The One Card EVERYONE Should Get – Including Me

You may be thinking this is going to be a credit card pumping post. Or here comes the sign up for the Chase Sapphire Preferred rehashed garbage. Well you would be wrong. I am talking about a debit card that everyone should get, including me. That card would be the Schwab Bank High Yield Investor Checking Account debit card. I will tell you why you (and I) should both have this card, if you don’t already.

Account Details

I know this card and account have been covered ad nauseam but I will go over the quick bullet points for people who have not heard of it:

- The account comes with a $100 welcome offer when you sign up for an account via a referral (we do not receive anything for the referral).

- There is a hard pull for opening the account because you also open an investment account at the same time. The $100 bonus is not worth the hard pull but I will tell you why the account is in a minute.

- The account is fee free including ATM fees and foreign transaction fees.

Why This Account/Card Matters

The $100 bonus is just a sweetener, there are two reasons I think everyone should have this card.

Reason 1

The first perk of having the Charles Schwab investor checking account is that it opens up access to the Charles Schwab American Express Platinum card (another non affiliate link).

The Charles Schwab Platinum is considered a different product from the other American Express Platinum cards (at least for the time being). Because of that you can get another welcome offer worth 60,000 Membership Rewards points. But the real perk of this version of Platinum is that it allows you to cash out your MR points at 1.25 cents a piece. When you cash them out they are deposited directly into your Schwab account. That is below most valuations for MR points, but cash is king. If you pair it with the American Express Blue Business Plus you are getting back 2.5% cash back on every purchase (for the first $50,000 each year). That puts the combo right up there near the top of the market.

Reason 2

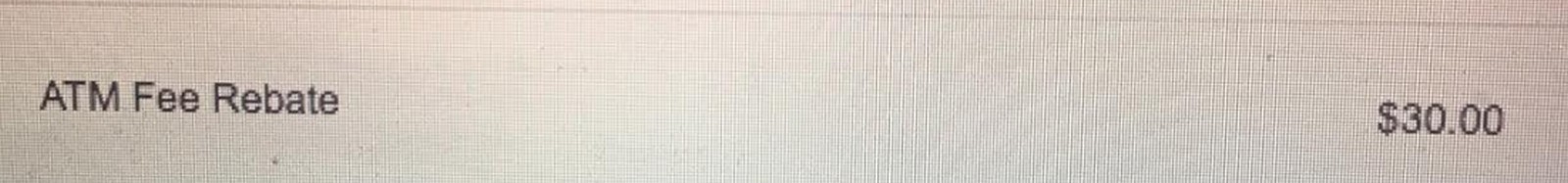

Gaining access to the Platinum card is nice but the real value of this card is that they refund ANY ATM transaction fee. When I say any I do mean any. This card reimburses the ATM fees anywhere, including Foreign ATMs. The foreign transaction fees are also waived in these transactions. The card also reimburses really high fees like the $12-$15 ones at Las Vegas casinos etc.

I recently asked my buddy to test the limits of this reimbursement. So when he found an ATM that charges a 10% fee to take out money, yes I was shocked this existed too, he gave it a try. He pulled out $300 with a $30 fee and waited to see if it was reimbursed. At the end of the month, when his credits usually post, this is what he saw:

Conclusion

This is the one card that I can say, without a doubt, every traveler should have. I myself have been lazy and have put off signing up for it, not any longer!

Having no foreign transaction fees or ATM fees on every international withdrawal is amazing. You can avoid the high fees at currency exchange windows. It will also save you from the growing fees at local ATMs too, even if it is $30!

Mark,

Any way to get the Amex platinum through affinityy?

I think most any account with Schwab will do but I am not 100% on that.

Which bureau usually gets the HP?

Schwab will only pull Equifax when you open a Brokerage account. If you have it on ice then it needs to be thawed out before. Once you open the Brokerage account, then you need to be prepared to have Experian pulled by American Express for the Platinum Card.

Count against Chase 5/24?

People in our Facebook Group have reported it does not

I guess I should have been paying more attention to this. Say, for example, I withdraw $300from an atm at a foreign airport. Any idea of what I would usually pay in fees? We’ve been using a Capitol one debit card, I guess they are charging us?

