Banana Republic Visa Mobile Wallet Offer

I have long been a fan of the Banana Republic Visa. Since I got the card a couple of years ago, I have been treated to a number of very easy to maximize targeted spending offers. This month’s offer is just about as easy as it gets. Let’s take a look.

The Offer

Key Terms

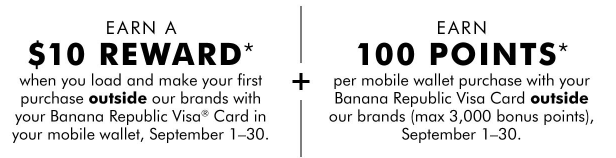

- If you load your Banana Republic Visa Card in your Apple Pay, Samsung Pay, or Android Pay mobile wallet and make a mobile wallet purchase outside our brands between September 1 and September 30, 2017, 1,000 bonus Reward Points ($10 Reward) will be applied to your account.

- You will also receive 100 bonus Reward Points per mobile wallet purchase made outside our brands with your Banana Republic Visa Card between September 1 and September 30, 2017.

- Maximum of 3,000 bonus Reward Points can be earned. Account must remain open, in good standing, and not become delinquent. Please allow up to two billing cycles for bonus points to post to your account.

Analysis

Banana Republic is paying me $11 ($10 + $1) to make my first purchase with the card in a mobile wallet so that is a no-brainer. Beyond that I am hoping I can find a cheap option for mobile wallet purchases. Maybe a cheap pack of gum or something similar so I can earn $1 in rewards per purchase.

Conclusion

While this isn’t a blockbuster deal, it is another example of how this co-branded store card really gives outsized value. I am glad I have it in my (mobile) wallet and will continue to use it when they incentivize me to do so.

Seems OK if you like those stores but overall it is my opinion that store branded cards have a negative impact on FICO scores.