Targeted Offers Without the Once Per Lifetime Limitation

American Express is a generous bank in many ways. I have found that it is fairly easy to get approved for their cards and I also LOVE the Amex Offers program. With that said, there is one frustrating rule they have. Unfortunately, you can only get one sign-up bonus per product per lifetime on personal cards. (Note: As of 2/25/16 this rule applies to business cards as well. More info here.) Here is the language they use on card applications:

Welcome bonus offer not available to applicants who have or have had this product.

There really isn’t much wiggle room in that. If you have had a card before, no matter how long ago, you will not receive the bonus. I have heard sporadic reports that people have received a bonus again when it has been many many years since they held the card, but I have also heard many reports of people being denied. Fortunately there is one way to still get the bonus again on a product.

Targeted American Express Offers

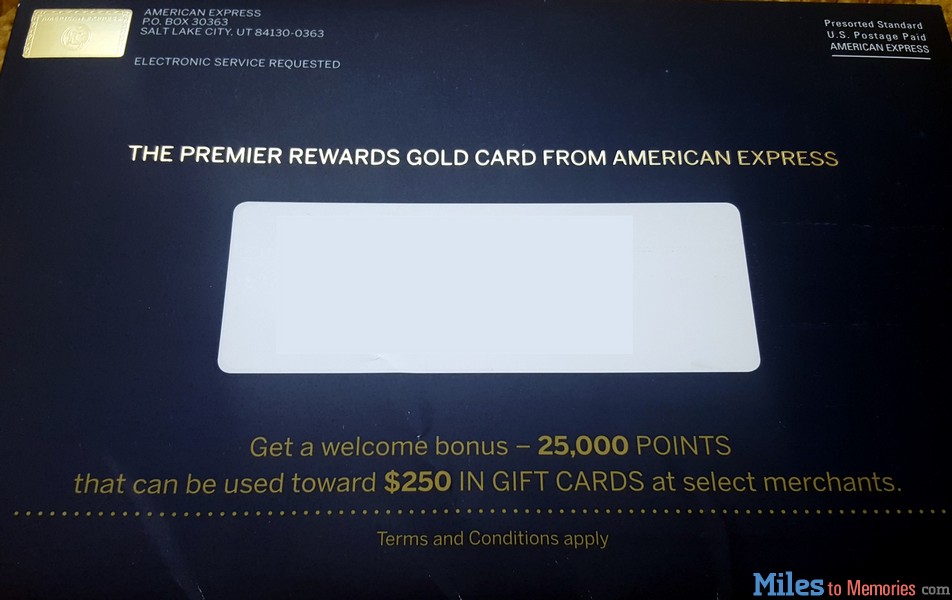

Last August I covered the news that targeted offers for American Express business cards were coming in the mail without the “once per lifetime” bonus language. Now it seems that similar offers are being sent out for personal American Express cards. My wife received the following offer in the mail last week for the Premier Rewards Gold:

Now granted 25,000 points isn’t a great offer on this card (50K offers surface somewhat regularly) what is amazing is that the “once per lifetime” language is not anywhere to be found. I went through the disclosures, welcome letter and application and there is no mention of that rule at all. The only real restriction mentioned is the hard expiration date of April 30. The card must be approved by then.

Watch For Targeted Offers

I believe American Express is sending out targeted offers to good customers who they don’t mind giving another bonus to in order to earn their business. For this reason I think it is a great idea to actively look for targeteted offers that come in the mail. I want to be clear that you aren’t guaranteed to get an offer without the language (or to get an offer at all), but this is definitely something to keep in mind or look for.

How to Make Sure You Are Opted-In

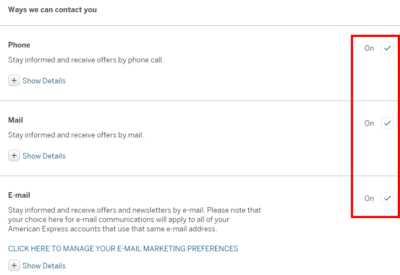

American Express has made it very easy to manage your communication preferences including whether or not you want to receive offers via email, mail or the telephone. You can also review all of your privacy and information sharing preferences as well since they are on the same page.

To manage your preferences visit: https://www.americanexpress.com/communications and sign-in to your account.

Conclusion

While there is no way to guarantee you will receive targeted offers without the once per lifetime language, you can make sure you are opted-in to offers and be sure to read anything you receive in the mail carefully. While this 25K offer for the Premier Rewards Gold isn’t the best, considering someone who has had the card normally isn’t eligible for anything, it isn’t bad either.

