Amex Platinum 100K Direct Link

Back in May a direct Amex Platinum 100K linked via Reddit and now it seems the same thing has happened again. Let’s take a look at the details and why you should perhaps use caution if deciding to apply.

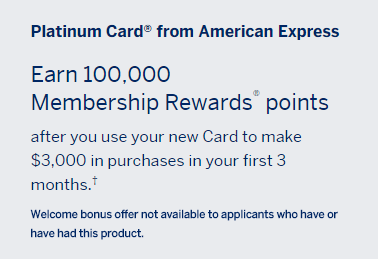

The Offer

- Earn 100,000 Membership Rewards after $3K spend in 3 months.

Key Terms

- Welcome bonus offer not available to applicants who have or have had this product.

- The annual fee of $450 is not waived.

Amex Platinum Benefits

This card has a ton of benefits, but the ones I use most are:

- Rental car elite status at National and others.

- Hilton HHonors Gold (for those who haven’t matched to Diamond).

- Amex Centurion lounge access

- Priority Pass lounge access

- $100 Global Entry Fee Credit

- $200 airline incidental reimbursement per calendar year. (Can possibly use for gift cards.)

This is the highest bonus we have seen publicly on the personal Platinum card.

Use Caution

Following that link being used widely in May, Amex began freezing the Membership Rewards accounts of people who applied and were approved for the offer. Then, after getting their accounts unfrozen and receiving the bonus, Amex clawed back points from many people for manufacturing spend. It was a mess.

I highly suggest you read the following post if you are interested in applying:

Direct Application Link

If you still want to apply, then here is the direct link. Make sure to use private/incognito mode or else it may not work.

HT: Doctor of Credit

Has anyone received the card yet. I applied for my wife and status still shows pending. When I called Amex, rep said they were having some technical issues.

Yes, my wife got hers five days ago.

[…] are little pearls of wisdom being decimnated on Reddit and I agree with them. Frequent Miler and Miles to Memories have put something out on this as well and I’ll just reiterate – something like this […]

My wife just got approved for 100K. Thanks for the tip!!!!

Applied for the wife and was approved. Took screenshots of the first and second page just in case there’s an issue. I’ll definitely have to walk the straight path on this one.

She’s never had a Platinum product so there’s no issue in that regard. I’ll 100% be avoiding MS. I’m honestly even a bit apprehensive about amex offers triggering the system into believing it’s a return because of the negative credit. Perhaps paranoia, but I did read at least one data point of someone who had met the spend requirements organically but still had the points taken. Who knows, could’ve been because of another Platinum product in the past. I’ll probably just eat a $60 fee and pay our property taxes and meet it in one purchase. Who knew paying thousands in taxes for a home could be so fun?!?!

@anthonyjh21 – Paying taxes is one of our favorite ways to meet spend downs. After that, insurance for home & auto. Then cable, phone, etc. Easy and no problems. Why people try to MS a spend down is beyond me. Remember, (especially in the last Amex offer) pigs get fat, hogs get slaughtered. Word to the wise.

Good points and I agree for the most part. I wouldn’t pay cable/utilities/phone with anything other than a 5%/5xUR card though. If I was forced to I could use it in lieu of bonus category spend but there’s a large opportunity cost that comes with it as I’m losing, on average, 4% cashback. On $3k spend that’s $120. Also factor in that my tax payment has a $60 fee. Point is, there’s always a cost, hidden or obvious.

Especially nowadays MS is much harder and while I wouldn’t get involved in money orders I can see why some might. Maybe they can’t spend 3k organically or they have throw away bank accounts and easy MO and liquidation options. It’s always YMMV.

It wouldn’t surprise me if Amex (and maybe others) begin to claw back bonuses, targeted or not, if you’re not meeting all spend organically. Going forward when it comes to amex I’m going to be cautious on all sign up bonuses. You’re right though, it’s better to be the pig than the hog. Through all of my activities the only banned/closed account has been Target. We have to be smart about not totally biting the hand that feeds us, especially in the current churning/MS era of watchful eyes.

I don’t own my home, so I always use a new card to pay four months’ of rent, three times a year. It’s gotten to where I feel like I’m losing out if I simply write a check to the landlord. I’ll be making my next quarterly rent payment on Feb. 1st. Until then, I’ll have plenty of time to decide on which card to apply for next.

Yeah I hear you. I had about a month gap recently where I didn’t have a card requiring any spend AND it was outside of bonus categories like gas or grocery. I felt like I forgot something at home and just felt as if something was wrong when I was making a payment. Funny how stuff like this happens to those of us in this “hobby.”

Hah! Yep, and forget writing a paper check for anything! My mechanic yesterday told me he couldn’t accept a credit card for the $600 repair bill, but he did accept cash (no way will I pay with cash!) or money orders. So I bought a couple of VGC’s, then used them to buy money orders. My cash will be used to pay the credit card bill.

My girlfriend thinks I’m nuts for playing this game. But I cringe when she makes large purchases with a check or with cash. Her last credit card approval was at least ten years ago and her credit is perfect. I keep telling her to take advantage of the great signup bonuses out there, but she doesn’t listen. She’s a perfect candidate for Chase cards, especially the Reserve.