, over a 2% card. If you are spending exactly $10,000 a month for example, you would be earning $50 more than using a 2% card. Over a year that is an extra $600. Even after paying the annual fee, you get $501 more.

Conclusion

This is still a great card, even with the new limitation. There’s no question that the first year is lucrative for big spenders, but even beyond that it makes sense to keep the card.

HT: Doctor of Credit

That is disappointing. Awhile back, they eliminated cash back on gift card purchases too. It was my “go to” card but it is now only marginally better than a 2% card because I have to pay the $99 fee and track my purchases so I don’t drop down to 1% after spending $10,000.