[…] terms 也没有这句话,很有可能可以 churn。milestomemories 上就提到 AmEx 会发出25K MRs 的 target mail offer,虽然比起 50K […]

[…] that American Express currently has a “one bonus per product per lifetime” policy and you are only eligible for this bonus if you have not had this card […]

[…] that American Express currently has a “one bonus per product per lifetime” policy and you are only eligible for this bonus if you have not had this card […]

[…] that American Express currently has a “one bonus per product per lifetime” policy and you are only eligible for this bonus if you have not had this card […]

[…] This has been possible for a while and it is still a very quick and easy way to figure out what cards you’ve had in the past, or if a very old card is still in the Amex system. Also keep in mind that just because you’ve had a card, it doesn’t strictly mean that you can’t get a bonus for 7 ore more years. See how to Avoid the “One Bonus Per Lifetime” rule. […]

I got a mail offer and an email offer on the same day Feb 19. Both have their unique RSVP codes and an offer code with the last digit being different. Yet both are 50K/$1K spend within 90 days and both expire on April 30. Neither the mailed nor the emailed offer has the restriction language.

Ended up just click the Apply Now link in the emailed offer to apply on Mar 2nd. Final charge on Mar 9th now posted to bring total charges above $1K. Went ahead to pay the full balance today as I have a short statement closes on Mar14. No pending pts showing. In fact there is not even an area for pending points in my Membership Reward account which correctly show both the Everyday and the PRG.

Hope the bonus would post smoothly as there nothing in either offer mentions about the life time only restriction.

2 years ago the 10K Everyday no fee card bonus did not post until the 3rd billing cycle and after lengthy chats with multiple reps. Finally a chat rep felt bad for me and contacted his supervisor who agreed to manually push through 10K because it had been on the 7th week and counting, and they all saw points were pending for almost 2 months. 3 days after they pushed thru the 10K, another 10K posted automatically – the manually pushed thru bonus had a tiny bit difference in the description comparing to the system generated bonus. So at the end, the system generated bonus also was posted.

And that is the first time to have the Everyday card about 2 months into its introduction. :rolleyes:

Some how despite being with AMEX since 2000 and have had various membership reward cards in the past, I never seem to receive the membership reward bonus early like others. Sigh.

Should I be concerned about them clawing back the bonus points when I close the account??

I applied for PRG@Feb.10 and received card at 2.12. Confirm with online chat that I have 50K bonus. Few days later, I received target PRG mail offer that I eligible for 50K offer with RSVP code. I couldn’t find any “once per life” language mentioned inside the mail and disclosure. It is wired that because I just apply for my first personal PRG card and amex sent me mail offer few days later.(I used VPN to apply for highest offer online). Something more wired that all two roommates received 25K PRG mail offer just one day after I got my paper offer. This is my second amex card, my first one is blue cash everyday.

I got a PRG targeted offer for 50,000 miles. No One Bonus Per Lifetime language.

I think this is the future with Amex. They will choose which customers they want through targeted offers.

[…] As I reported the other day, American Express does send out targeted offers without this language from time to time. There really isn’t any way to ensure you get targeted other than opting in to marketing. Even then you simply have to hope and wait. You can find out how to opt-in here. […]

Business cards all say “once per lifetime” now. Unless you get a targeted offer in the mail without the language.

Bad news. Thanks for sharing this.

The “one sign up bonus per product per lifetime” is a bit misleading. My wife had an ITT Sheraton card in the 90’s which was converted to a Starwood card when that program was created. She never received a SPG bonus. She canceled the card several years ago. She got a new SPG card a few months ago – the thought process was she never got a bonus (sign up or otherwise) for this product and this would be her first. But since she had the card before, they would not give the bonus. So Amex’s terms are accurate but the language generally employed to describe it is not.

Good point and that is why I put the exact terms in the post. I’ll try to find a better way to describe it in the future.

I’ve had my mail options set to YES for every bank for 10+ years and I never receive any offers that I actually want. Always crap from no-name banks that send me apps every few days. And I’m opted in to receive pre-screened offers of credit too.

The only mailer I ever got that was good was the Ink Plus card a few weeks ago for 60k and $0AF and I just got my card for that one. They had my business name on the mailer, and I’ve never given that to Chase. No EIN either, just sole prop. Maybe my wholesaler is selling my info, and if they are they can sell to Amex and other banks too!

Same for me regarding mail options. This is what I receive:

1. 5000 Discovery applications every hour

2. 1-3 Ink Plus offers a year for my business even though I already have the card (they pull your business info from public records)

3. The 2 Amex Gold apps I mentioned above

4. A few silly offers from no names offering me 1% back on everything and 25% APR

If you aren’t getting multi-colored Discovery apps every day, you really ain’t living!

Oh yeah, I’m getting Discover several times a week. And some other bank almost every day.

Back when I worked for the state and had tons of free time I’d bring in all my junk mail and any other crap I wanted to toss. I’d gather all the business reply mail envelopes and cram all my crap into them. If they want the mail from USPS they have to pay based on weight. If they send me crap I’ll send them crap. And boy did I!

