Increased Bonus for Cathay Pacific Credit Card, 35K Asia Miles and Waived Annual Fee

Cathay Pacific Credit Card from Synchrony Bank has an increased signup bonus. While this is not the best bonus we have seen, this time the annual fee is waived. Let’s check the details.

The Offer

Earn 35,000 Bonus Asia Miles when they spend $2,500 in the first 90 days of opening an account.

Annual fee of $95 is waived for first year for cardholders who apply between January 16 and March 31, 2018.

Earning Structure

- Earn 2 Asia Miles per $1 spent on eligible Cathay Pacific travel and in-flight purchases.

- Earn 1.5 Asia Miles per $1 spent on dining in the US or abroad.

- Earn 1.5 Asia Miles per $1 spent on purchases outside of the US.

- Earn 1 Asia Mile per $1 spent on all other purchases made in the US.

Other Card Benefits

- New members will enjoy a complimentary Green membership to the Marco Polo Club for the first year of enrollment.

- Enjoy 2-day priority redemption for discount flight award booking tickets online from time to time.

- No foreign transaction fees.

Analysis

This is a decent bonus. We saw a 50K bonus last year with the annual fee not waived. So you are getting 15K less miles this times around but saving $95. Spending requirement is reasonable and the card is issued by Synchrony Bank which issues mainly retailer cards and should be more lenient than other banks with approvals.

Some of the highlights of this card, besides the bonus, are that it earns 1.5 Asia Miles per $1 spent on purchases outside of the US. This could be a good option for people who travel a lot and have non bonused spending abroad. You also receive complimentary Green membership to the Marco Polo Club for the first year of enrollment. There’s usually a $100 to join, and membership give you the ability to redeeem miles for lounge access and other perks.

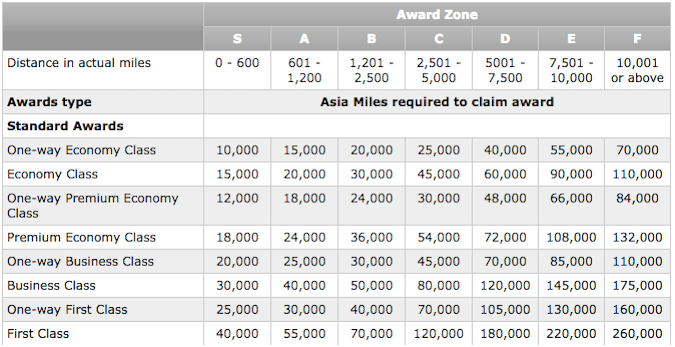

When it comes to redeeming miles for award flights, their chart is distance based.

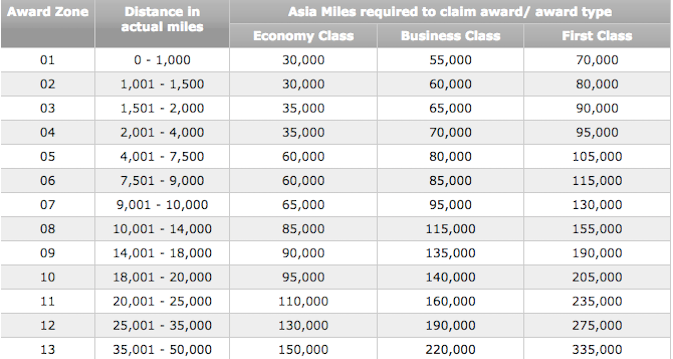

And here’s their OneWorld chart:

If you need more miles, you can transfer points from Starwood Preferred Guest, American Express Membership Rewards and Citi ThankYou programs.

Conclusion

This is a decent offer, and it probably makes sense to get this card for the signup bonus if you’re in need of Asia Miles.You’re getting last miles compared to the highest bonus, but you’re saving on the annual fee, so it’s not much worse. There’s a few perks that comes with the card, but they’re mostly an afterthought. It helps that they partners with some major rewards programs so you can easily get more miles if you’re working towards a redemption.

HT: Doctor of Credit

[…] Increased Bonus for Cathay Pacific Credit Card, 35K Asia Miles and Waived Annual Fee […]

I wonder how that bank reacts to buying gift cards? I would not buy them for the minimum spend, but maybe afterwards to build up some points.