The Best Credit Card Offers In The World Are In The U.S. – Here’s A Look.

I recently saw an ad for credit cards in Brazil, and it made me wonder what the best credit card offers in the world are. My conclusion is that the U.S. has the best credit card offers in the world. Here’s a look at typical credit card offers in a few different countries to show just how easy it can be to rack up points & miles with offers in the U.S.

The Comparisons

In order to be fair, I searched for 2 different credit card welcome offers to compare. First, a card that you can get anywhere in the world: the Platinum Card from American Express. Second, a card from an airline based in that country and offered locally but not anywhere else. Let’s look at how easy it is to rack up a bunch of points and miles with these credit card offers in various countries.

U.S.A.

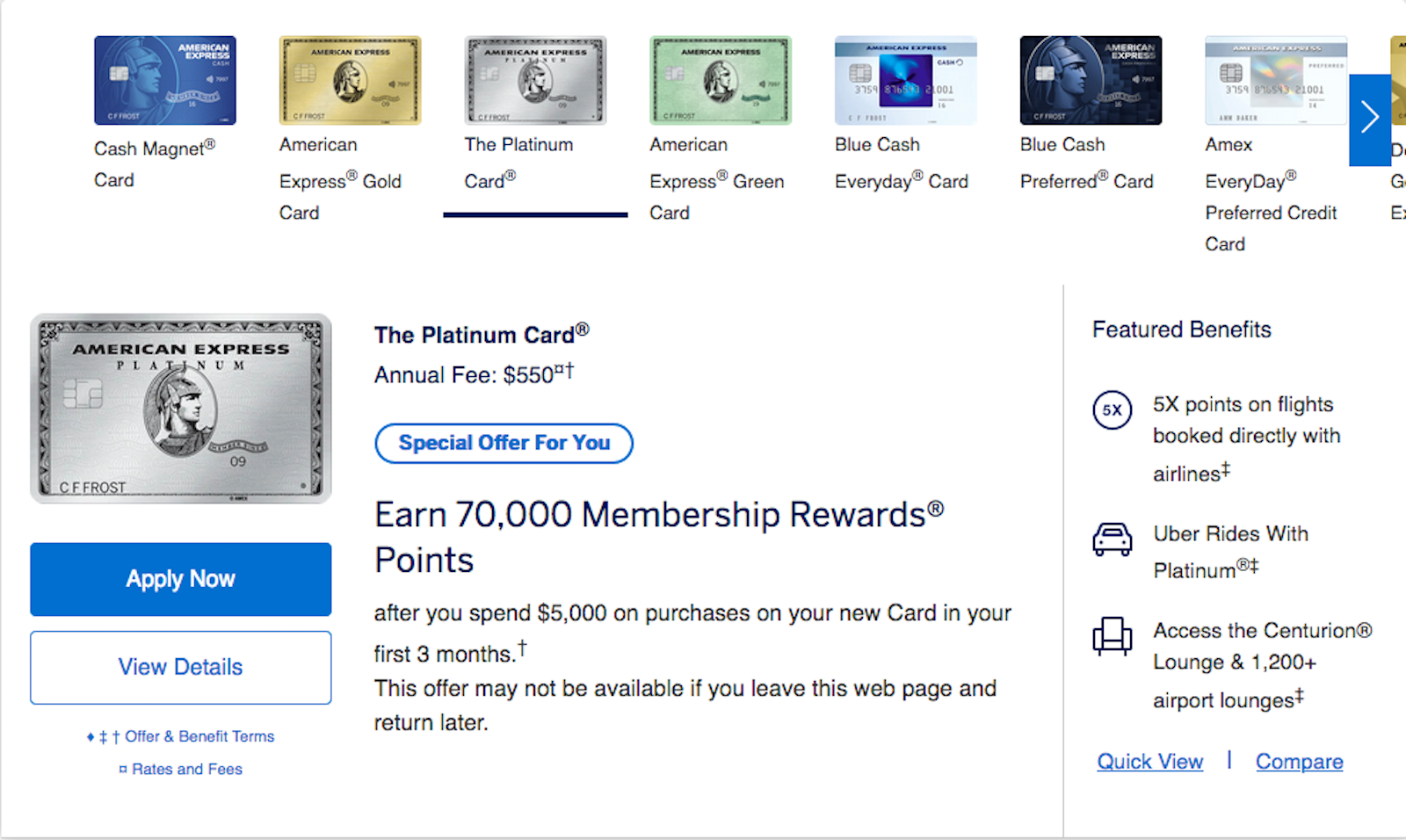

American Express Platinum Card

In the U.S., you currently can get a welcome offer of 70,000 Membership Rewards points after spending $5,000 in 3 months. With the points earned from spend, you’ll have at least 75,000 points after $5,000. You’ll also pay a fee of $550.

