AT&T Access More Changes

The Citi AT&T Access More card has been one of the more lucrative cards I have had the pleasure of carrying around the past couple of years. Truthfully I really don’t carry it around, but instead use it for online purchases in order to earn 3X ThankYou points.

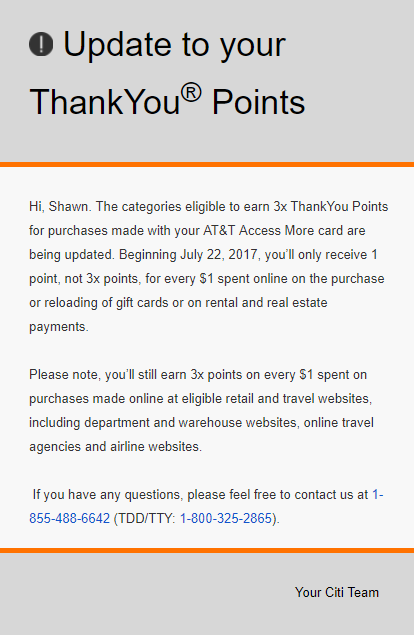

Unfortunately the card is getting a bit less generous. As has been the trend lately, Citi sent out a notice to cardholders explaining that gift cards will be specifically excluded from the bonus categories. Rental and real estate payments are now excluded as well. Bye bye 3X Plastiq.

Here is what the notice says:

Conclusion

I can’t say this is a surprise given yesterday’s news of Visa cards being blocked at Plastiq for mortgage payments. While it remains to be seen how Citi will block gift cards from earning 3X, my guess is they may start not paying bonuses at websites that only sell gift cards. A tightening for sure.

What do you think about this? Are you sad to see the best mortgage/rent options going away or are you glad they are just making small changes so they can keep the larger 3X online bonus category?

Just a thought, but when you setup your payment with Plastiq, it lets you designate the category. I had car payment to Well Fargo that I had coded wrong and got 1x points, but my mortgage to Wells Fargo got 3x points.

I had mistakenly listed a category, and Citi did not give me 3x points. I wonder if I just set the category for something that is more “online”, would I still get the 3x points?

My mortgage payments on Plastiq stopped earning 3x points months ago. I’m surprised that this is supposed to go into effect in July.

How do you suggest going forward if you have been using the ATT Card to pay rent? Which cards are still good to use instead of the ATT Card? Also can you product change that ATT Card since that basically what I have been you that card for?

The best card to use is probably one with the best everyday rewards. Maybe the Alliant CU 3% first year card? Discover it Miles 3% first year? BofA Travel Rewards if you have Platinum Plus Honors with them. 2% cards are going to be losers.