Note: We have a direct business relationship with Bilt Rewards and may receive compensation if you apply via links in this post.

Bilt Mastercard Now Lets You Pay Rent for Free in Existing Payment Portals

Bilt Rewards has announced a new option when it comes to paying your rent.

As you know, Bilt rewards you for paying your rent with a credit card. You can earn 1x on rent payments with no fees (on up to $50,000 in rent payments every year). Cardholders must meet a minimum of 5 card transactions per statement period in order to earn points. You can read more about Bilt here.

However, until now there was one issue. If your landlord wasn’t in the Bilt Rewards Alliance, you would have to send a physical check. And many landlords aren’t part of Bilt, since it is relatively new.

The new option that we mentioned now lets any Bilt cardholder in the country pay rent with the Bilt Mastercard in an existing rent portal a landlord uses (ClickPay, RentCafe, etc) or pay an independent landlord electronically. And you can still earn points for your payments.

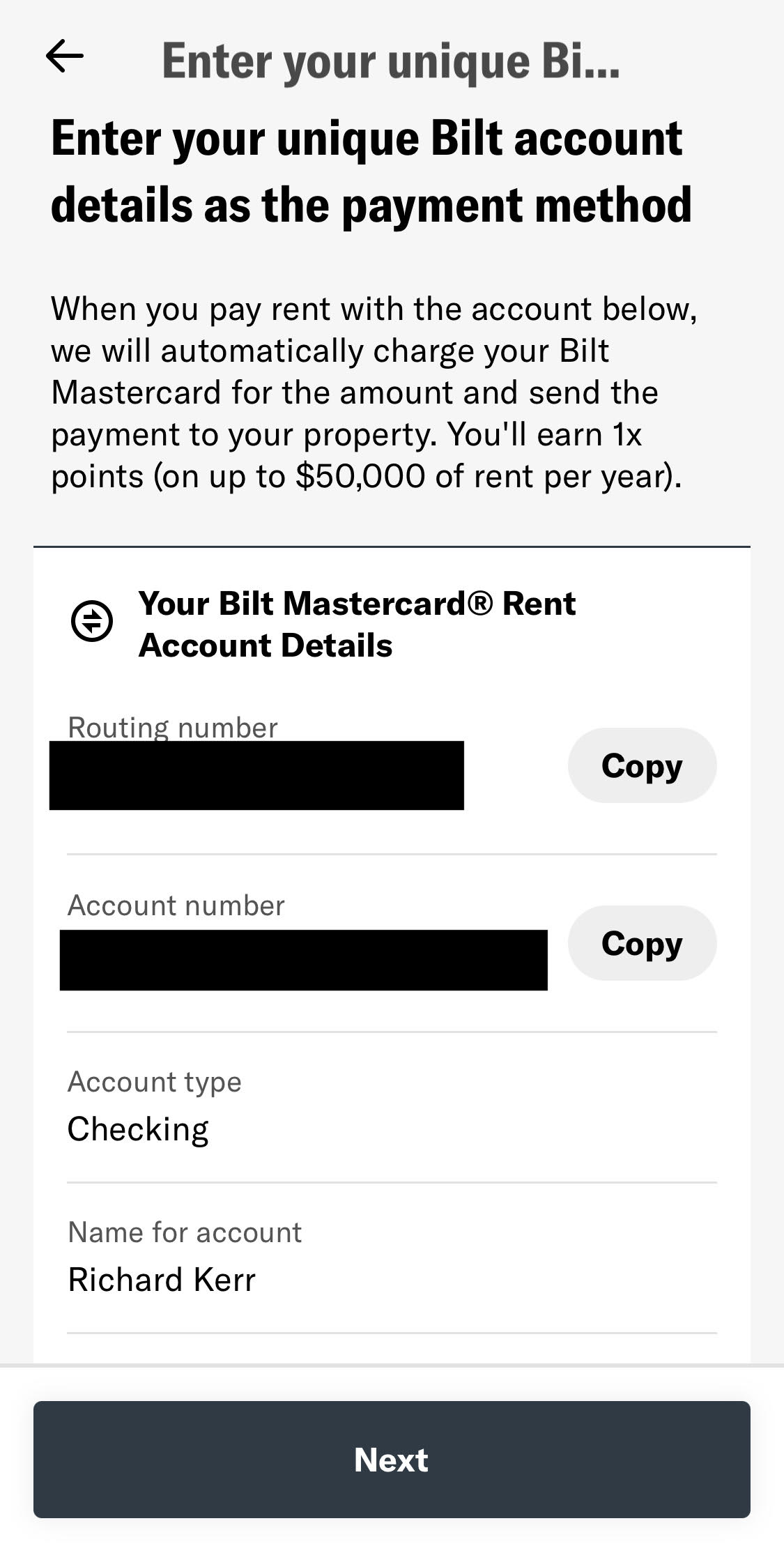

A Bilt cardholder can head to the Bilt Rewards app and activate a Bilt Rent Account which will generate a routing number and account number to pay via an existing payment portal. There will be no fees to pay rent with the Bilt Mastercard using the Bilt Rent Account and you’ll still earn 1 point per dollar paid in rent.

How it Works

If a Bilt cardholder wants to continue paying their landlord by check, they can continue to do so. If you want to use the new option, then you can find it in the Bilt Rewards App in the ‘Pay Rent’ tab at the bottom.

You can copy the routing and account number, and use them in a rental payment service.

With rent having skyrocketed over 25% year-on-year in Austin, NYC, Miami and other major US cities, and with the scam “amenity fee” surcharge game having been ramped up at rental properties across the US, Bilt will probably see some serious growth this year.