Points per $1: 13.5

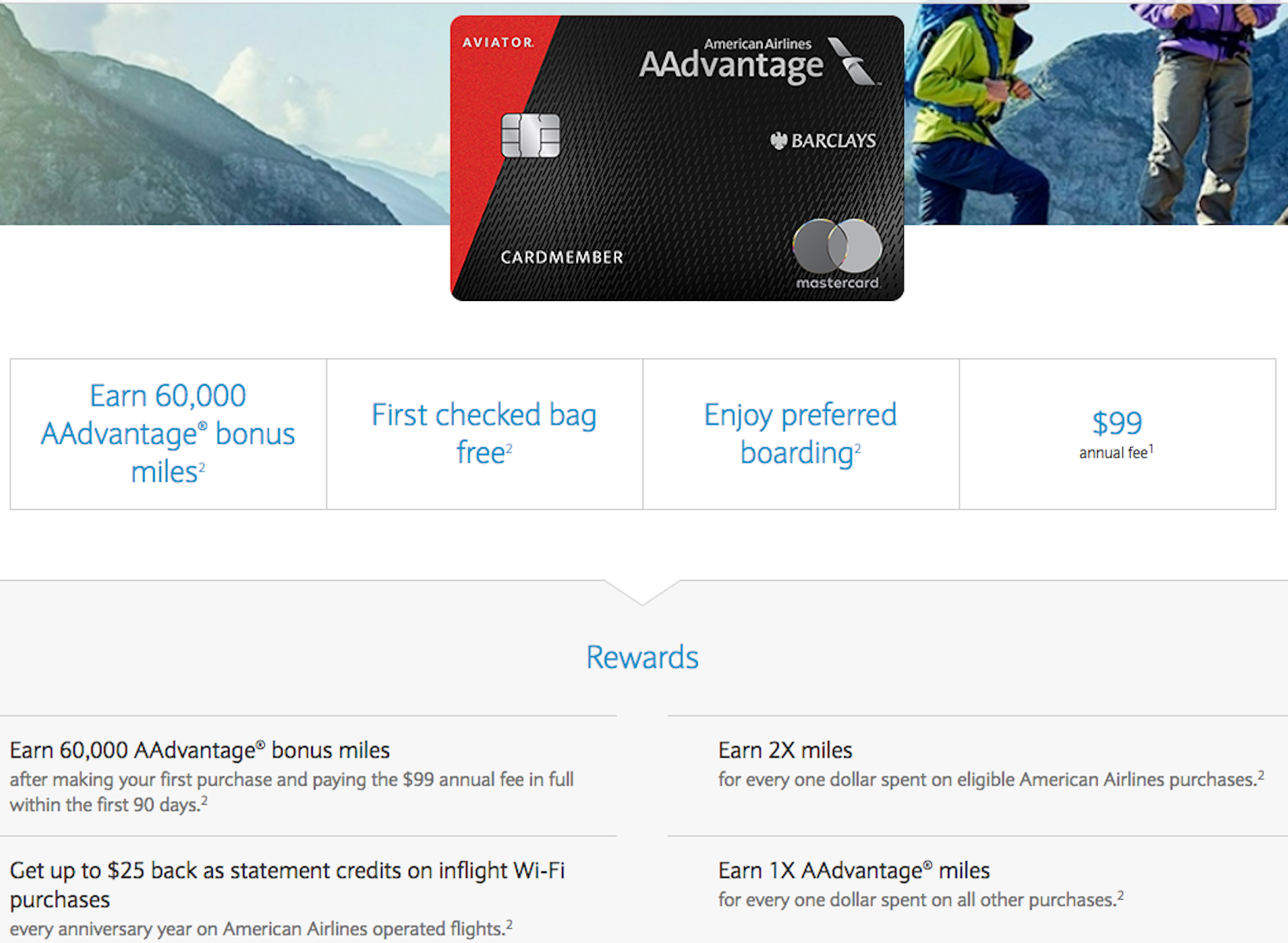

Barclays AAdvantage Aviator Red Mastercard

There’s no simpler welcome offer than this one. Pay a $95 annual fee, make any purchase, and the miles are yours. Earn 60,000 American Airlines miles for $96, at minimum. With spend, you’ll have 60,001 miles if you do the bare minimum.

Points per $1: 625

Canada

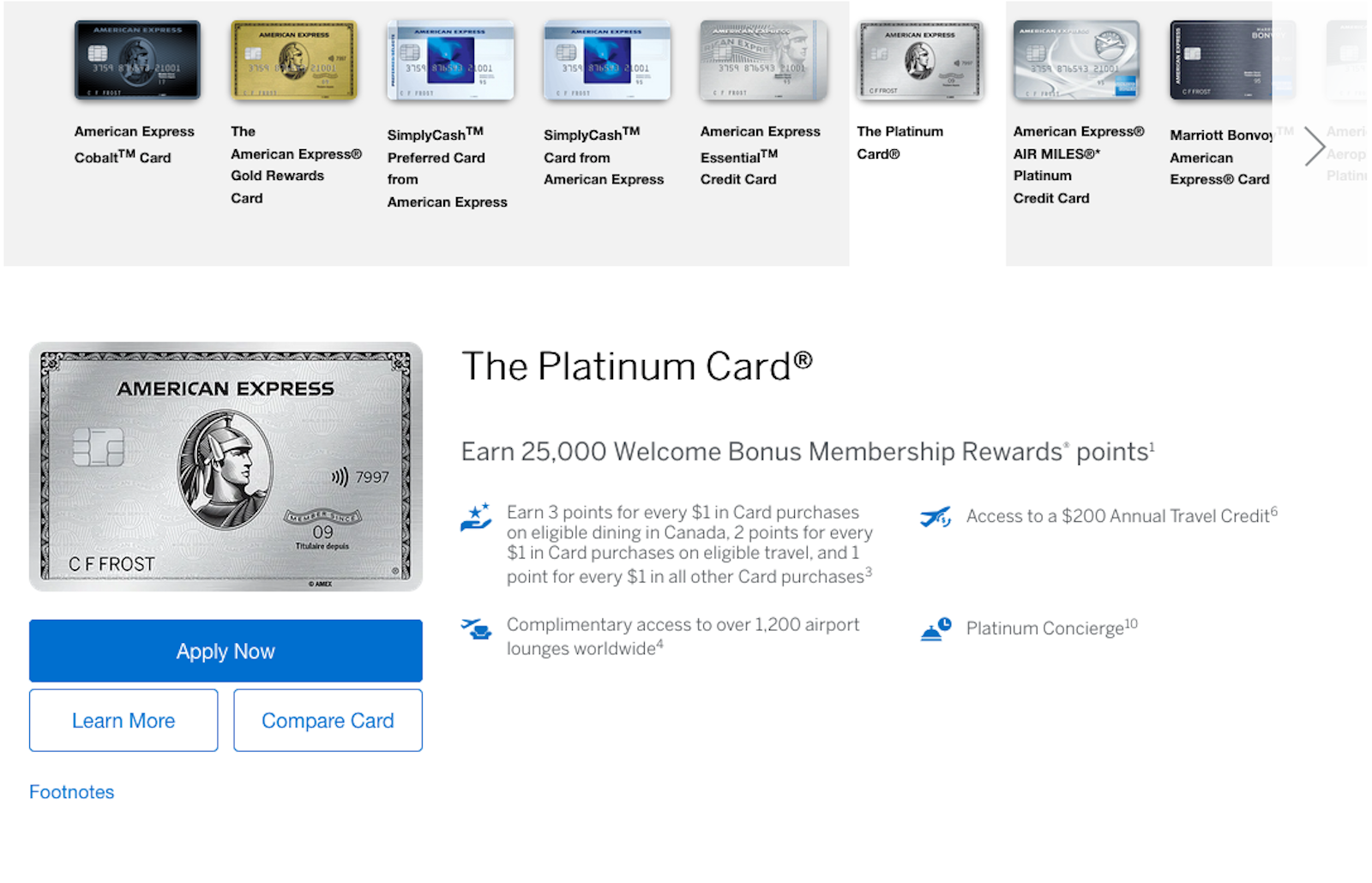

American Express Platinum Card

In Canada, Amex has a welcome offer of 25,000 Membership Rewards points after spending $2,000 CAD in 3 months. There are different categories for points earning, but you’ll have at least 27,000 points after meeting minimum spend requirements. You’ll also pay an annual fee of $699 CAD. $2699 CAD = $1988.16 USD

