| Miles to Memories does not have a direct relationship with the card issuing bank(s) and this post does not include any affiliate links. If you wish to support the site by applying for credit cards or using other referral links, you can do so here. Before applying I highly suggest reading the following posts: Slow & Steady Doesn't Make You A Loser and A Mandatory Waiting Period to Apply for Credit Cards?. You can find all of our credit card reviews here. |

|---|

British Airways Visa 100K Avios Offer

Chase has once again brought back the popular 100K bonus on their co-branded British Airways credit card. Lets take a look at the offer to see if it is worth applying for.

The Offer

Earn up to 100K Avios. Earn 50K after $2K spend during the first 3 months + earn 25K after $10K total spend in the first year + earn 25K after $20K total spend in the first year. (Basically, spend $20K get 100K.)

Application Link (I couldn’t find the direct link on their website, so I took someone’s affiliate link and stripped out the information. As far as I know this is a direct link and it definitely doesn’t pay me any commission.)

Card Features

- 3X Avios on direct British Airways purchases and 1X Avios on everything else.

- Travel Together Companion Ticket after $30K in annual spend. (More info on that benefit here.)

- $95 Annual fee is NOT WAIVED the first year.

Analysis

First off, there isn’t a point in taking advantage of this offer if you don’t plan to spend the entire $20K in order to get the full bonus. The normal bonus on this card is 50K after $2K in spending, so you can get that anytime without the large spend.

The question then becomes is it worth it to spend $20K to earn 120K Avios. I think it is. Many people transfer Ultimate Rewards or Membership Rewards to Avios. If you do that then you can almost look at this as a 100K offer in one of those currencies. At the very least by getting this card you are saving those flexible currencies for other programs.

Best Uses

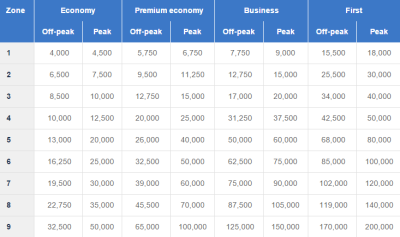

British Airways Avios is a distance based program. There used to be some decent premium class redemptions, however this year’s devaluation all but eliminated those. The best use of Avios is for short to mid-haul flights. They are also great for last minute redemptions since they don’t charge a close-in booking fee.

I use Avios all of the time for redemptions in the U.S. on American Airlines, US Airways and Alaska Airlines. For example, I have used 12,500 Avios several times to fly from the West Coast to Hawaii. There are also some decent redemptions on LAN and TAM in South America and even JAL and Cathay in Asia. British Airways does charge fuel surcharges on most airlines, so it is important to check those.

Best Offer?

I believe this is the best offer ever on this card. While the card used to earn 1.25X on everyday spend, that has been devalued, but the 100K bonus after $20K in spend has surfaced every year for the past several. One thing to also keep in mind is that it may be worth it for some to spend the extra $10K to get the Travel Together ticket. That won’t be the case for everyone though.

Conclusion

It isn’t often that you can pick up 100K of a currency with one sign-up bonus. (Although we have had a few cases lately.) 100K Avios are potentially worth thousands of dollars if redeemed properly. I always prefer to have a nice stash of Avios and am seriously considering applying for this card. I have tried to layoff my Chase applications lately so I could jump on a big bonus if it came along. Now might be the time.

HT: Frequent Miler via Milecards

With the current terms, do I have to wait until the final threshold bonus from my last application applied to my account to be elbible, or to 2 years from the time the initial sign-on bonus applied?

Good question. It really depends on how Chase decides to enforce it. My guess would be after the initial bonus, but the only real way to know is to do it or ask Chase.

It’s definitely not the best offer *ever* for this card. There was a public offer of 100,000 miles for $3000 spend in 2011 (I got the card back then). But I believe you would correct in saying this seems the best offer in many years.

Making me nostalgic. That 2011 Chase BA 100,000 Avios was the first offer that got me into “The Hobby”

Anyone found a working 100K link for the business version? The standard Chase page only shows the normal 50K.

I think it’s most accurate to compare to regular offer, so is it worth $95 and $18K spend for 50K avios? I think there are easier, free ways to get those points. eg. sign-ups from Chase SP or Ink+ where 1st yr has no AF and transfer points…

There are always cheaper ways to generate points depending on how far you want to go. I know for a lot of people this would make sense. With that said, you do make a good point. You are paying a $95 annual fee and foregoing $360 in cashback on a 2% card. The Avios can certainly be worth a lot more than that, but it will depend on the person and the situation.

Also, Ink and SP are not very easy to get anymore for the average churner. I do appreciate the comment and your perspective. You definitely have valid points.

Shawn! Love your blog. I want to apply for this, but also keeping my eye on the Southwest 50k offers (want to sign up for 2 cards to get the Companion Pass). Do you think I’d be able to get all 3 in one round?

I believe the limit is 3 cards per month, so technically it could be possible, but I would expect some pushback from them. It also depends on how many cards you have with them currently along with a number of other factors.

In other words, it is possible, but it will be difficult, especially since reports are they are being more stringent overall with all applications.

Thanks! I currently have 2 cards with them, with just one opened this year (the Hyatt card, using one of your referrals!). I want to wait till early October to apply for all 3, so I can get maximum usage out of the Southwest Companion Pass. I thought Chase wasn’t being so stringent on their co-branded cards?

I was under the impression earning miles for the Southwest Companion Pass was based on the calendar year. I’m also holding off on applying for any more Chase cards for the rest of this year(!) so that come January 2016 I can apply for 2 Southwest cards if/when the 50K bonus comes back up and get that companion pass good until December 2017.

I could be wrong, but I think the only way your plan would work is if you apply for the cards in October and wait until January (the very end of “the first 3 months”) to meet your minimum spend, else you could lose a year of the pass.

You have three months to meet the minimum spend and the points post after your statement closes. Some people try to time it so the statement closes right at the beginning of January so they get as close to two years as possible with the companion pass. If you were trying to time it that way, you would want to apply soon. I personally always liked having a little room for error, so I generally wait until later in the year to apply.