Get Double The Welcome Bonus On The New Amex Gold Card

Update: The public welcome bonus has also been increased to 50,000 Membership Rewards points.

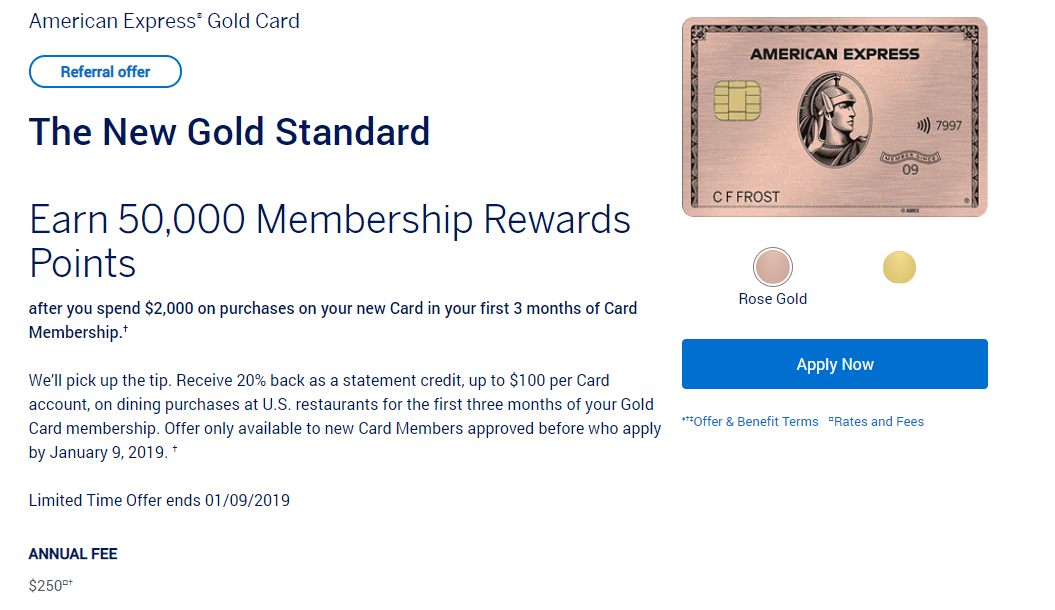

Earlier today we wrote about the American Express announcement of a new version of its popular Premier Rewards Gold Card, which will now be called the “American Express Gold Card”. It comes with an increased annual fee of $250 and additional benefits such as 4X at restaurants and supermarkets. You can read my review here. One drawback was the welcome bonus, which was only 25K. But now you can do better if you apply through referral.

The Offer

If you apply through a referral link you can get the following bonus:

Receive 20% back as a statement credit at U.S. Restaurants with the Gold Card within the first 3 months of your Card Membership, up to $100 back. Offer available to new Card Members who apply by 1/9/2019.

Plus, earn 50,000 Membership Rewards® Points after you spend $2,000 on eligible purchases with your new card within the first 3 months.

Eligibility

Keep in mind that this is the same product as the old Premier Rewards Gold card. If you have had that card in the past, you do not qualify for the bonus.

Conclusion

With the higher 50K signup bonus and 20% back at restaurants up to $100 it makes more sense to grab this card. The $250 annual fee is still not waived though, so keep that in mind. If you think the annual fee could be waived in the future, then hold off on applying. But with the increased benefits, I doubt we’ll see it any time soon.

There are only 20 days left to use this doubled $200 airline credits –

Here’s my 50K referral link

http://refer.amex.us/CHANGX6MeM?XLINK=MYCP

20K spend in 3 months, 50K MR points back (~$800 value), first 3 months dining credits up to $100,

If applied by the end of 2018, you could get $200 airline credits in your first account year since it is a calendar-year-basis.

-Really appreciated, thank you for using!

The referral code is below to receive your 50,000 points bonus on newly released Amex Gold thru the referral link. 50,000 points are worth $1000 if redeemed wisely!

http://refer.amex.us/STANIRENid?xl=cp01

http://refer.amex.us/BRANDN7b3n?xl=cp20 let’s enjoy some extra rewards!

50K Referral here: http://refer.amex.us/BENJASUepN?xl=cp20

50k referral link here:

http://refer.amex.us/NATHAS6oLO?XLINK=MYCP

Thanks Rob. Approved!

“Are the 3 you have kept open annual fee cards? Some suggest they have been targeting people that never pay annual fees with that message.”

Two of them are (Hilton Ascend and Delta Platinum). I have paid the AFs more than once on both these cards. However, I have put very little spend on them in the last few years, keeping them mainly for the perks. I use the Hilton card when I stay at a Hilton hotel (although most of the time these are award nights so the only charge to the card is incidental expenses). Same with Delta, except that I do have to buy a full-fare ticket when I use the companion fare.

I applied for this card and was denied for the application bonus, not sure why. I was notified that I did not qualify for the bonus and given the chance to cancel before my application was submitted (which I did of course. $250 fee up front with no bonus is too steep for me, even with a card like this one that I would absolutely use). I got the vague message “based on your history with American Express welcome offers, introductory APR offers, or the number of cards you have opened and closed, you are not eligible to receive this welcome offer.” I have never had an Amex Gold Card, have only opened 6 Amex cards in the past 8 years (3 still open), never closed a card in less than 12 months. Not sure why they don’t like me. Is this happening to other people?

Are the 3 you have kept open annual fee cards? Some suggest they have been targeting people that never pay annual fees with that message.

Increased fee is $55, not $25

Or you meant increased fee of $250 and missed the zero 🙂

Yup $250 🙁 Thx

https://mgmee.americanexpress.com/refer/us/en/card-details/4A315CE2292E05C3DE3CE8B6DAE7A66C378A3C7EFCFF16653AD8900CBF5BDBCD42F5FB1476008E144691E769D0F60E9053F4B6992AA1DCC1762257EDF37972FE22F7749EE1EBF292069619638C64CC19E0338A3CC534E4659F3AA7FB8776BB3277B754100A48C1EBCB7151F6501AE03E?GENCODE=349992620928582&extlink=US-mgm-spa_web_myca-copypaste-784-201673-GBPC:0001&cpid=201673&CORID=R:O:B:E:R:S:4:2:B:a-1538674868095-1893298489

50K referral link if you need one.

Annual fee is $250 and not $25

Updated – thanks

The credit available is only for a very specific list of restaurants, none of which I eat at.

You can use seamless or grubhub to take out from a wide variety of restaurants.