[…] Amex Churning: The One (Targeted) Way to Avoid the “One Bonus Per Lifetime” Rule by Miles to Memories. Glad to see this happening more on personal cards as well. It’s not always bad news in this hobby, despite what some people say. […]

I appreciate you setting the record straight, Shawn. I was one of the first last year to report that I had gotten the bonus a second time. A moderator of another forum refused to believe me. And then I was told, well, the system forgets you after seven years, so maybe that’s the reason. It hadn’t been that long, and, in fact, you can see from a post above there is no lengthy gap requirement at all. The reality is that AMEX has to aggressively seek business due to the loss of Costco and Fidelity (and possibly SPG down the road). These new targeted offers (with no bonus exclusion for former cardholders) will only increase in number over time. And if CHASE soon enforces its 5/24 rule across the board, then watch AMEX become even more aggressive. Good for us!

Where in the terms would it have the “one per lifetime” wording? Thanks..

Generally where it describes the requirements for the bonus.

I have a few Amex cards and also got this 25K Gold offer in the mail. I’ve had the Plat in the past but not the Gold. So…I’m not really interested in a 25K bonus because I know they have had higher amounts in the past and if they only allow once per lifetime (in theory), I should hold off. Has anyone successfully negotiated their way to a higher bonus?

I currently do not have an Amex card, i have been waiting for the larger sign on bonus for Gold Premier Rewards card and finishing getting my Chase cards, 5/24. Wanting to know if there is a way to get targeted offers of any size from them for the Gold Premier Rewards card in order to be able to churn this card?

Yes, confirm I had the personal gold, cancelled about a year back, got a targeted mail offer for 50k, $1k spend. Got the points last month. I had also checked the terms and it made no mention of once ever. Obviously that’s why I got the mailing and points again. Funny thing, I’ve only had the card a couple months and yesterday I got the exact same offer/mailing, but this time with a different RSVP code. Could I apply for another card and keep this one open. Who knows? Doubt it. They might accept me but deny the bonus again. I called Amex about this but the rep had no idea what would happen. I also asked if my wife (who has a great credit score) could apply using my RSVP code. Rep said no, system would immediately deny her, code is tied to your name he said . . and probably social. Wonder if anyone has ever applied using someone else’s one time RSVP code and if it worked?

Thanks for sharing your experience! It used to be possible to apply with someone else’s RSVP code and I think it is still possible, however I have heard that Amex is starting to crack down a bit.

As a test, I tried using my RSPV code for my wife. When you go to the link on the paper form, it asked for two things:

1. The RSVP code

2. Last 4 digits of your SSN

When I put the last 4 of my wife’s SSN in the field, it said no match and stopped me cold right there, wouldn’t even take me to the application page.

Does once in a lifetime bonus apply to co-branded ( like SPG) Amex as well?

Yes it applies to all American Express issued charge and credit cards, unless you receive a targeted offer without the language.

In October 2014 I cancelled a business gold amex. In Sept 2015, with a completely new business and new EIN, I applied through a targeted mailer. They will not honor the 75k bonus because I was within a 12 month window, even if it was for my separate business. Buyer beware on that issue!

GTK

Yeah they base it on the individual not the business when it comes to the 12 month rule and they have very good tracking it seems. Thanks for sharing the warning.

Does this 12 month window apply to personal cards as well? I just received a Premier Rewards Gold Card offer as well, with no prior bonus language in it, but I just cancelled my previous one in May or June of this year.

Yes once per lifetime applies to all cards but some targeted offers don’t have any of that language. If you are sure the language isn’t there then you should be able to get the bonus again. Others have done it without issue.

I cancelled my Amex gold business card last Oct. and 45 days later I received new offer for same card and 75000 M.R. after $5000 spend. Not sure of how that came about but I have a new Amex gold Business card .

How hard is it to cancel? Do you just call them and say you want to cancel the card??

Received a targeted offer in email. It does not mention the one per life time rule.

On a related question, I received the version of this with 50K Membership Rewards with the 175 Annual fee. So, when the fee comes due, should I call them a few months in advance and ask them to close the card because I don’t want to the pay the fee? Or should I ask them to convert it to something else??

I don’t think there is a fee free charge card so I think you should just close it…not sure they would change a charge card to a credit card but I could be wrong.

Ah, okay. Thanks for that suggestion.

You’re right, they won’t product change to a credit card and there is no no AF charge card.

You can wait until the fee posts. They’ll erase it if you cancel before it is due. I would call and ask what they can do for you and offer the suggestion of converting to the no-fee Everyday card. They may not let you convert a charge card to a credit card. But it can’t hurt to ask.

When I’ve called to cancel business cards, they’ve offered me other cards with better spend bonuses or a cash credit to keep my account open. You never know what could happen. If you close the account before the fee posts, you aren’t in as good a bargaining position.

Thanks for the heads-up!