Amex Posted My Welcome Offer Before Spending Was Complete

Hmmm. This one is confusing to me but I figured it was worth sharing. I mean it is Monday after all so let’s talk about something interesting! It appears that American Express posted my wife’s welcome offer bonus before the spending on her account was even finished. Talk about a lightning quick posting! This was for 60,000 Membership Rewards for her new Charles Schwab Platinum card, the very card that helped me cash out all of our points.

Details Of The Offer & Spending

The offer for the Charles Schwab Platinum card is pretty much always 60,000 points after spending $5,000 within the first 3 months of card membership. There are targeted offers for a little bit more but they are rare.

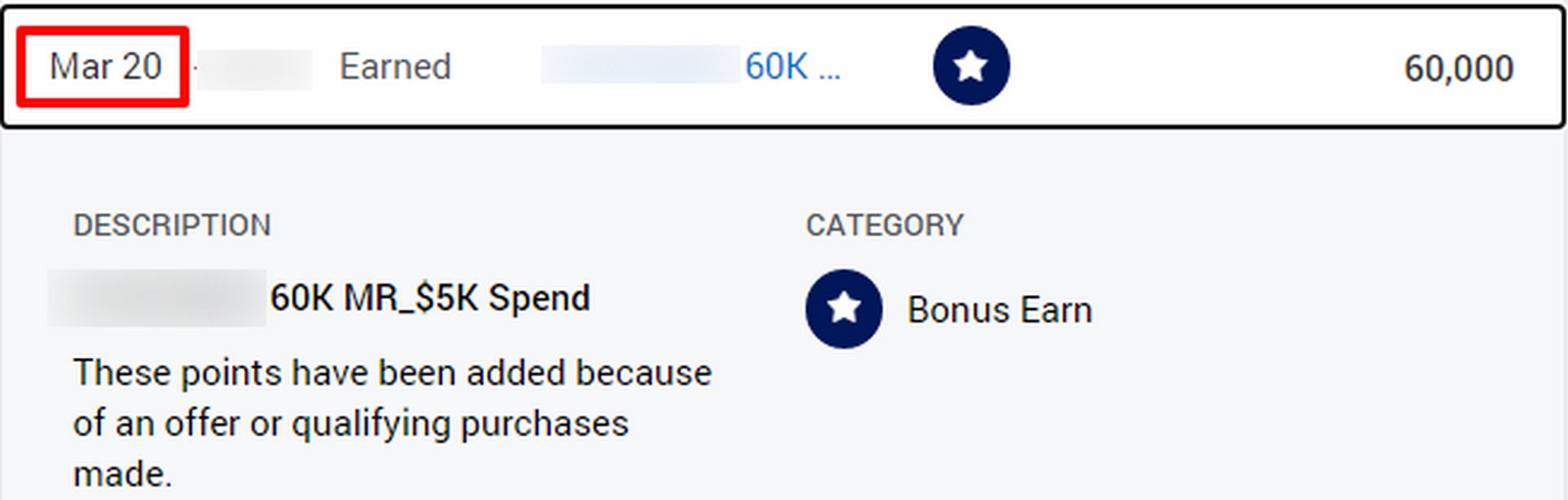

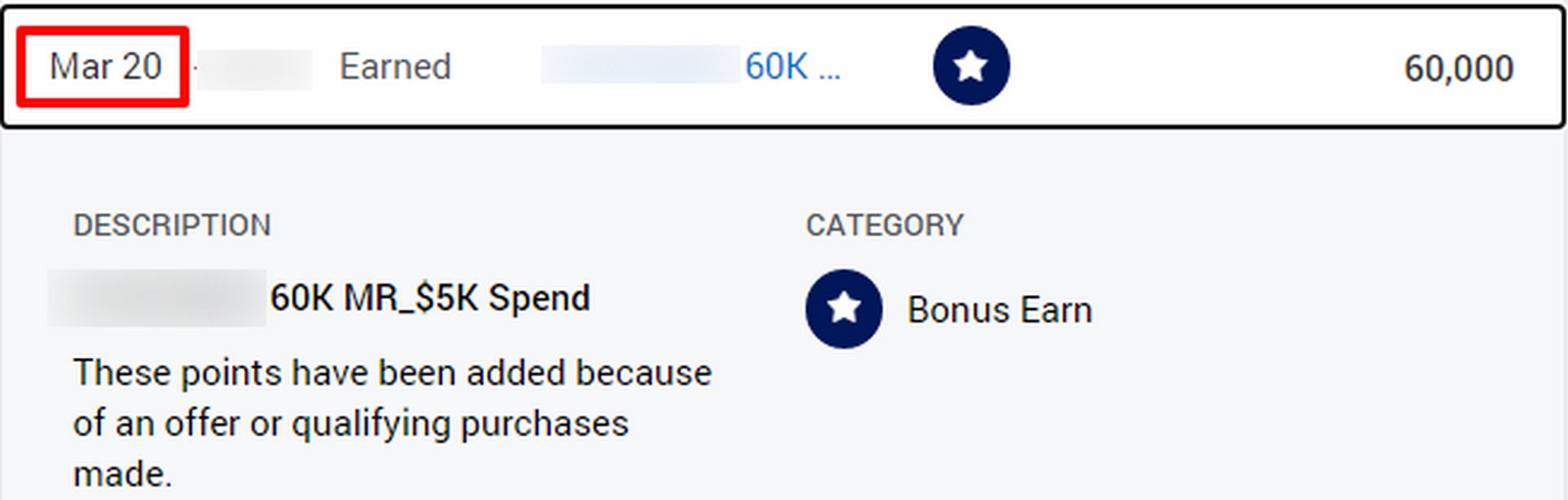

She signed up a few weeks back in our recent run of applications. We had completed around $2000 in spend when her first statement cut last week and there were some charges that were still pending and settled a day or two later. To bridge the remaining gap, I had worked it out with our kid’s school that we could pay tuition for next year now. That charge would complete the remaining required spend. So yesterday, Sunday March 21st, I made that payment which would push her over the top. A few minutes later I logged into her Amex account just to verify that the charge had posted okay etc. That is when I saw that her balances had shot up. I thought, that is strange and looked at her recent activity and that is when I saw this:

What Is Going On Here?

As you can see in the image above the points are showing as posted on March 20th which was Saturday, a day before the payment and when she was well below the required spend amount. I made the actual purchase pushing me over the top on the 21st. And it wasn’t a close call amount that some airline incidental purchases or PayPal credits etc. counted when I hadn’t planned on them etc.

I feel like I checked the account earlier in the day to pay some bills and the balance was unchanged at that point as well. Now, they could post their points at a certain time each day and it pulls everything for the last 24 hours etc. But, my guess is the March 20th is just wrong on their end or a day earlier for internal reasons.

I feel like my purchase on the 21st triggered it and it posted as soon as the charge hit the card. That is strange because I had only just made the purchase and it had not settled yet. The charge did settle this morning which was really quick overall as well. Usually things take a few days to fully settle.

Maybe since I made the payment through a donation program it codes differently with Amex and the charges are instantly validated? I really am not sure what happened but I am not complaining 😁.

Final Thoughts

My best guess is certain charges post instantly in Amex’s system and that triggered the offer being completed. It was pretty surprising to make a large charge and have a bonus hit her account immediately, even before the charge being settled. I am not sure if anyone else has had this happen before or if there is a way to recreate this. Maybe Kiva Loans or something like that would give similar immediate results? Although waiting a few days for the charge to settle isn’t a big deal but it could be useful info if you needed the points ASAP I guess.