Points per $1: 13.58

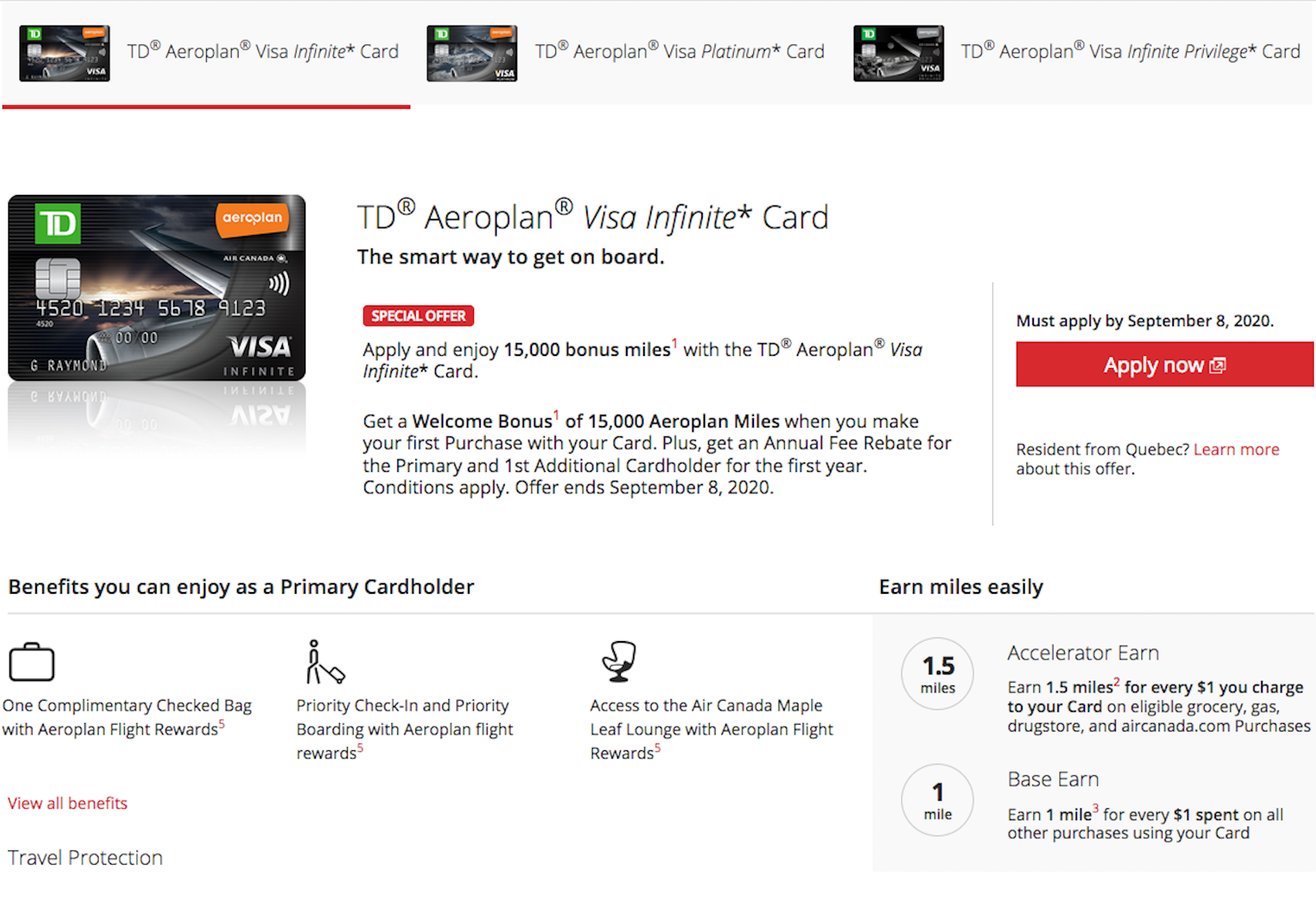

TD Aeroplan Visa Infinite Card

Another “first purchase=bonus” card, TD Bank offers this card only in Canada. You earn Aeroplan miles, which are from Air Canada. The annual fee is waived the first year, and you earn 15,000 miles after your first purchase. You’ll have 15,001 miles if doing the bare minimum.

Points per $1: 15,001

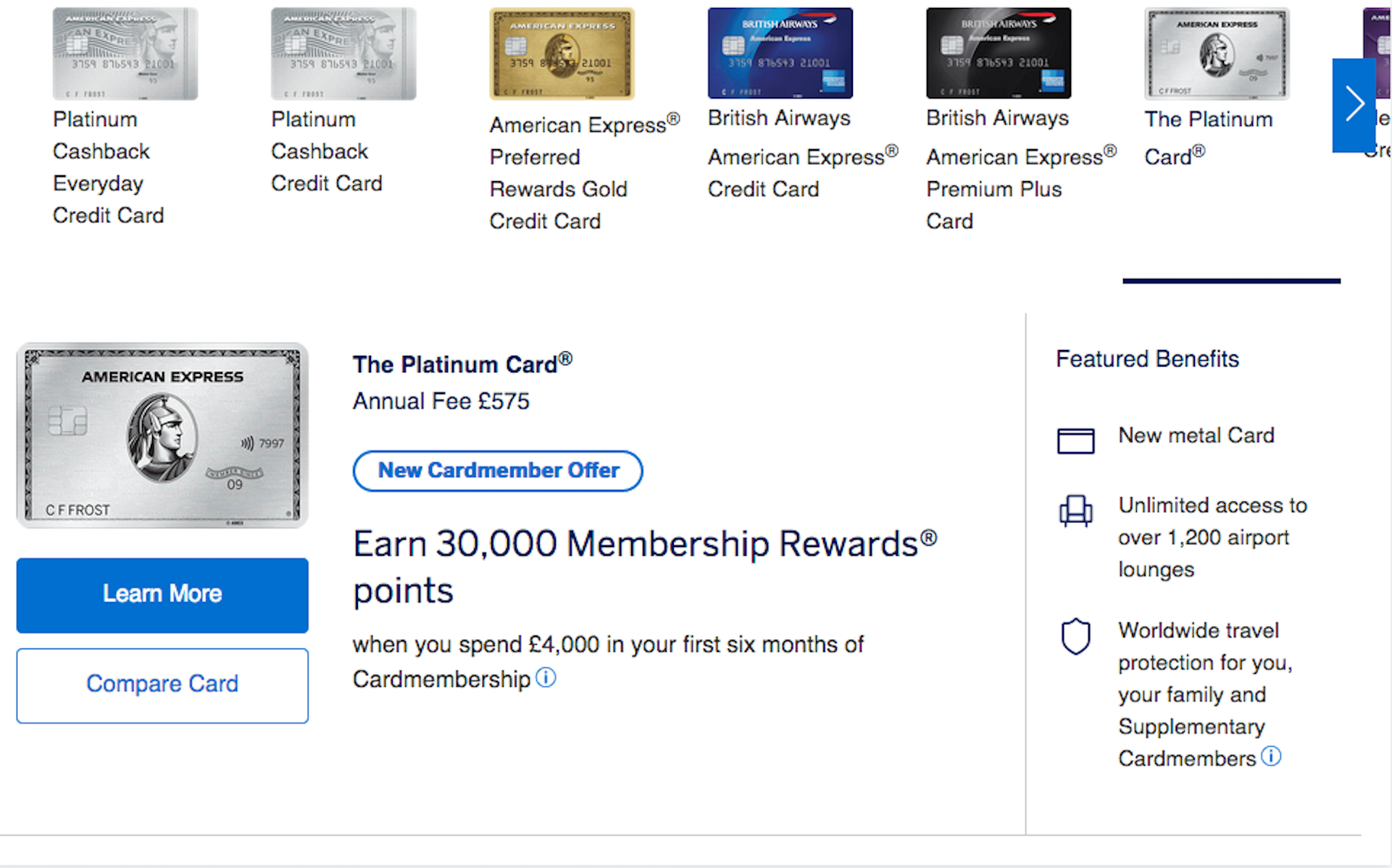

U.K.

