Note: We have a direct business relationship with Bilt Rewards and may receive compensation if you apply via links in this post.

Bilt Rewards Mastercard New Benefits

We first covered the Bilt Rewards Mastercard a few months back. What makes Bilt Rewards special is you are able to earn points on rent payments, something that up until now has not normally been possible for most people. The rewards you earn can also be transferred to several travel partners making this a program worth looking at.

Now Bilt Rewards is introducing an even more rewarding earning structure, additional member benefits, a simpler status program, and an additional point transfer partner. Let’s see the details of these changes that were just announced today. Plus we have a Bilt Rewards promo code to help you skip the waitlist!

Bilt Rewards Mastercard Introducing 0-1-2-3 Earnings

The Bilt Rewards Mastercard has made changes to its rewards structure after user feedback from the first 3-months in-market. Here’s how the new 0-1-2-3 points earning structure breaks down:

- $0 annual card fee

- 1x on rent payments with no fees (on up to $50,000 in rent payments every year)

- 2x points on travel (when booked directly with an airline, hotel, car rental or cruise

company) - 3x points on dining

- Plus 1x points on all other purchases

Bilt Rewards Mastercard

Bilt Rewards Points Earning & Sign-Up Bonus

- How to earn points with Bilt Rewards Mastercard: The Bilt Rewards Mastercard is unique in that you have to use it in order to earn your points. How does that work? All you need to do is use your card for a minimum of 5 card transactions per statement period.

- Bilt Rewards Mastercard Sign-Up Bonus: All new cardholders will also earn 2X points on all purchases for the first 30 days.

Bilt Rewards Mastercard New Benefits Added

Newly added benefits for all loyalty members include:

- Earn Interest on Points (Silver, Gold, Platinum)

- A first-of-its-kind offering, Bilt will pay interest in the form of points to a member’s

Bilt Rewards account every month, based on their average daily points balance

for each 30-day period. - The rate will be based on the FDIC published national savings rate found

here: https://www.fdic.gov/resources/bankers/national-rates/.

- A first-of-its-kind offering, Bilt will pay interest in the form of points to a member’s

- Bilt’s Homeownership Concierge (Gold, Platinum)

- Members who opt to redeem Bilt Points towards their home down payment can

utilize the help of a dedicated concierge that will walk members through the home

buying process step-by-step.

- Members who opt to redeem Bilt Points towards their home down payment can

- Bonus Points on New Leases or Renewals (Silver, Gold, Platinum)

- Bilt will deposit up to 50% bonus points on top of points issued by landlords to

members for signing for new tenant leases and lease renewal., depending on

member status.

- Bilt will deposit up to 50% bonus points on top of points issued by landlords to

- Complimentary Bilt Collection Gift (Platinum)

- Upon reaching Platinum status, members will receive a complimentary gift from

the Bilt Collection – an exclusive and curated assortment of home decor and art

- Upon reaching Platinum status, members will receive a complimentary gift from

Bilt Rewards Adds New Status Tiers

Bilt Rewards has now simplified its status structure so that member status is based on total points earned over the calendar year, vs. monthly points accumulation. Points can be earned from any source such as rent transactions, non-rent transactions, bonus points, and more.

The new Bilt Rewards status structure is as follows:

