New Upgrade Offers for American Express Cardholders

American Express is sending out upgrade offers to some cardholders by email. You can also check the Amex Offer section in your accounts. These are offers to upgrade to either the Blue Cash Preferred or Everyday Preferred cards. You can earn $150 with a waived annual fee, or 40,000 Membership Rewards points.

Amex upgrade offers allow you to essentially get a welcome offer without a hard pull. And, it can be like a double dip if you have had the card in the past. That is because it is available to previous cardholders too.

If you have never held the card before it may be better to sign up for a card first before taking the upgrade offer. Once you take an upgrade offer you will be ineligible for any future welcome offers on that card.

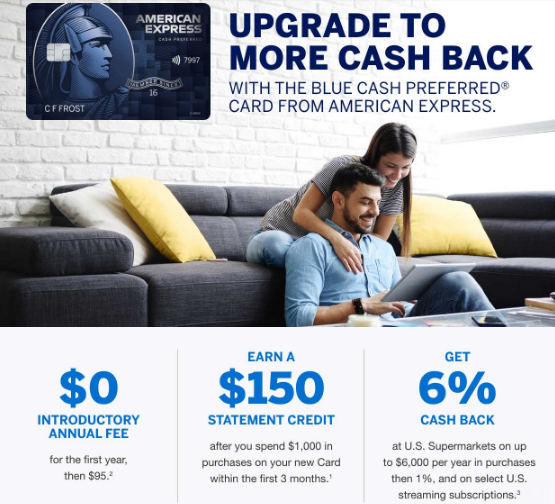

Amex Blue Cash Preferred Offer

Here are the details of the offer:

- Earn a $150 statement credit after spending $1,000 within 3 months of accepting the offer.

- The $95 annual fee is waived.

You can use your old Blue Cash Everyday card until the new Blue Cash Preferred card comes and it will work as if it is the new card. Any purchases made on the old card, after accepting the offer, will count towards the spending requirement and will earn at the increased rates.

Amex Blue Cash Preferred Details

- 6% cash back at U.S. supermarkets on up to $6K per year in spend

- 3% cash back at U.S. gas stations and select U.S. department stores

- 1% cash back everywhere else

- $95 annual fee (after the first year)

Amex Everyday Preferred Offer

Here are the details of the offer:

- Earn 40,000 Membership Rewards points after spending $2,000 within 3 months of accepting the offer.

- The $95 annual fee is waived.

You can use your old Everyday card until the new Everyday Preferred card comes and it will work as if it is the new card. Any purchases made on the old card, after accepting the offer, will count towards the spending requirement and will earn at the increased rates.

Amex Everyday Preferred Details

- 3X points at U.S. supermarkets on up to $6K per year in spend

- 2X points at U.S. gas stations

- 1X point on all other purchases

- Use your Card 30 or more times on purchases in a billing period and earn 50% extra points on those purchases less returns and credits.

- $95 annual fee

Final Thoughts

If you have carried any of these cards in the past then this is a no brainer offer. We have seen offers for $250 in the past for the Blue Cash Preferred. Now you get $150, but the annual fee is waived.

Earning 6% on grocery purchases is about as good as it gets. Once you upgrade you may want to keep the card long term since you only need to spend $3166.66 in the grocery category to offset the increased fee.

The Everyday Preferred Card also offers a big upgrade bonus of 40,000 Membership Rewards points. You have to pay the annual fee, but the bonus is worth $600 or more for most people. The earning rates on this card are not as exciting, but with the bonus it can still go up to 4.5X at supermarkets.

Just make sure to keep the upgraded cards for at least 12 months after accepting the offer. You don’t want to end up on the American Express shutdown and clawback list do you?