Amex Gold Resy Offer

Huh? Yes, I’m talking about the current Amex Gold Resy offer today. That might sound odd, because the Amex Platinum Resy welcome offer gets most of the attention. Indeed, it should, as that’s perhaps been the juiciest ongoing Amex welcome offer. The 15x version of that bonus can bring up to 475k Membership Rewards points. Undoubtedly, everyone should consider this Platinum offer before giving the Gold one a single thought. But eventually, it can make sense to pick up the Amex Gold this way. And it’s an even better option right now if you’re targeted for an elevated offer. Let’s take a look.

Amex Gold Resy Offer Highlights

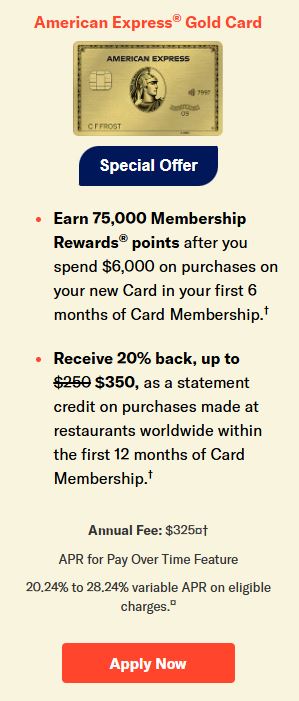

While perusing different offers, I bumped into the following one for the Amex Gold via Resy:

- Earn 75k Membership Rewards points after spending $6k within the first six months of card membership.

- Receive 20% cash back, up to $350, via statement credit on restaurant purchases within the first twelve months of card membership.

- Offer Link

This offer is available through Resy link above, but it will often show up to $250 cash back via statement credit on restaurant purchases. Try different browsers, clean browser windows, and other methods to open the link, and hopefully the offer will appear.

My Take

This offer comes with a solid, if not jaw-dropping, amount of Membership Rewards points after spending a modest amount in an extended timeframe. Most all cardholders can responsibly spend $6k over a six-month period to pick up 75k bonus points. Even better, cardholders can earn an additional 4x along the way via spend in the Gold’s generous categories of US supermarkets and dining.

But what takes the bonus up a notch is the additional cash back on restaurant spend. By spending $1,750 at restaurants, cardholders can obtain the maximum cash back bonus of $350. That might seem like a lot of dining out, but that’s easily doable over the twelve-month timeframe – just under $150 of restaurant spend monthly.

And these days, cash back might be preferable to more Membership Rewards points for some. Indeed, cashout fans are now subject to a new limit on cashing out Membership Rewards points for maximum value via the Schwab Platinum’s Invest with Rewards benefit. On the flip side, Schwab cashout fans well under that threshold can easily pick up a total of $1,175 from this welcome offer.

But this isn’t the best all-time offer for the Gold. And those in two-player mode would be giving up a referral bonus. Otherwise, this offer’s worth an extra look for individuals in the market for an Amex Gold right now.

Conclusion

Of course, consider this offer through the prism of the Amex Gold’s ongoing benefits, as well. For us and many others, the refreshed perks have more than made up for the recently-increased $325 annual fee. But those benefits can take some work to use. I’m up for that minimal extra effort but can understand many aren’t. For what it’s worth, I’ve found the new Dunkin’ and Resy credits remarkably simple to consume. The older Uber Cash and dining credits aren’t rocket science, either. So when you’ve finished your big plate of Amex Platinum Resy earning, maybe consider a second portion with this targeted offer for the Amex Gold, too.

How are you feeling about the Amex Gold these days?