Is Amex Old Blue Cash Dead For Good?

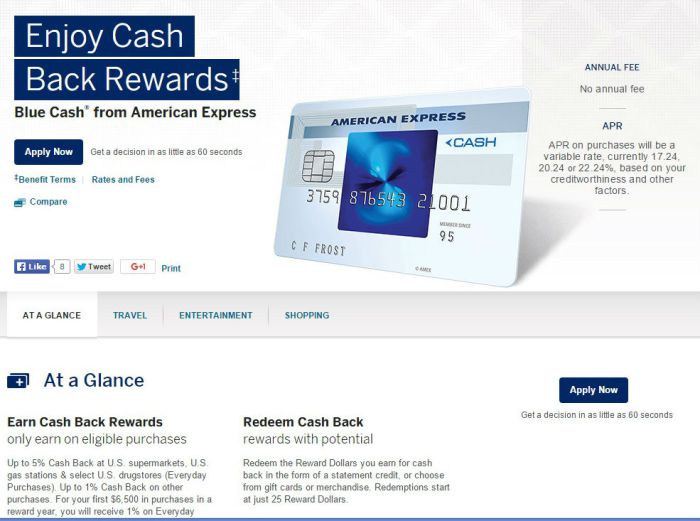

Blue Cash from American Express, or Amex Old Blue Cash as it’s commonly known, is a great card to have. The card hasn’t been publicly advertised for years, but you could still apply for it until recently. The application page could be found here, and often would require incognito mode to access it.

Now the application link is no longer working and it redirects you to the Blue Cash Everyday® Card. I suspect this is not just a glitch. Amex Old Blue Cash cardholders can still keep using their cards for now.

Card Benefits

The card didn’t have a signup bonus. The main draw was the 5% cashback on Everyday Purchases up to $50,000. There is a catch, the first $6,500 in purchases would only earn 1%. Everyday Purchases include supermarkets, U.S. gas stations & select U.S. drugstores, which are favorite merchants for mos readers.

- For your first $6,500 in purchases in a reward year, you will receive 1% on Everyday Purchases, and 0.5% on other purchases. After your first $6,500 in purchases, you will receive 5% on Everyday Purchases up to $50,000 and 1% on other purchases

- Redeem the Reward Dollars you earn for cash back in the form of a statement credit, or choose from gift cards or merchandise. Redemptions start at just 25 Reward Dollars

Conclusion

It’s sad to see this card go, although there’s a slight hope that it might come back. Hopefully, current cardholders can keep taking advantage of its benefits for a while longer.

Do you have the card? Do you use it often? Let us know!

I still have this card but do not hear much about it any more. Still working the same? 5% “Everyday” after $6500 spend up to $50k a year?

Anyone notice the lack of a cash rewards calculation on their November statement? What is up – the November statement is not showing any category calculations as in prior statements.

Yep. I suspect Amex is trying to make it a little harder to maximize the benefits. You have to go online now to see. App doesn’t tell you either. You have to go online. This link has an explanation of how to see your rewards and understand your rewards year. By the way, you can also get 5% when you buy gift cards at a grocery store or pharmacy with the card after the first 6500. Which is great because Christmas falls near the end of my rewards year.

https://travelwithgrant.boardingarea.com/2019/02/13/amex-old-blue-cash-how-to-see-cash-back-for-each-transaction-calculate-6500-minimum-spend/

I have had this card for over 10 years, and find it to have excellent points benefits vis a vis other cards for pharmacy, gas, and groceries. Hard to beat 5% cash back. For a family of 5, it is easy to cross the 6500 barrier and reap the 5% rewards. At the time I first applied, it was listed as the best cash back card you could get of all credit cards. The newer Blue Cash cards are not as generous on rewards. I have a number of points/cash back cards for other types of purchases, but I haven’t found one better for gas/groceries/pharmacy.

Had this card since ’01. Only the two of us, but we use it for just about everything and a rough calc still has us ahead vs the new card. Probably about $75 more in reward cash over this past year. For a larger family with a bigger spend it’s a no brainer. AMEX changed it for a reason. I’m glad they grandfather the existing cardholders.

For the grandfathered ones, does that mean you earn 5% on any purchase after meeting initial spend?

Not any purchase, but Super markets, gas, and pharmacy are 5% with no cap

Have had this card for years. Just applied for SO about 3 weeks back. Was tempted to hold off until she dropped under 5/24 and then apply, but then decided against it at the time and went ahead anyway. I am now glad I timed it right!

Good call 🙂

Have had the card for years. Wish it was a cash or point card like chase freedom. I’d take the points.

That would have been insane 🙂 but I’ll take the 5% in cash. Hopefully it lasts.

I applied about 2 weeks ago and it arrived 2 days ago. Trying to understand the spend requirement on it very clearly. 5% on everything up to 50K is a bunch of points. I plan to put legitimate and MS on it and see how that goes.

The catch is that the first $6,500 will earn only 1% on Everyday Purchases, and 0.5% on other purchases. After that you will start earning 5% on $50K. Still great IMO.

It’s not 5% on anything, it’s only on “everyday purchases”, which is a specific amex term for grocery store, gas station and drug store purchases.

How are you able to apply for this card? I am unable to find the card on http://www.americanexpress.com... They have the other Blue offers. (which aren’t as good as this one).

Could you please provide a link, as to where/how to apply for this card?

Thanks,

Jon

Sorry Jon it is no longer available