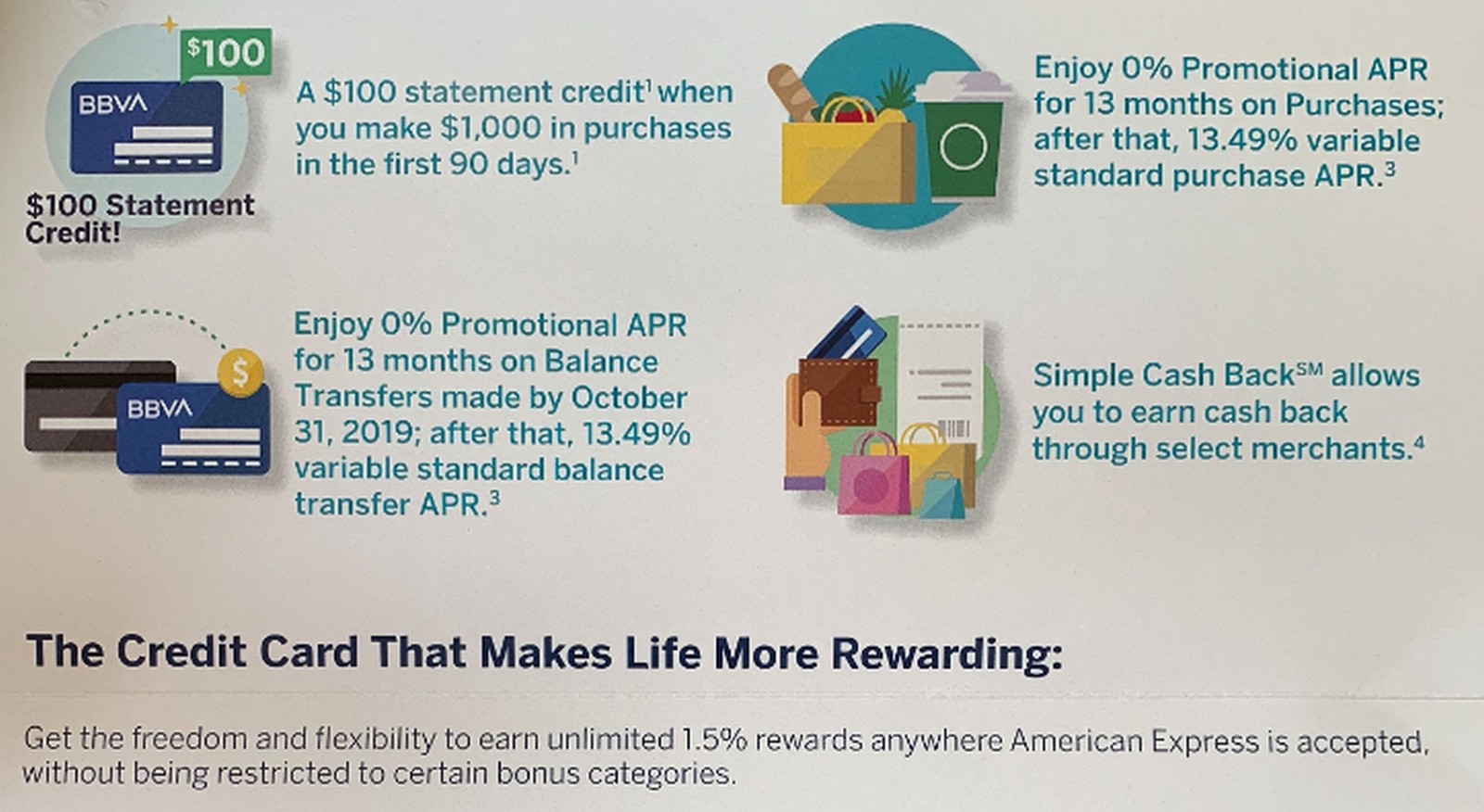

BBVA Credit Card Spending Offer – $100 Statement Credit

BBVA has been known to send out some pretty good spending offers over the years. It used be a valuable card during the NBA finals for 5X earning but people have held onto after the changed up the system for these offers. This most recent one is offering a $100 statement credit.

Details of the Offer

The offer came via snail mail and the terms are as follows:

- Get $100 statement credit when you spend at least $1000 dollars

- Must complete the spend within 90 days

- 0% APR on purchases for 13 months

- Earn your normal 1.5% back as well

Final Thoughts

This card, much like the Sears and Banana Republic cards, is a long term keeper solely for these type of spending offers. With new account bonuses being harder and harder to come by these are things that can help us in between applications.

Don’t forget the 0% purchase APR for 13 months.

Good point – I’ll add that in. I don’t think many have great limits on their cards but could be a consideration for those that do.