Amex Changes “Reward Year” Rules For Blue Cash Cards

American Express will make changes to the way a Reward Year is calculated on Blue Cash cards. Let’s take a look.

Amex Blue Cash ‘Reward Year’

Amex Blue Cash cards have cashback benefits that are are reset every year, so knowing when a Reward Year starts is important in order to maximize credits. Here’s the earning on the cards, related to the Reward year:

- Blue Cash Everyday

- 3% CASH BACK at U.S. supermarkets, up to $6,000 per year

- Blue Cash Preferred

- 6% CASH BACK at US supermarkets, up to $6,000 per year in purchases

- Old Blue Cash

- After your first $6,500 in purchases, you will earn 5% on Everyday Purchases up to $50,000

Changes Coming June 30th

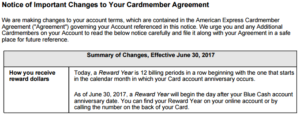

American Express is changing the way a Reward Year is calculated for your Blue Cash cards. Changes will kick in June 30th, 2017. You should see the notice at the bottom of your statement.

- BCE and BCP

- OLD RULE – Today, an annual reward year is 12 billing periods in a row beginning with the one that includes January 1.

- NEW RULE – Starting on June 30, 2017, an annual reward year will be a calendar year.

- OBC

- OLD RULE – Today, a Reward Year is 12 billing periods in a row beginning with the one that starts in the calendar month in which your Card account anniversary occurs.

- NEW RULE – As of June 30, 2017, a Reward Year will begin the day after your Blue Cash account anniversary date. You can find your Reward Year on your online account or by calling the number on the back of your card.

Conclusion

These are not major changes, but it’s good to know when the new Reward Year start exactly, so you can plan your spending appropriately and maximize returns. Hopefully this is a smooth transition.

HT: r/churning

More important is the other change:

**************************************************

**Important Change Effective 30Jun2017***

Eligible purchases do NOT include:

• fees or interest charges,

• balance transfers,

• cash advances,

• purchases of traveler’s checks,

• purchases or reloading of prepaid cards, or

• purchases of any cash equivalents.

*********************************************************