American Express Platinum Card

In the U.K., the Platinum Card welcome offer is 30,000 points after spending £4,000 in 6 months. There are different categories for points earning, but you’ll have at least 34,000 points after meeting minimum spend requirements. Add an annual fee of £575. 4575 GBP = $5711.41 USD

Points per $1: 5.95

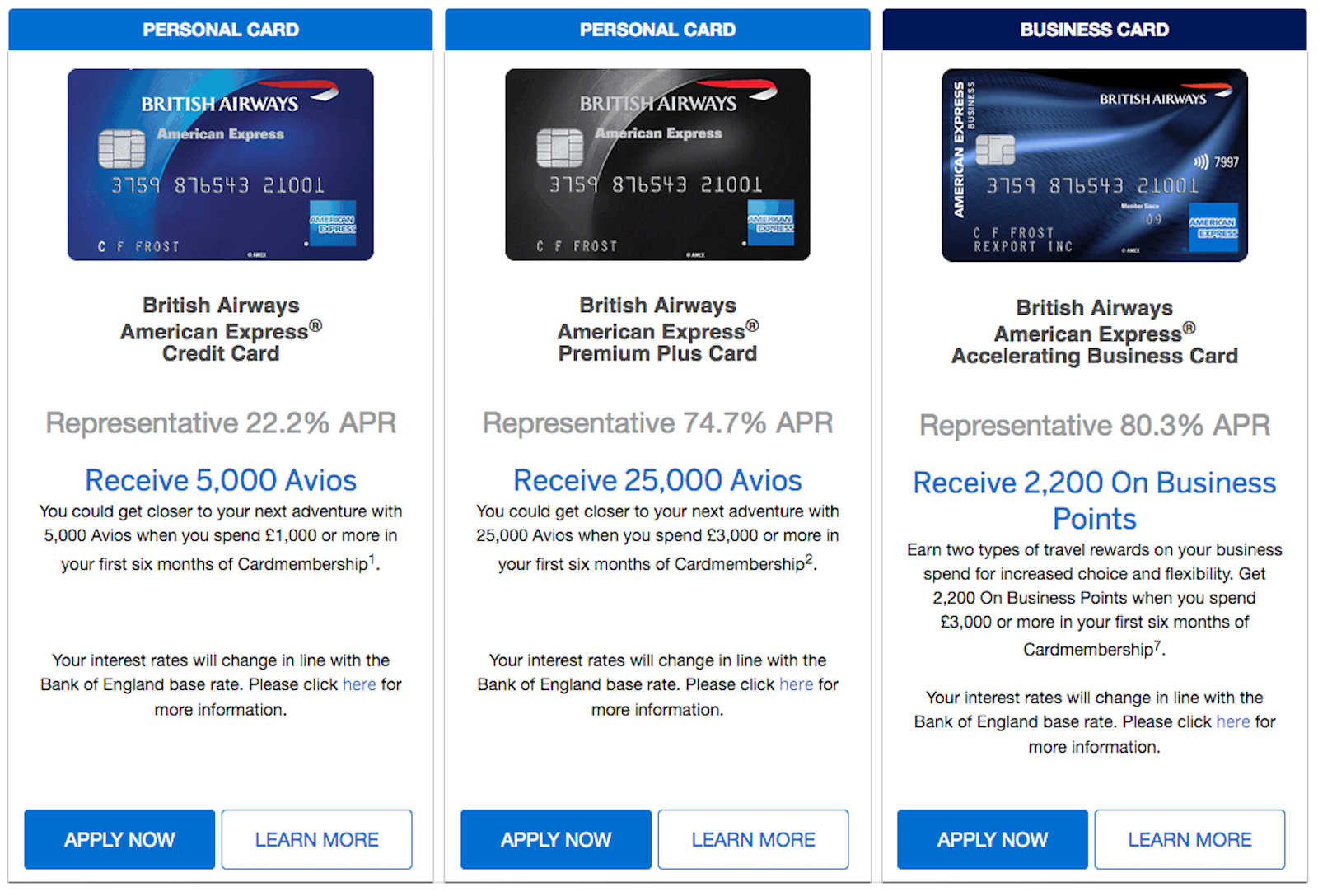

British Airways American Express Premium Plus Card

In the U.K., American Express offers multiple card that earn avios from British Airways. With the Premium Plus card, you can earn 25,000 avios after spending £3,000 in 6 months. Compare this to the British Airways Visa Signature Card from Chase in the U.S., though. Chase’s card offers 50,000 avios after spending $3,000. On the U.K. card, you’ll have 28,000 avios. 3000 GBP = $3745.18 USD

