Americans Are Saving More, Banks Get an Extra $2 Trillion in Deposits

During the coronavirus pandemic that quickly spread through the country in the last few months, spending has decreased. Most people have been staying indoors. Many businesses have been temporarily closed, especially when it comes to leisure and entertainment. Add the uncertainty of the economy in the near future, and people have been focusing their expenses on essential items mostly. A TD Bank survey for example shows that 78% of Americans have saved an average of $245 just by not going out to eat since the pandemic started.

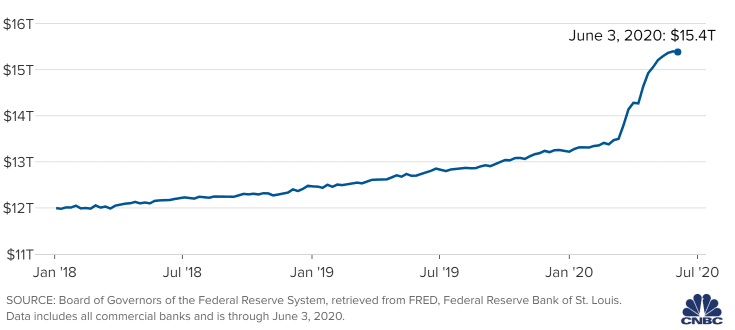

So Americans who have not had a significant loss of income have been able to save more. A record $2 trillion surge in cash has been added to deposit accounts of U.S. banks since the first coronavirus cases were discovered in the U.S. in January. The information comes from FDIC data.

Even people who have lost their jobs have received stimulus checks and generous unemployment benefits that give most people an extra $600 weekly, in addition to the benefits they would normally receive. That have resulted in some people having even more income while being unemployed. The government sent out hundreds of billions of dollars to small businesses in loans and grants.

Here is a chart published by CNBC that shows weekly, seasonally adjusted, commercial bank deposits.

Other Reasons

But it is not just individual consumers and businesses that have fueled the rise in deposits. Big banks serviced a large part of the Paycheck Protection Program. So a good share of the $660 billion fund that was set aside for it, was first deposited in bank accounts of the firms that facilitated the loans.

Additionally, some large corporations that were heavily affected by the pandemic early on, such as corporations Boeing, Ford, airlines and more, drew billions of dollars from lines of credit. That money was initially left at the institutions that issued the loans, thus increasing deposit balances.

I’m in the airport transportation business. I’m saving as much as I can because my business is non existent. Cut my cell phone plan, cable bill and just buy food. The unemployment will run out. If a second wave comes in the fall all bets are off…..

Sorry to hear that Tom. Hopefully things can get back to normal soon.

It makes sense especially if there is going to be a phase 2 of this virus you just don’t know…