- Blue – anyone enrolled in Bilt Rewards with under 25,000 points

- Silver – 25,000 points earned

- Gold – 50,000 points earned

- Platinum – 100,000 points earned

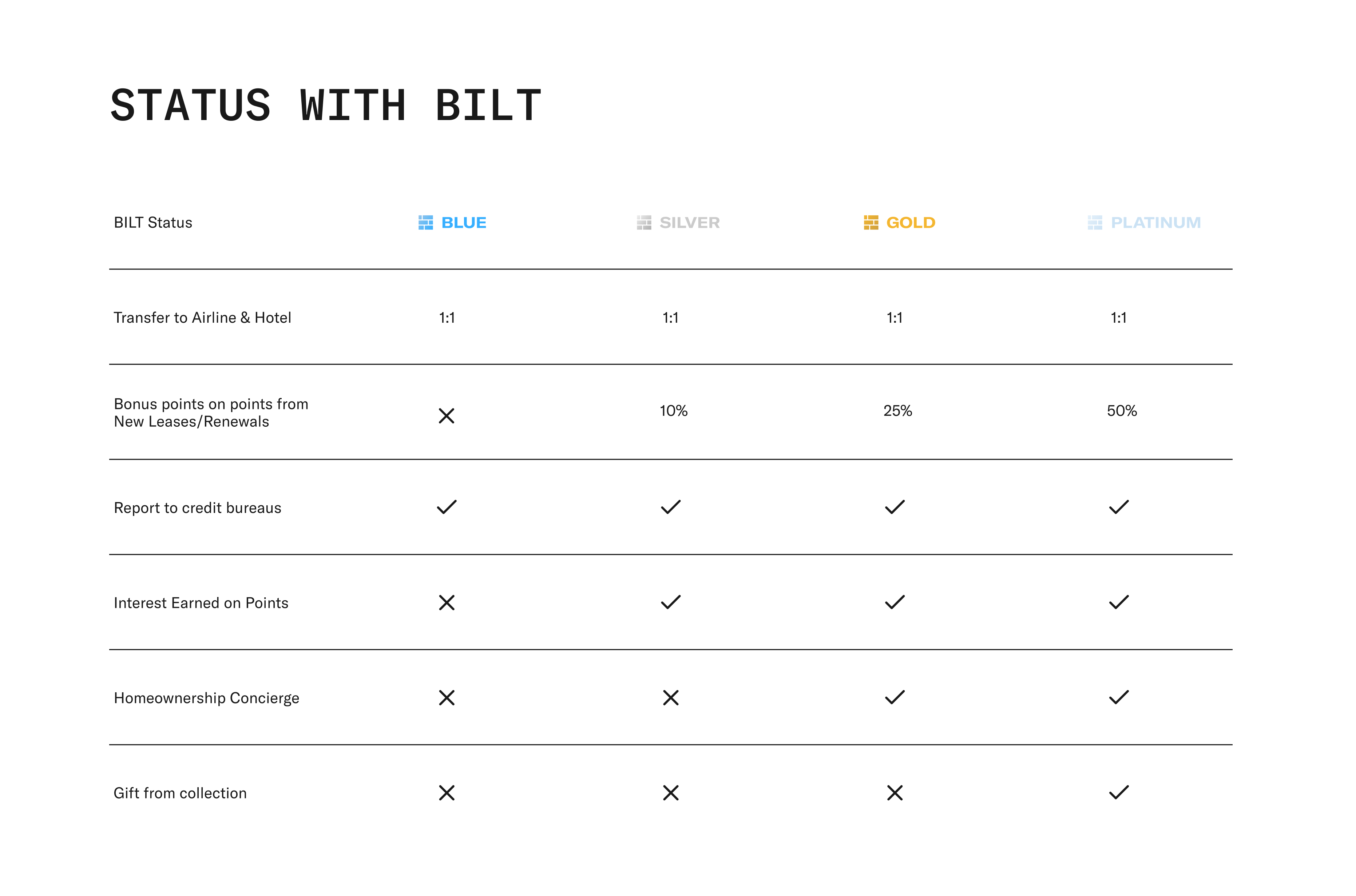

Initial status benefits at each tier are outlined in the following chart. Additional status benefits will be rolled out in the coming months.

If you earn status between Jan 1 and Jun 30 each year, it will expire Jan 31 of the following year. If you earn status between Jul 1 and Dec 31, it will remain active the rest of that year and the entire following year.

Bilt Rewards Adds IHG As Transfer Partner

IHG Hotels and Resorts will join Bilt Rewards as a transfer partner, enabling Bilt members to transfer their Bilt Points 1:1 to IHG Rewards, where they can book hotels in 6,000 destinations around the world.

IHG Rewards joins Bilt’s network of loyalty partners including: American Airlines AAdvantage, Aeroplan, Emirates Skywards, Flying Blue, Turkish Miles&Smiles, Virgin Points, Hawaiian Airlines HawaiianMiles, and World of Hyatt.

Other Bilt Rewards Mastercard Benefits

- Cell Phone Insurance – Up to $800 per claim if your cell is stolen or damaged. Limited to 2 claims per year.

- Purchase Protection – Covered from theft or damage within 90 days of the date of purchase, up to $1,000 per claim.

- Trip Cancellation Protection – You’re protected against forfeited, non-refundable, unused payments and deposits if a trip is or interrupted. Up to $1,500 per incident.

- Rental Car Insurance – Get covered for physical damage and theft of most rental cars when you pay for the rental transaction with the Bilt Mastercard

- $120 of Doordash credit per year – A $5 discount will be applied to your first 2 Doordash orders of each month.

- $60 of Lyft credit per year – When you take 3 rides per month.

- No foreign transaction fees

Bilt Rewards Mastercard

Bilt Rewards Mastercard New Benefits – Bottom Line

Bilt Rewards has made a number of changes to enhance their rewards program and credit card offering. With no annual fee, bonus categories, a decent amount of transfer partners plus other interesting benefits such as earning interest on your points, I think it is worth considering and can’t wait to see how Bilt Rewards grows and evolves over time.