Points per $1: 7.48

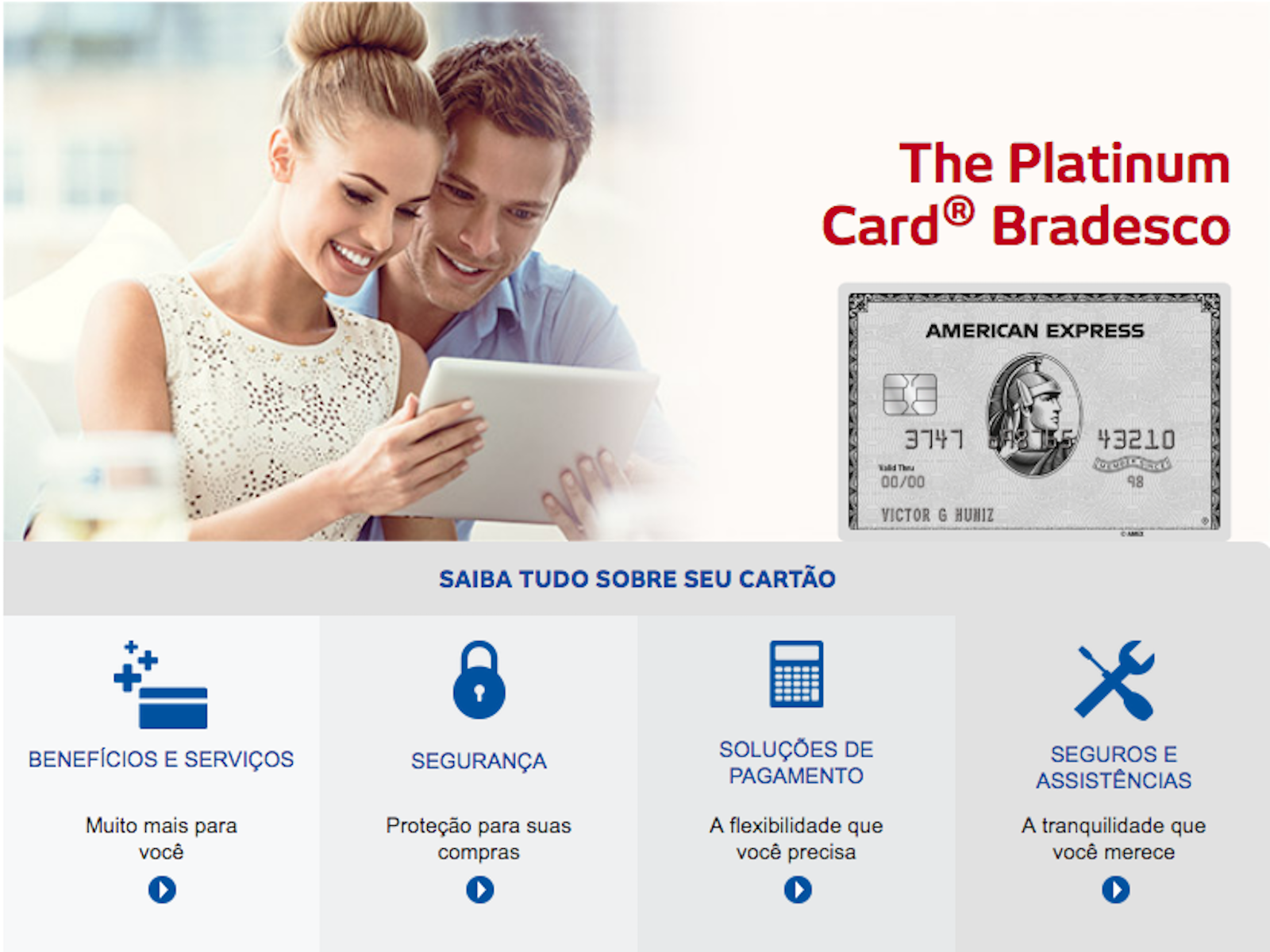

Brazil

American Express Platinum Card

Strangely, American Express farms out the Platinum Card to Bradesco in Brazil. Even more strangely, there is simply no welcome offer. You earn points from spend, but there’s no bonus. To apply for the card, you need to prove that you have an annual income above R$100,000, which is about $20,000 USD.

Points per $1: 1

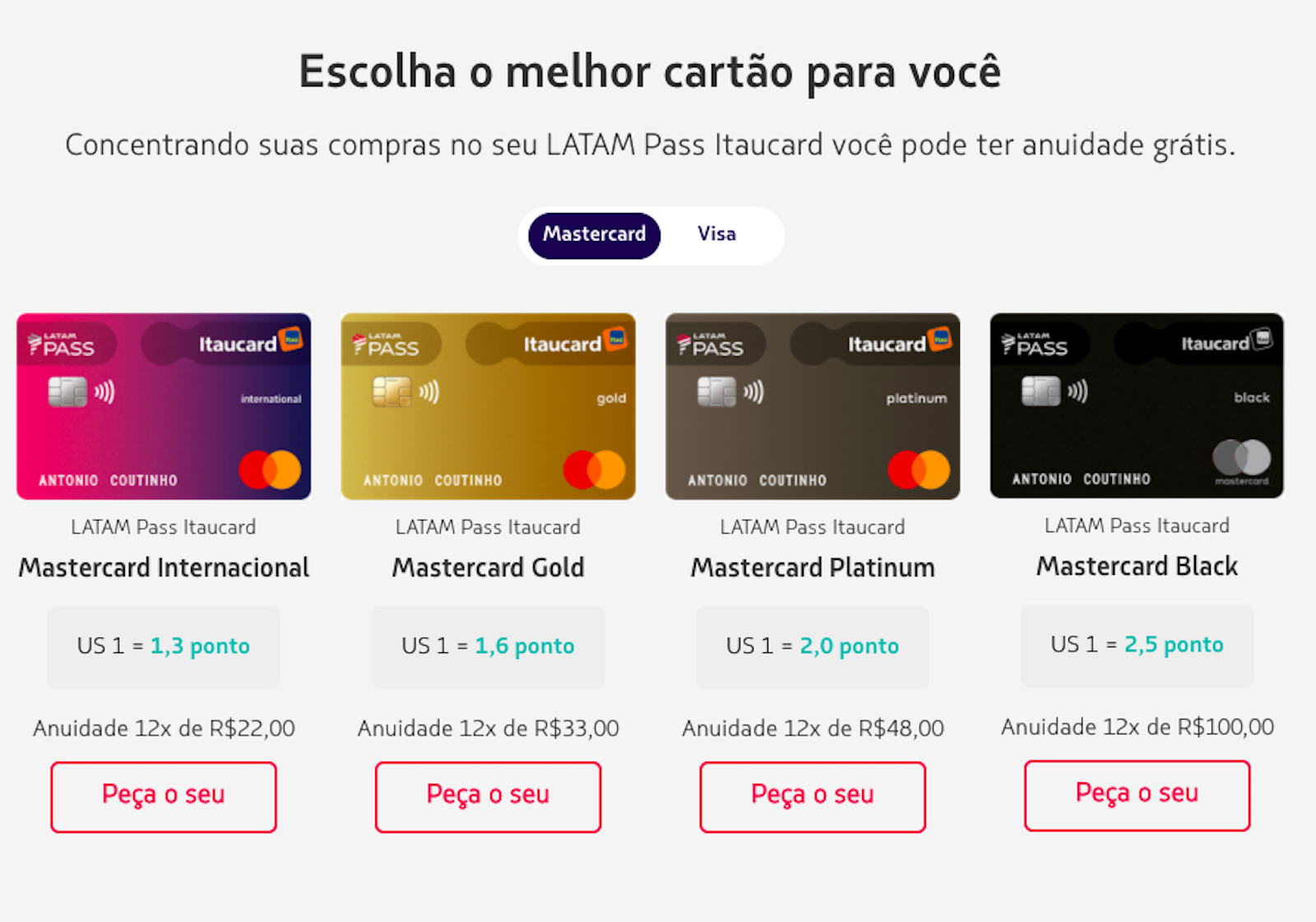

Mastercard Black From LATAM Pass Itaucard

Itau bank offers co-branded LATAM credit cards in Brazil. As with the Platinum Card mentioned above, there is no welcome offer. You earn different levels of perks with the card, but all points come from daily spend. Instead of an annual fee, there is a monthly fee. In exchange for a higher monthly fee, you earn points at a higher rate. Notice that points accumulation is against the USD exchange rate, which means you earn less points if the exchange rate gets bad.

