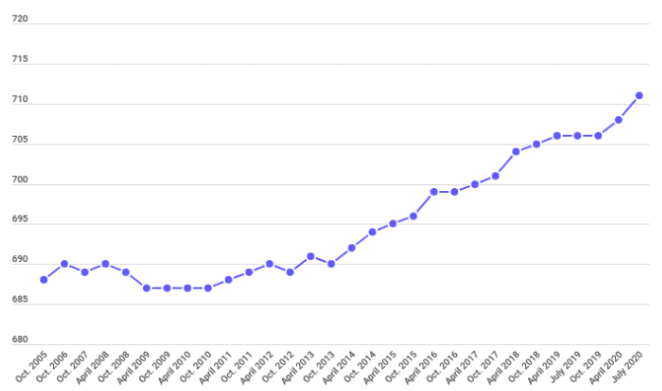

Average U.S. FICO Score Rises to 711 During Pandemic

The pandemic has had a huge negative impact on U.S. consumers and the global economy in general. But strangely enough, FICO credit scores have been rising. The average U.S. FICO® Score now sits at 711, which is 5 points higher than the average score just a year ago.

Sounds crazy that with high unemployment and an economy in recession, FICO scores actually went up. But, FICO scores don’t shift rapidly, Ethan Dornhelm at FICO scores tells CNBC.

“The FICO score shouldn’t be thought of as a leading indicator or as a predictor of where the economy is headed,” he says. There’s typically a lag between major macroeconomic eventand changes in the average FICO score. During the last recession, FICO score average hit its lowest point in late 2009, nearly two years after economists ruled that a recession had actually started. Now, the lag between the start of the pandemic and its affect on credit scores, is further affected by the significant steps taken by both the government.

Besides the lag, there are also a number of likely drivers behind this latest average score figures:

- Missed payments reported in the credit file are down. As of July 2020, just 7.3% of the population had a 90+ day past due missed payment in the past 6 months. This is down from 8.1% pre-COVID (Jan 2020). On time payments make up about 35% of the overall FICO® Score calculation.

- Consumer debt levels are decreasing. As of July 2020, U.S. consumers had on average $6,004 in credit card debt, down from an average of $6,934 back in January 2020. That reduces the utilization rate, which accounts for 30% of the FICO® Score calculation.

- The FICO® Score doesn’t negatively consider forbearance/deferment agreements. Accounts reported as “current” with credit reporting codes related to forbearance or deferment, or that the consumer has been ‘affected by disaster’, will not cause the FICO® Score to drop. This is good news for millions of consumers holding accounts that have been reported in some form of payment accommodation since the onset of the pandemic.