Bank of America Shifting Credit Lines & A Surprise Refund

For those who have been around this hobby awhile, it is fairly common to find your credit limits shrinking as you get more cards with a bank. Each bank has only a limited amount of credit they will issue and thus the more cards you have, the lower the limit per card. I have written before about Citi’s hard inquiry on credit line shifts, but thankfully Bank of America has no such restriction.

Shifting Credit Lines with Bank of America

My wife was recently looking to beef up her credit line on a card to take advantage of a recent deal. She has four cards with Bank of America, but the highest limit is in the low four figures. That wasn’t enough for this deal, so she decided to see if she could pool all of the credit together and leave minimum lines on the remaining cards.

To request this, she simply called the number on the back of her Alaska Airlines Visa Signature card. When the representative answered, she explained that she would be making a large purchase and was looking to combine her credit on one card. I had heard the minimum that could be left on each card was $500, but the representative said she could bring the remaining three cards down to $200 and shift the rest. She did just that.

Instant Confirmation

My wife was on the phone with Bank of America for about 20 minutes while the agent processed the shifts one by one. No hard inquiry was done and the best part was that the new beefed up credit line on her Alaska card was visible online right away. She also asked the agent to notate the account of an upcoming large purchase. Fast forward and everything worked perfectly. But there was one surprise!

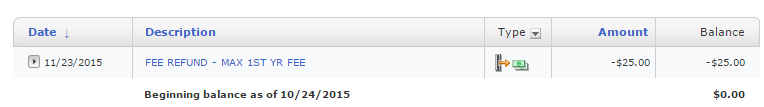

$25 Refund on Alaska Airlines Visa Signature

When my wife logged into her account recently, she noticed two of the cards she shifted credit from had a $25 credit. These cards are also Alaska Airlines Visa Signatures and she paid a $75 annual fee up front when she got each of the cards. It took a second, but I immediately knew what had happened. To understand, lets look at a provision of the CARD Act:

The CARD Act and implementing regulations provide that an issuer may not require consumers to pay fees (other than penalty fees) during the first year in which an account is opened which exceed 25% of the total initial credit line.

By lowering her credit limit to $200, the maximum fees Bank of America could charge my wife in the first year are $50. Since they collected a $75 annual fee up front, they needed to generously refund $25 of it to remain in compliance. This was a happy mistake and not one I would recommend trying to recreate. Forcing the bank to refund money probably won’t be good for your long term relationship. I’m not worried in this case, since the agent on the phone was the one who suggested the $200 minimum limit.

My View on This

I have actually heard of similar things happening by accident with cards that carry a hefty first year annual fee that is not waived. Some people have been able to get their annual fee partially refunded by asking to lower their limit on one of these cards. I actually bring this up for the opposite reason you think. I am in no way advocating doing this on purpose. I believe it is a bad practice and one that will lead to problems down the line. In other words, this paragraph is to make it clear that I am not hinting at anything.

Conclusion

Bank of America makes it fairly easy to shift credit lines if you have an upcoming big purchase. With a simple phone call you can get things moved around and your account notated so that you can earn valuable rewards on life’s BIG EXPENSES! While the $25 per card was appreciated, it certainly isn’t anything I would try nor want to do again!

It has worked for me without a HP recently.

BOA told me i would have to keep $5000 minimum on each (Visa Signature) card unless I downgrade the cards. Even if i downgrade, it would take 6-8 weeks before i can move credit line!

Did anyone have this issue?

Called BoA to shift credit from 4 cards onto 1. Was told it would be a single hard pull.

It seems like that has been the case for others as well. I’m not quite sure what was different in our case.

Well…. I have been asking this same question on forums and called many BoA reps who said it IS a hard pull. Not sure what to think about this… Was trying to get the wife around $30-40k of CL on Alaska card for this very reason. We just completed checking & savings for both of us funded with her $20k CL. 80k completely for free is still a good deal, but would have been nice to have almost double that. I still don’t know that it would have worked though. For that one hard pull we can get 50k with another personal & business AOR though.

Yeah it seems like people are having mixed results. I’m not sure why that is happening, but I have confirmed no hard pull was done. Even with a hard pull it might be something worth considering, especially if you can use that account to fund a checking and then a savings account.

I had a surprise shift between 2 credit limits on B of A cards done by the bank . When I applied and got instant approval for a B of A Alaska card with 19k limit apparently the took the 19k from my existing 20k limit on my B of A Virgin Atlantic card reducing it to a 1k limit. They didn’t ask me or tell me they had done this. I had a pool resurfacing job finished the next day and had told them to charge my Virgin Atlantic card . I caught on to the credit shift 1 hour before the pending charge would have posted and put me over limit. I guess B of A feels no need to inform us if they make an extreme shift

hmmm. i might have to try again. I called in a month ago and tried to do this w/ my 3 BOA alaska cards and was told that they do not allow credit lines to be reallocated and that I had to keep the limits exactly the way they had initially set them up..

[…] Shifting Credit Lines at Bank of America, Why & How It Resulted in an Unexpected Bonus X 2 – Shifting credit lines with Bank of America and how doing it on one card resulted in an unexpected credit. […]

Chase has been great about moving credit around, too. I forgot I had moved some of my credit line from one Chase card to another. We installed AC this summer in our 1901 house, costing a hefty sum. As the contractor was running my lowered-limit card, I remembered there wasn’t enough credit line on it. I called and the Chase agent immediately moved enough credit back to cover the expense. The agent beat the on-line credit card processing software by seconds.

I didn’t get $25 back. 😉 That would be a nice surprise.

[…] Read the full story at milestomemories.boardingarea.com […]

Are you sure that it wasn’t a hard pull? Because I wanted to do the same couple of days ago and CSR (I chatted instead of calling) told me it would be a hard pull for CL reallocation and I backed up. I even found a post on DoC website confirming that BoFa does a hard pull for CL shifting. Unless your wife is still in 30 days after CC was opened.

I’m sure. I have two monitoring services on her credit and would have been notified. She confirmed several times there wasn’t a hard pull and her last card with them was more than 30 days prior. Of course that isn’t to say they don’t have different policies or that they won’t run your credit.

I do know of others who have done this without their credit being pulled. That said, if a representative says it will be a pull then it probably will be.

It’s great to know that this can be done without hard pull.

I’ve had no success with BofA so far.. tried calling three times and was always informed that there’ll be a hard pull when moving credits around.

BofA told me it was a hard pull to shift credit as well, and it would have been between 2 Alaska cards as well.

Ditto

Ditto 3

This is how some people like me got the annual fee refund for Ritz card last year. That was one of of the best offers ever: 140k points+ $900 credit without paying annual fee.

By the way, a B of A rep told me that they use any trailing credit pull as long as it’s not farther out than 30 days. After receiving multiple Alaska cards from applications submitted over a 4 week period, this seems to be the case. In reviewing my hard pulls from that timeframe (5 months ago), I only see one pull, for the first card.