(Targeted) American Express SPG Spending Offer

My buddy sent me an email that he got from American Express for a spending offer on his SPG card. This is probably an enticement to win over card holders after the changes to the card that was announced recently.

Barclays does something similar around the time the card’s annual fee is coming up. I am not sure if that how American Express is picking who they send the offer to or if it is based on spend numbers etc.

RELATED: What Should you do with Your SPG Card Going Forward

Details

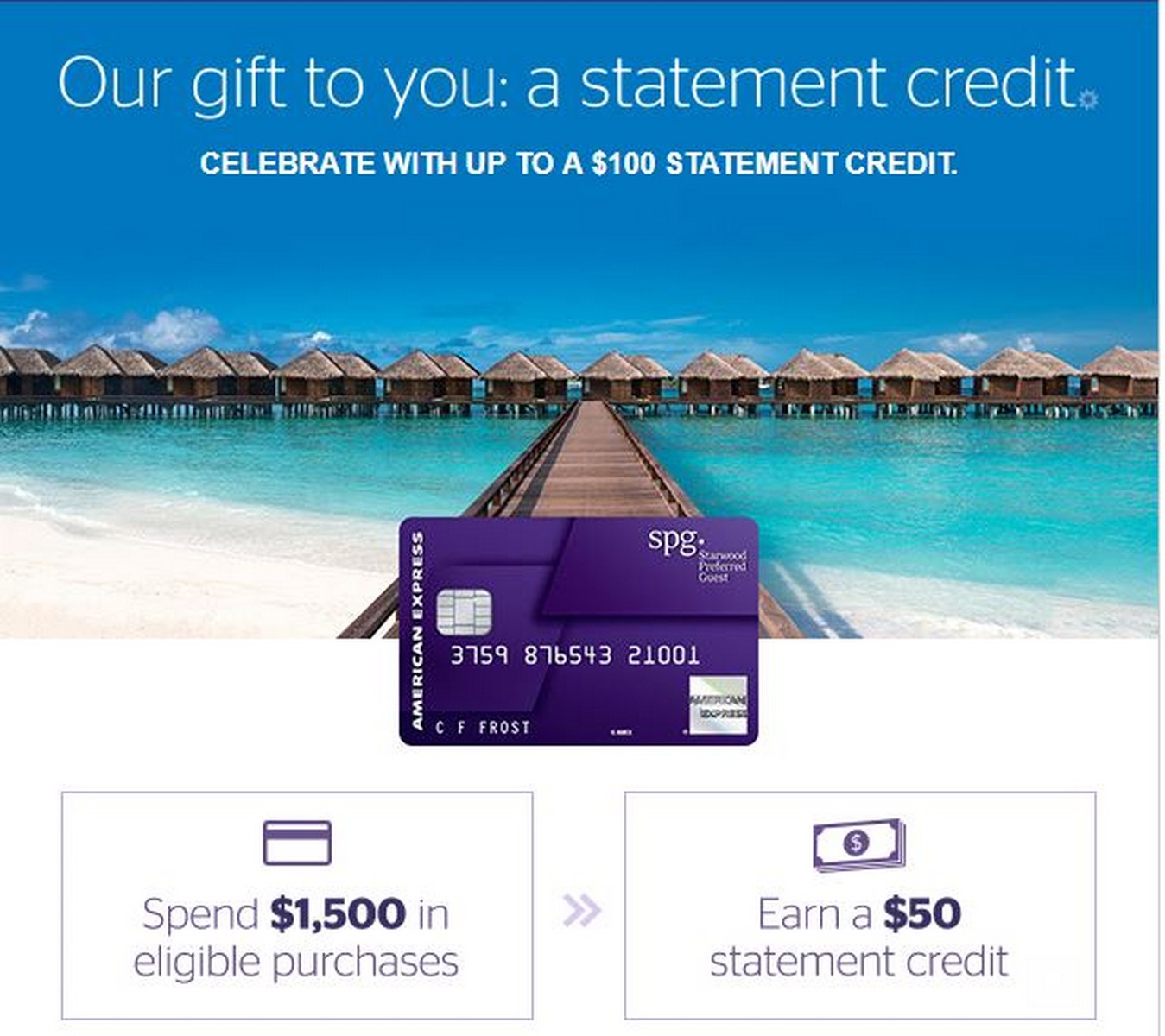

The details of the offer are as follows:

| 1. | Register your Starwood Preferred Guest Credit Card from American Express by May 31, 2018. |

| 2. | Make $1,500 in eligible purchases using your Card by August 10, 2018. |

| 3. | Earn your $50 statement credit. |

You can do the offer 2 times for a total statement credit of $100. That is a 3.3% return before you add in any rewards you earn which would be another 2% (minimum).

Link to see if you were Targeted

Conclusion

This is a great offer if you are able to get it. Remember that the SPG card still earns what is essentially 3 Marriott points per dollar until August. That is when it drops to 2 Marriott points per dollar. Be sure to get the spending completed as soon as possible.

Remember that Amex’s RAT team is on the prowl and they have denied bonuses like these because of gift card purchases in the past.

Hat Tip Ryan J.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I got nuthin’ 🙁

I didn’t get the email, but when I clicked on your “link to see if you were targeted”, a verification code appeared, but I couldn’t get any further. I called AMEX today to ask, and after about 20 mins, the rep said I have the offer. I still don’t have an actual email verification, however, so I am doubtful whether or not it has gone through.

Maybe try it again online a little later or get it confirmed via chat and have them give you the chat ID as evidence?

Your link includes an RSVP code. I think it’s customized to your account (you may want to remove it) since when entering it, Amex says you’re already enrolled in the promo. Using my own account info for the same promo page says I’m not targeted.

Got it, or rather spouse got it, which raises question number one: Will AU spend count toward the $1,500 (then $3,000, ’cause why stop at $1,500?)?

Question number two is: What are “eligible puchases”? I get that one wants to avoid GCs, but what about, say, Plastiq?

I did click wherever I could on the enrollment pages, but came up empty with respect to details.

So far Plastiq hasn’t been an issue buy YMMV. Not sure on the AU spend – I would lean towards no since AU accounts have different card numbers but that is me erring on the side of caution.

No offer for me. :(. Business card, renews in July. :/