Get Over $1000 Bonus with Brex Card and Brex Cash Account

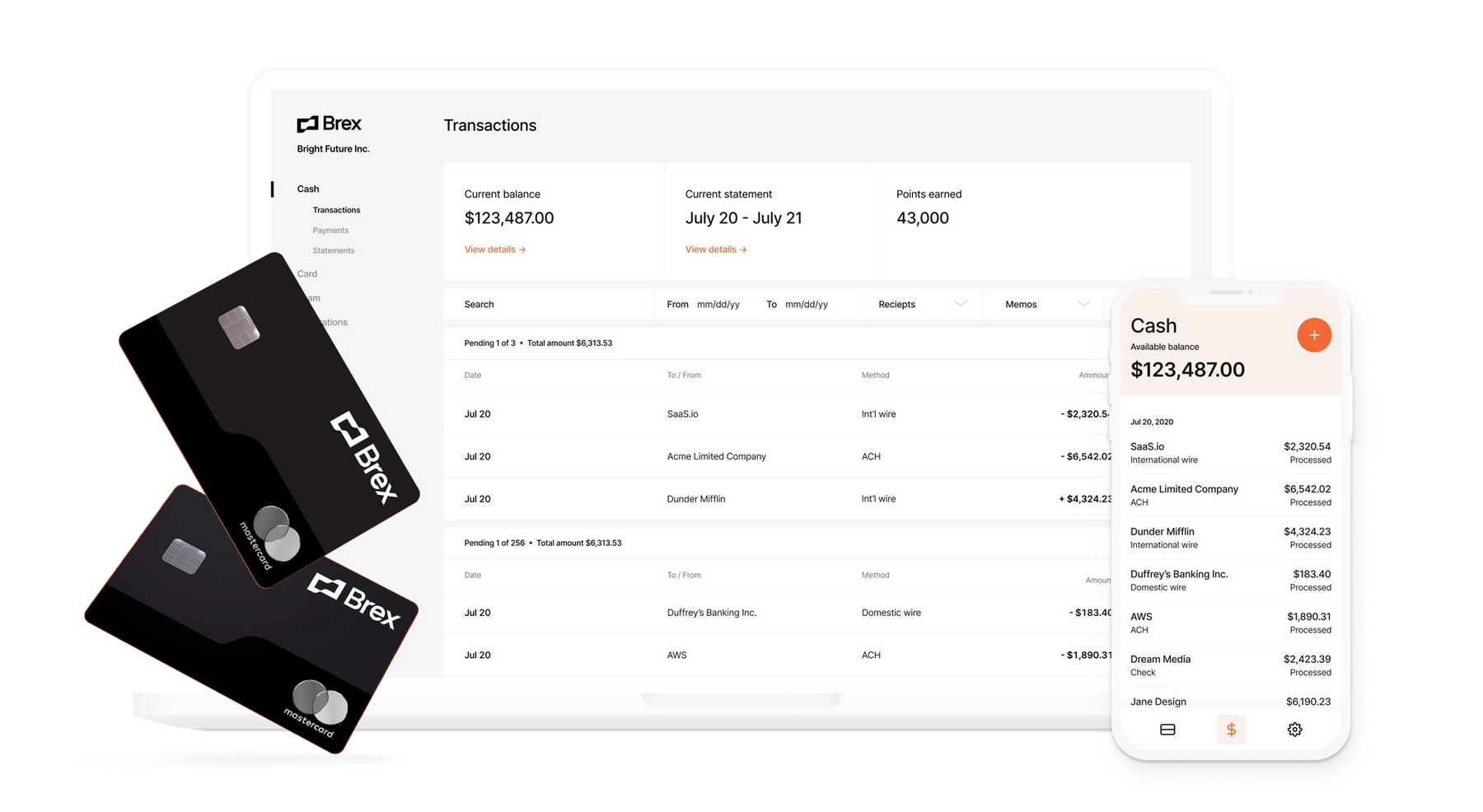

Brex is a cash management account aimed at startup companies, and different from the usual cards in the market today. Instead of evaluating applications based on a business owner’s personal credit, it focuses on the business itself. Signing up will not affect your credit score, but you need to own an wn an LLC, LLP, C-corp, or S-corp in order to apply.