Points per $1: 2.5

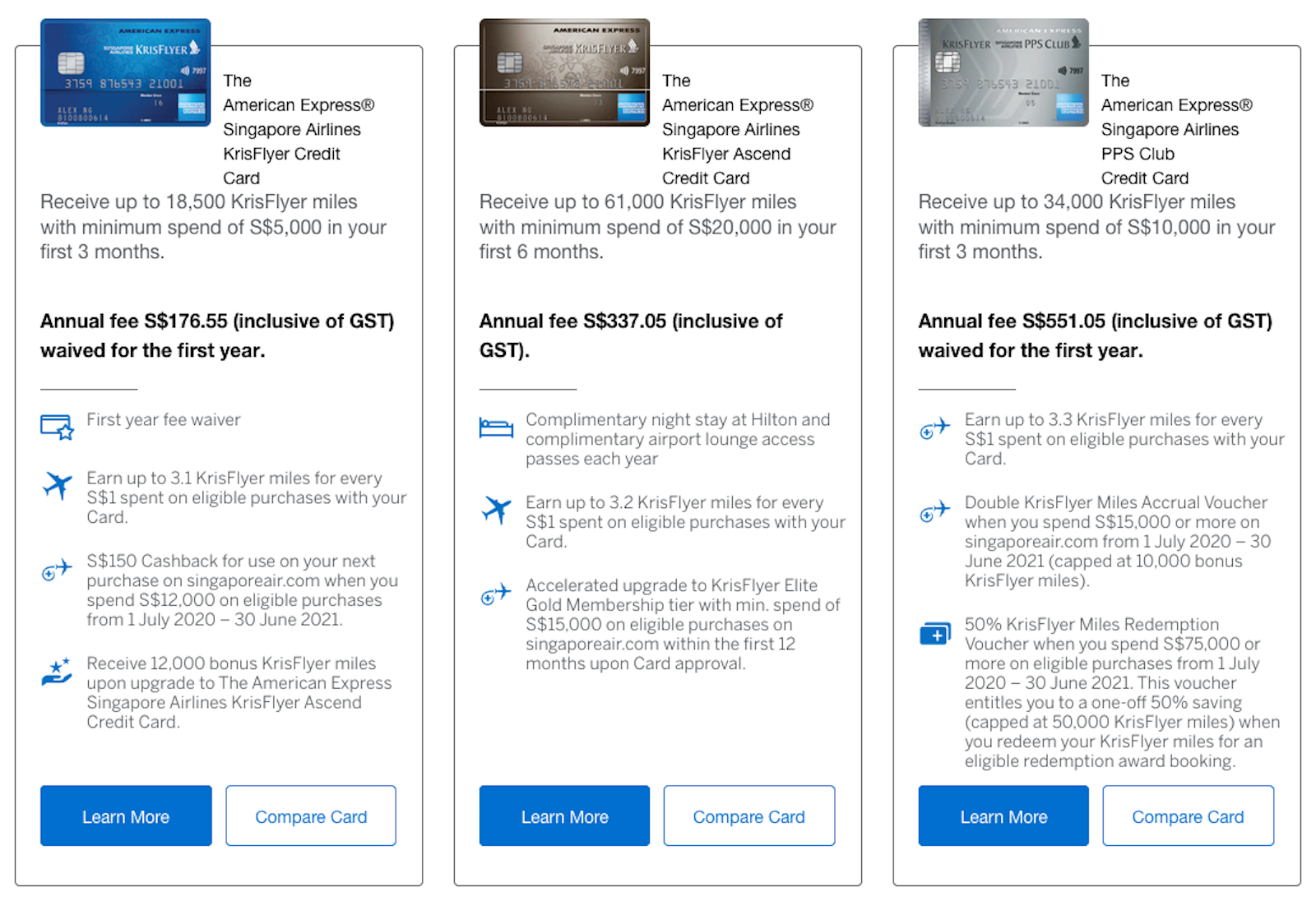

Singapore

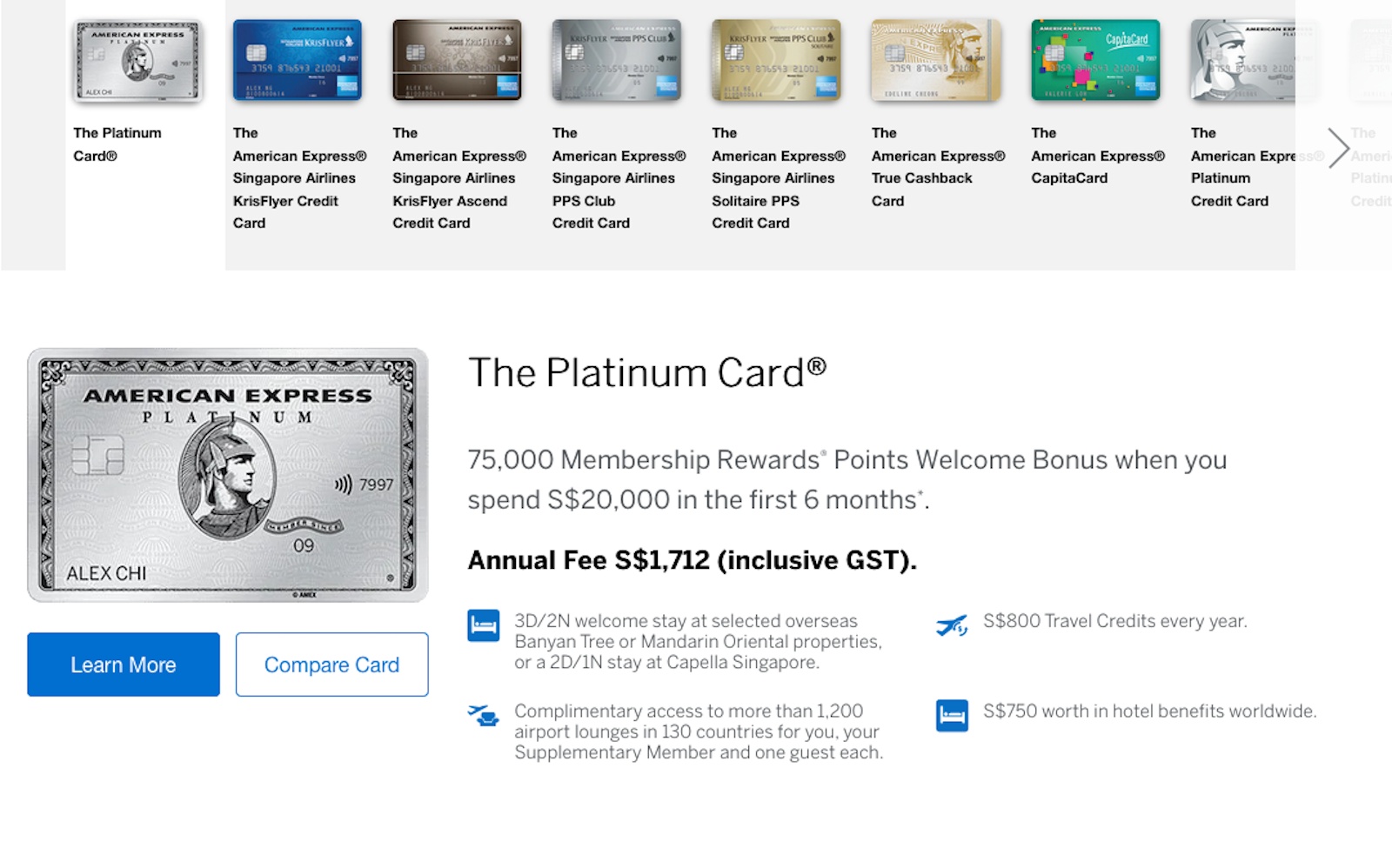

American Express Platinum Card

In Singapore, the welcome offer on the American Express Platinum Card is 75,000 points after spending S$20,000 in 6 months. Standard points earning is 2 points per S$1.60 of spend. At minimum, you’ll have 100,000 Membership Rewards points. The annual fee is a WHOPPING $1,227.19 USD after exchange. To earn the 100,000 points, you’ll spend a total of $15,563.54 USD.

Points per $1: 6.43

American Express Singapore Airlines KrisFlyer Ascend Credit Card

