PSA – Check Your Account For American Express Upgrade Offers

I love Amex. They’ve been so good to us over the years, and things just seem to keep getting better. In the last few days, Amex has added an additional $200 of credits to many of their already-impressive credit card offers and sweetened their referral offers with 4x Membership Rewards points at certain stores. Also, more quietly, Amex has recently released new targeted upgrade offers for existing cardholders. Here, I’ll give you an example of what I was offered on my Amex account. I bet there are additional offers available to other cardholders, as well. Here are just a few of the American Express upgrade offers currently available – including one that I find particularly excellent.

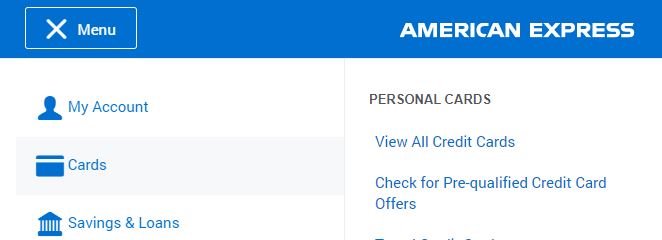

How to Check for American Express Upgrade Offers

- Log in to your Amex account.

- Click Menu.

- Then, Click Cards.

- Click Check for Pre-qualified Credit Card Offers.

Amex Platinum

In my Amex account, I was offered the opportunity to upgrade an Amex Gold card to the Platinum card. The terms of the offer are as follows:

- Earn 25k Membership Rewards points with $2k spend within six months of card membership.

- Earn 10x points at U.S. gas stations and supermarkets on up to $15k in combined purchases within the first six months of card membership.

Delta Platinum Amex

I was offered the opportunity to upgrade my existing Delta SkyMiles Gold Amex card to the Platinum card. I wasn’t offered any bonus upgrade miles, but I would imagine others have.

Hilton Amex Aspire

I was offered the opportunity to upgrade my existing Hilton Honors Amex card (no annual fee) to the Aspire card. Again, I wasn’t offered any bonus upgrade points, but I bet others have. Interestingly, I downgraded to the no annual fee card from the Aspire only a few weeks ago.

American Express Upgrade Offers Analysis

The Delta and Hilton offers will obviously be most appealing to anyone offered a miles/points bonus for upgrading. Of course, some who have held the Delta Platinum or Aspire previously and need the benefits of those cards again may benefit from an upgrade.

The true standout in my opinion is to upgrade a Gold to a Platinum. Let’s crunch the numbers:

Amex Gold

- An Amex Gold cardholder can maximize the 4x supermarket category with $25k annual spend for 100k Membership Rewards points.

- This cardholder can also take advantage of $20 in monthly credits (Uber/Uber Eats and Grubhub) and the $100 airline fee credit (if he or she has held the card long enough).

- $250 annual fee

Amex Platinum

- If that same Gold cardholder decides to upgrade to the Platinum, he or she can earn 25k Membership Rewards points with $2k spend in six months.

- Additionally, the cardholder earns 10x in the supermarket AND gas station bonus categories for six months, up to $15k of spend. That’s 150k more Membership Rewards points for active spenders.

- And don’t forget all of the additional Platinum credits:

- $400 of airline fee credits (card membership year covering 2021 and 2022)

- $200 of Uber/Uber Eats credits (again, 2021 and 2022)

- $150 of Saks Fifth Avenue credits (again, 2021 and 2022)

- $120 of PayPal credits ($30 monthly through Jun 2021)

- $550 Annual Fee

When Is Upgrading to Platinum Worth It?

Of course, upgrading to Platinum is a no-brainer for those who have already maximized the 2021 Gold supermarket category. But what about if a cardholder hasn’t done so? By comparing the above two situations, it’s clear that many would benefit from upgrading even if they have not spent one single penny in the supermarket category on their Gold cards in 2021. Indeed, a Platinum cardholder could earn up to 175k points for $15k spend (over 11.5x) in the supermarket category compared to a Gold cardholder obtaining 100k points for $25k spend (4x). Additionally, the Platinum upgrade requires $10k less spend to obtain the far superior earn rate! And this is before even taking the additional Platinum credits into account. Some may find upgrading advantageous even if they would not maximize the 10x earn rate. As always, incorporate your own spend patterns as you crunch the numbers for yourself. Some are reporting that they are seeing no lifetime language in their targeted offers. Of course, only pursue an upgrade you are comfortable with and take into account your own personal situation.

Conclusion

Amex, never change. You’ve thrown us a variety of curveballs over the years. But on the whole, you continue to reward loyal cardholders, and most importantly, in new and creative ways. And from my view, it’s a win-win. We get more rewards from you, and you get more attention and business from us. Amex, you just get me. So many other banks don’t. Have you been targeted for any Amex upgrade offers? Did you pursue any of them?

Looked at the upgrade from Gold. Right off the bat is the warning about if you have had any version of this card before. So I bet that kills it for many folks. Might want to add that detail, IMHO.

Too bad, too as I would have jumped at that, having dropped my Platinum about a year ago, figuring I was gonna be dead in a year. They need to be less picky!

I am seeing the same lifetime language on my Gold to Plat upgrade. I think it is worth calling out in the article to check this as some folks might just click on through.

Updated.

I got the same offer for the Platinum card. I cancelled my Platinum card last year due to lack of travel. At first there was no upgrade offer. Then it was a pathetic 15K, then 25K, and now 25k + 9x bonus points on gas + groceries. I’m not planning to travel again until late summer at the earliest, so I’m going to hold pat for a better offer.

Arlington_Traveler,

I hear you. Like much in the hobby, reconciling a given offer with one’s personal situation plays a major role. Thanks for reading!

Unless the spend is an issue, 175k is probably the best you’re going to get…

Parts Unknown,

I agree, at least until the next Amex surprise, maybe. 🙂