Now Brex is offering an increased signup bonus when you sign up for Brex Cash as well. This welcome bonus is exclusive to One Mile at a Time. Miles to Memories may receive compensation if you click through to One Mile at a Time from this post. With this bonus you can get 80,000 to 110,000 bonus points. That’s easily worth over $1,000. So let’s see how the offer works and how to apply.

The Offer

Earn 80,000 points when you sign up for and are approved for Brex Cash accounts through OMAAT. The account just needs to be funded, and you’ll get the bonus points once you’ve spent $1,000 on your new Brex card.

On top of that, you can earn up to 30,000 additional bonus points:

- You’ll earn 20,000 bonus points when you link payroll to your Brex Cash account

- You’ll earn an additional 10,000 points after spending $3,000 on your Brex Card in the first 3 months

You can earn a total of 110,000 points which are worth $1,100 or more. You must own a business that is registered in the United States as a C-corp, S-corp, LLC, or LLP in order to get this bonus.

Card Details

The Brex card has great rewards earning capabilities with as much as 8X back for on rideshares, 5X on travel, 4x on restaurants and more. You earn more rewards if you make daily card payments using Brex Cash. These are the earning rates for daily card payments:

- 8x on rideshare, including Uber, Lyft, taxi, and scooter

- 5x on flights and hotels booked through Brex Travel

- 4x on restaurants and dining

- 3x on recurring software like Salesforce, Zendesk, Twilio, and more

- 3x on eligible Apple products like Mac and iPhone, via the Brex portal

- 1x on everything else with no cap on how much you can earn

If you do monthly card payments, you still get more generous rewards over traditional cards. Here are the rates for monthly card payments:

- 7x on rideshare, including Uber, Lyft, taxi, and scooter

- 4x on flights and hotels booked through Brex Travel

- 3x on restaurants and dining

- 3x on eligible Apple products like Mac and iPhone, via the Brex portal

- 2x on recurring software like Salesforce, Zendesk, Twilio, and more

- 1x on everything else with no cap on how much you can earn

Redeeming Rewards

You can redeem points as cash back or towards travel for a value of 1 cent per point. You can also transfer points to airline partners. Eligible partners include:

- Aeromexico Club Premier

- Air France/KLM Flying Blue

- Avianca Lifemiles

- Cathay Pacific Asia Miles

- Emirates Skywards (Coming soon!)

- Qantas Frequent Flyer

- Singapore Airlines KrisFlyer

Transfer ratio is 1 to 1 for all partner airlines.

Application Process

Brex will pull your Plaid / Chex report after your application during their review of your business information and financials etc. If you have a lot of dings on your Chex report (many opened checking accounts etc.) this could lead to a denial. They are more of a conservative bank so that is something to be aware of. I would still personally give it a try since I don’t value a Chex pull as much but we figured you should know.

Conclusion

This is a big bonus for a Brex account and it looks like a great product for those who qualify. Not everyone can apply, since you need to have a registered C-corp, S-corp, LLC, or LLP. But if you are eligible, it is definitely worth considering, since there’s no hard pull on your personal credit report. The Brex card has no annual fee and their cash management product comes with a several benefits and no monthly fees either.

Applying will not affect your credit score. Brex says that it is not a bank and Brex Cash is not a bank account, although it is FDIC insured and really works like one. The account also comes with some extra perks such as up to $150 in Google Ads credit, 50% off Dropbox plans, 20% discount on annual Zoom subscription and more.

they told me the same thing!

I signed up with your link. They told me it takes 5-7 business days for account review until I can transfer money in. Is this normal?