Available only in Singapore, this Singapore Airlines card from Amex earns KrisFlyer miles. After spending S$20,000 ($14,336.35 USD), you can earn points from the welcome offer of 61,000 KrisFlyer miles. You have 6 months to meet this steep spend. You’ll also earn 3.2 KrisFlyer miles per S$1 of spend, so you’ll have a minimum of 81,000 KrisFlyer miles.

Points per $1: 5.65

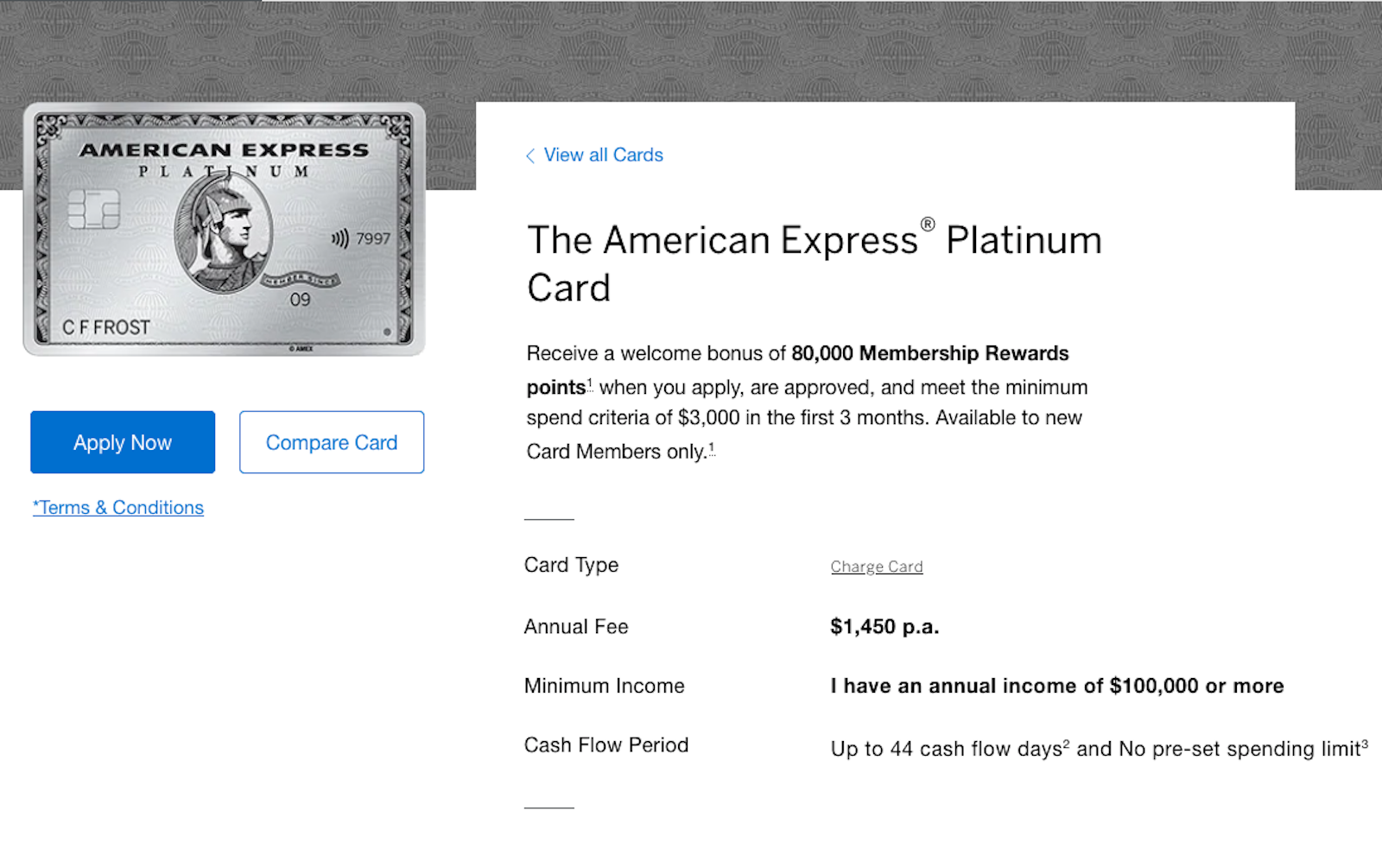

Australia

American Express Platinum Card

In Australia, you need to prove an income of $100,000 AUD ($69,420.00 USD) to even apply for this card. After spending the equivalent of $2,082.60 USD in 3 months, you can earn 80,000 Membership Rewards points. You’ll have 83,000 points with the earnings from your daily spend, and you’ll pay an amazing annual fee of $1,006.59 USD.