If you have had something similar happen let me know down in the comments.

Chase Sapphire Preferred® Card

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

Got my Amex points yesterday, the day I reached $4,000. Must be a policy change?

In contrast, for me it appeared that I received my Chase British Airways card initial bonus of 50,000 avios posted to my Chase record a little earlier than when I had actually completed my minimum spend of $3K. And when I have logged into my BA Executive Club account in recent weeks, the amount of avios earned through actual spending (1 for 1) posted to BA soon enough each month after my Chase statement closed, the 50K bonus hadn’t posted to BA. After a couple of weeks of closely monitoring these two accounts, it was time to call Chase and ask about this. The Chase agent said she would initiate an investigation. That was a week ago, possibly too early for the investigation to be complete.

But this is reminiscent of some two years ago when I opened a Chase Iberia card account. The monthly spend posted to Iberia right away, but the bonus didn’t. I called both Chase and Iberia multiple times, with each pointing the finger at the other as to whose fault it was. Finally I called Chase once more and asked to speak with someone familiar with the actual Chase-Iberia liaison — he called me within a few days, and it was a relief to be able to talk to someone who understood the problem. Within a week or two the full bonus finally appeared in my Iberia Plus account.

Now it remains to be seen how many more times I am going to have to reach out to Chase to get the BA bonus to show in BA, and how long it will take.

Chase Bank, are you listening?

Hopefully you don’t need to go through all of that again! Let us know once it gets figured out JT

A long delayed reply: my first 50K Avios bonus got posted to ba.com within a week or so after I contacted Chase that one time. My second 50K bonus got posted to ba.com within a few days of my having met the further minimum spend.

Had one post early a few weeks ago

Seems more widespread than I would have thought – thanks for the DP Cindy

Mine still has not posted and completed spending in February. I was thinking that had to wait until was paid as due date is next week.

Hopefully it comes soon. I would check with them on chat and make sure they are showing the spending as completed on their end.

My 60k posted on 3/20, the same day the purchases that put me over the top were made, not quite the day before, but surprisingly fast.

I wonder if this will be the new norm? I hope so!

Had the same thing a few days, points posting date was a day before I made the transaction. Wasn’t statement cut-off time though.

Just had the exact same thing happen on the same dates as you, made a tax payment with a biz Plat for a 100k MR SUB. Also not complaining.

Interesting – wonder if it was a glitch just on Sunday.