Note: We have a business relationship with the Capital on Tap Business Credit Card and the following links are affiliate links.

Capital on Tap Business Credit Card Overview

The Capital on Tap Business Credit Card may have come to your attention a few months back when they came out with a valuable new welcome offer. The Capital on Tap Business Credit Card has been around for a while now, in the United Kingdom, but just reached the shores of the US a few years ago. Since then they have looked to aggressively add new small business owners to their client list and help them reach their company’s financial goals. In this Capital on Tap Business Credit Card overview we’ll take a look at the current welcome offer, who is eligible for the card, the earning structure and every other detail you need to know. Let’s dive in.

Capital on Tap’s Mission

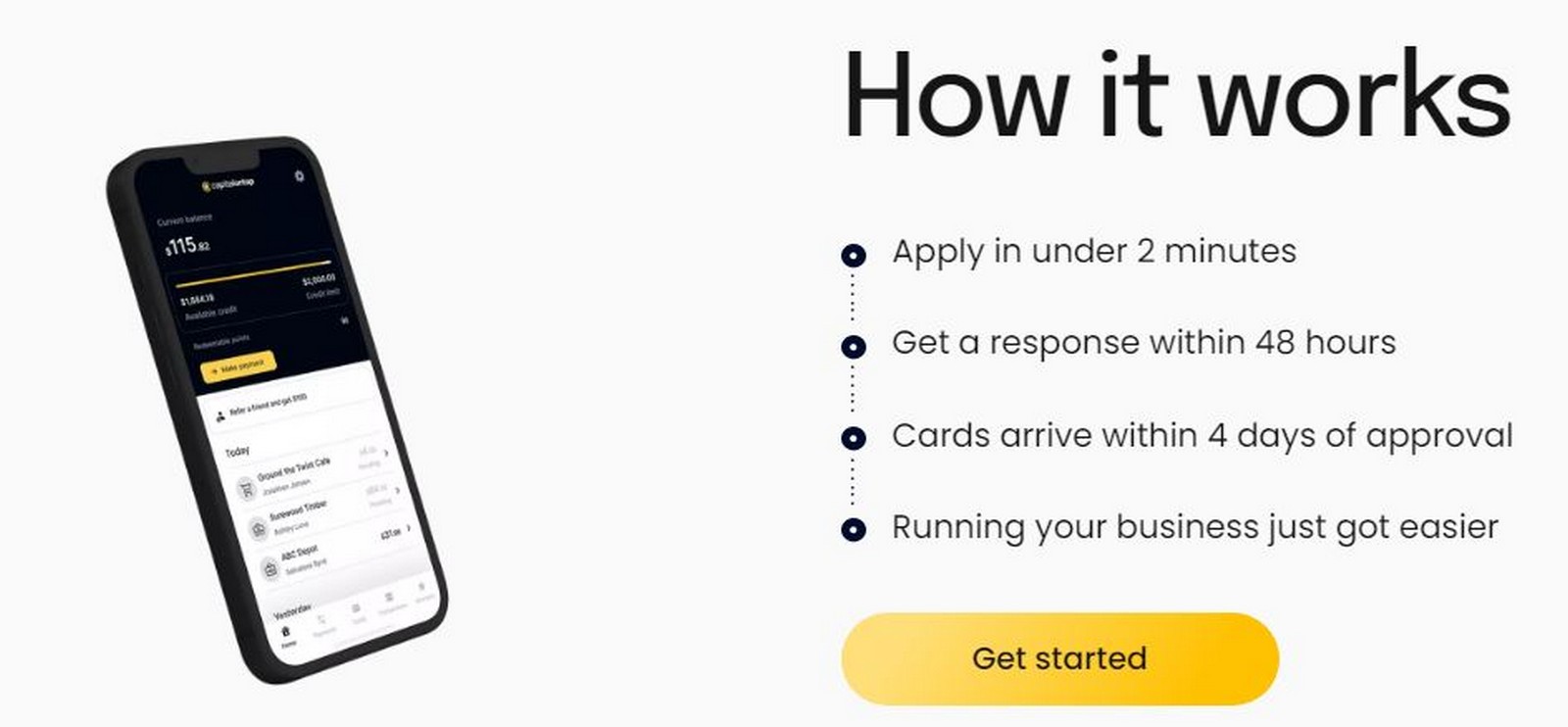

The Capital on Tap Business Credit Card‘s goal is to make your life easier and simplify your company’s credit needs. There are many different options and rewards programs out there, so many so that it can be debilitating making a decision on who to use. The program looks to help out there by offering you straightforward rewards paired with an easy to use app.

Welcome Offer Details

Here is the current public welcome offer:

- Earn $200 after spending $15,000 within the first 3 months of account opening

- No annual fee

There was an offer for $750 after spending $7500 in the past but this is the base line offer. We are not sure when, or if, that better offer will come back around. The offer is not showing on the landing page but it should be applied automatically. The details will show up on the “Sign-up for rewards” page after approval.

Earning Structure & Redemptions

The earning structure of the card is a flat 1.5% back on all purchases. There is no limit to amount of rewards you can earn.

There are a few different options to cash out your rewards:

- You can get a statement credit

- You can redeem the rewards for gift cards.

- If you choose the gift card option you get a 2% reduction on the cost.

- So a $100 gift card would cost you $98 in rewards.

Unique Features Of The Ecosystem

What really drew my attention to this product was some of the unique features of the program. The Capital on Tap Business Credit Card offers an easy to use app for all of your account needs but you will also get a physical card as well. None of that is anything new, but what is unique with their process is there is no hard pull for your application. That stood out to me for sure. The card is issued by Web Bank and is a full credit card option.

They doesn’t want to waste your time either, guaranteeing a fast application process. You will usually know instantly if you are approved or not, but the entire process will take no longer than 48 hours if they do end up needing more information from you. That is refreshing to see, especially when compared to some other lenders that can take weeks, or months, to get you through the entire application process.

The Capital on Tap Business Credit Card system lets you attach a debit card to your account, as well as a checking account, to make payments. This is unique in that you don’t need to call in to make instant debit card payments. I think you are limited to one or two attached to your account though, so just be aware of that in case you switch who you bank with etc.

They are also working on integrating their system with Quickbooks which will be very useful to many small business owners. Hopefully that will be available in the near future.

Requirements For Applicants

Capital on Tap Business Credit Card is looking for some specific requirements from their small business owners. You will need to have the following to even be considered as a card member:

- The business has been active and open for more than six months.

- You have at least $2,500 in revenue per month.

- The business sells goods or services.

- Must be an LLC or Corporation

I know this may eliminate some of our small business owner readers that have a side business and not that level of revenue. We will be sure to keep you up to date should the requirements ever change.

Final Thoughts

I am intrigued by this product and ecosystem and plan on putting in an application myself when the higher welcome offer returns. I like the fact that there is no hard pull, the welcome offer is one of the better we have seen for a no fee card and I like the various options for payments and rewards. While the 1.5% may not be the sexiest option out there it is nice that it is at least unlimited. The simplicity of the program will be attractive to many small business owners too.

What do you think of the Capital on Tap Business Credit Card and their welcome offer? Is it something you plan on applying for?