Points per $1: 26.87

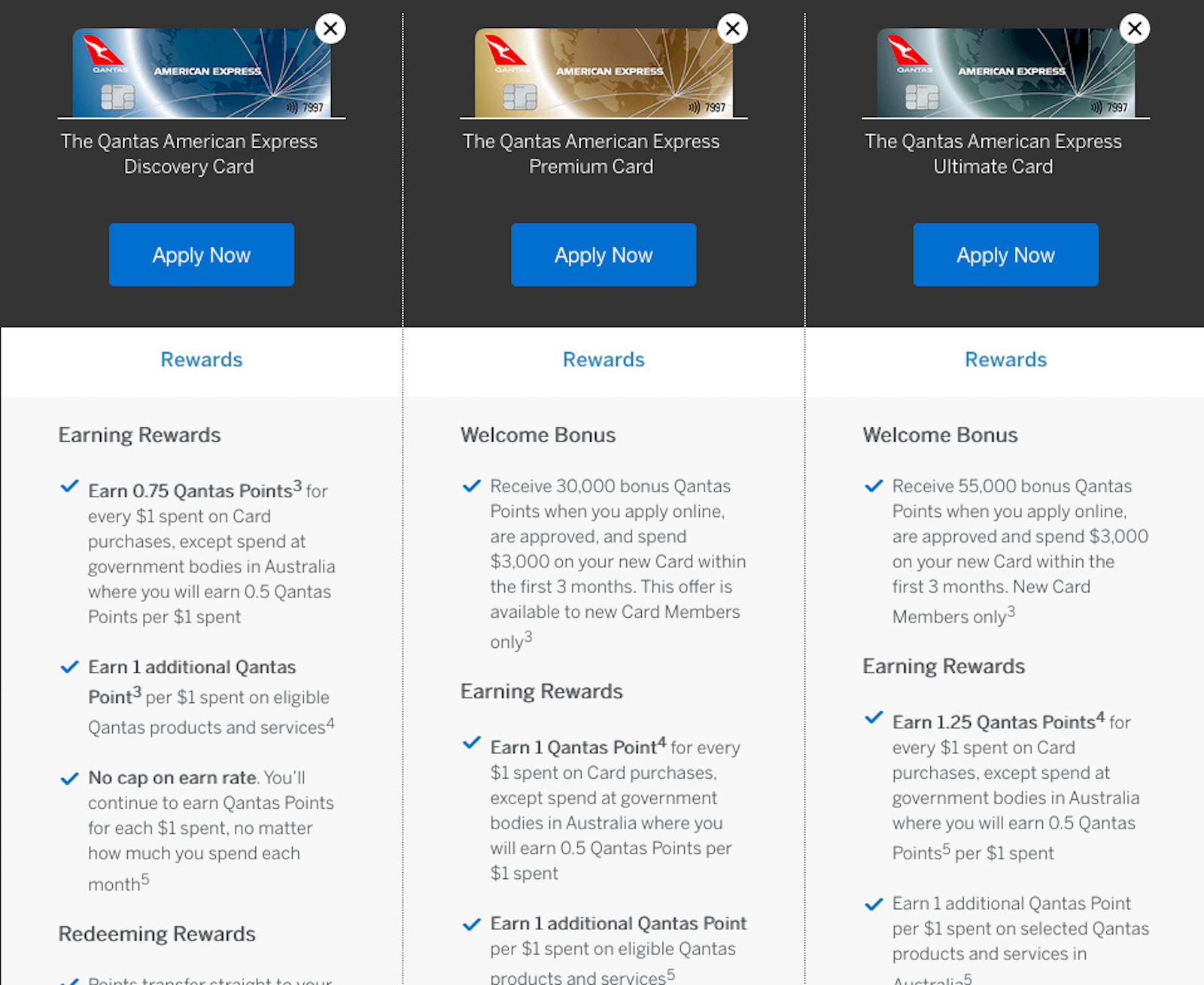

Qantas American Express Ultimate Card

Available only in Australia, the Qantas American Express Ultimate Card comes with a welcome offer of 55,000 Qantas Points. You need to spend $3,000 AUD ($2,082.60 USD) and pay an annual fee of $312.39 USD. After this, you’ll have a minimum of 58,000 miles.

Points per $1: 24.18

Breaking It Down

So, how do these stack up? Are the best credit card offers in the world really in the U.S.? I’ll immediately rule out Brazil, because the cards don’t have a welcome offer, just points earned from daily spend. Welcome offers in Australia and Singapore are quite good, but you need to prove that you have a high income and will also pay steep annual fees.

Comparing the U.K. version of the British Airways cards to the one available in the U.S. shows a much bigger pool of points to be earned in the U.S. The welcome offer on the Platinum Card is incomparably better in the U.S., as well.

Canada does have a “one purchase and done” card to rival the Barclays Aviator, and you don’t even have to pay the annual fee in the first year. However, the number of points that you earn is much smaller. You can’t do a ton with 15,000 Aeroplan miles, but you can do a lot with 60,000 American Airlines miles.

Final Thoughts

Overall, while some of the “points per mile” rates in other countries may be better, the overall number of points you can earn from credit card welcome offers in the U.S. is much bigger. The annual fees in places like Singapore and Australia are insane. Additionally, credit card rewards become a much more elite / hard to access realm if you can’t demonstrate the high income requirements to even apply for the cards.

In the U.S., earning points and miles is simply easier than in most places. Yes, it takes some effort, but look at how much faster we can earn points & miles from opening credit cards than people in other countries. To me, this is why I don’t pursue elite status, since I can just get a bunch of miles and then choose to fly business class if I want to use the extra miles. When you compare the welcome offers, the best credit card offers are in the U.S.

In Israel, Amex Platinum is only $320 a year and includes a free AU. No welcome bonus, terrible point earning, minimal transfer partners, 2.7% FX fee.

But, for $160 a card if you get the free AU, you do get the full suite of Amex Plat benefits (FHR, Centurion/SkyClub lounges and the other random lounge partners, concierge, Hilton Gold, Radisson Gold, Hertz 5 Star). You also get various free gifts on your birthday and a few holidays, which knock off about $75 from the fee in recouped value. Plus tons of freebies and discounts that rotate each month and can be double dipped with the AU card, basically always getting you into net positive territory by the end of the cardmember year.

Honestly, despite the crap point earning, for a pair of Delta SkyClub/Centurion lounge flyers, I doubt a better out-of-pocket cost deal can be found elsewhere.

It sounds like you’re paying to have the card for the perks. I don’t value those fringe perks highly enough that they’d offset better points earning, better transfer rates to airline/hotel partners, huge welcome offers/bonuses. It’s a good “have for the benefits” card from your description, but it can’t pass the value of what you can get in free flights with the US version, due to welcome offer and ongoing points earning.

And since the article is about offers, I come back to saying the US has the best offers.

For Membership Rewards, the point values are different in each country. I don’t see how doing a points earned per dollar spent comparison is meaningful.

Yes, depending on the country, the points transfer to airline partners at different ratios. That becomes more of a “what are points worth in different countries” discussion, but it would further support the idea that the best offers (get the most out of credit card bonuses) is in the U.S.

I agree with you that U.S. cards offer the best bonuses, as i have done some research on my own. However, i just don’t think the info presented in this article can fully support that claim.

How so? Always happy to hear others opinions.