Most banks you would get hit with the ATM transaction fee and then a lot of them will change a foreign exchange fee of around 3%. Not all of them do though.

Mark’s “friend” did atm research at a gentlemen’s club. That’s the only place I’ve ever seen a 10% atm fee. $20 minimum, too.

Haha that wouldn’t surprise me in the least

The focus on only earning rates of the AMEX Platinum and AMEX Blue Business Plus cards without consideration of the annual fee and the ability to use the airline incidental, Uber, and Saks Fifth Avenue credits designed for maximum breakage is misleading. A disciplined annual spend analysis would likely show that a no annual fee 2% cash back card would put more money in your pocket as the analysis showed me.

Jim that is true but that also doesn’t take into account the other MR earning cards or what kind of MR balance you have. If you are holding a regular Platinum card anyway then this is a better option imo vs that.

Just tried links mentioned in the article and within the comment section but both were invalid …

That is weird – maybe someone can post their referral link here in the comments then? They both still work for me but maybe it is tracking my IP address or something.

I use Radius Bank which gives reimbursement for all ATM fees. I’ve used in several countries and it has always been reimbursed. Radius Bank does not give a hard pull, requires only $100 to open, no minimum balance, transaction or deposit requirements to earn the ATM refund feature. Also you can initially fund the account, up to $1,000, via Visa or MasterCard 🙂

Nice!

Nailed it, Mark! I couldn’t live w/o my Schwab debit card. I live in Thailand and access my US funds this way. I once asked them why they are so generous with ATM fee refunds and they explained that it is cheaper to refund the fees than to opening branches. ATM fees are steep here (more than $6) and I don’t want to shoot the golden goose so I try to keep their costs low by only withdrawing the maximum. In other words, less frequently. I couldn’t care less about the platinum card. It was just dead weight in my wallet. But try to take my Schwab debit card and you’ll lose you hand.

That does make sense – cheaper to use other people’s networks that are already set up. It is a pretty amazing feature.

Huh? I’m missing the mental connection on how this works.

“If you pair it with the American Express Blue Business Plus you are getting back 2.5% cash back on every purchase…”

Blue Biz Plus earns 2X MR per dollar – if you use the Schwab Plat to cash out those MR points at 1.25 cents a piece that is like get 2.5% cash back on every purchase you make with the BB+

Ah! I didn’t realize MR can be transferred. I only have one MR-earning AmEx (so far…). Thanks!

I tried to use the referral link For the Schwab referral bonus and it was invalid

Weird I just tried it in regular and incognito and the link worked fine

I opened this account earlier in the day with out the $100 promo and when I called Schwab they said I need a unique referral code. What can I provide them ?

I think people usually just send a friend a referral link. You could try to say you were sent this but went through the normal link instead on accident.

https://www.schwab.com/public/schwab/nn/promo/refer-prospect.html?refrid=%7BREFID%7D

thanks they used 7BREFID. Hope you are able to get some credit as well.

They don’t have a referral system like that but I am glad it worked for you!

A Capital One chking acct can be set up for free in 5 min online & offers no-intl-fees as well.

That is a good option as well. I like that this opens up the Schwab Platinum option though so I would give it the slight edge because of that even though it comes with the hard pull (and $100 bonus).

The Cap1 card does not refund the other bank’s fees though. It’s my current card of choice, but the Schwab one is a step up.

Thanks Joe

So basically, this isn’t bad for two signups to get a 60k bonus. Maybe I should consider it an alternative to my MB AMEX Platinum (with the MB part going away).

Also, getting a new card would give me a refresher on AMEX offers. I’ve not been getting much lately.

Amex offers have been slim pickings lately and I also have not been targeted much lately.

Can you have a “normal” Platinum card and a Schwab Platinum card at the same time? Or do you need to close the normal Platinum before opening the Schwab? Thanks in advance!

People have carried 2 platinums before but I wouldn’t recommend it solely because they have the same perks but the Schwab has the 1.25 cent MR redemption which makes it a little better imo.

The no limit fee refund for ATMs is ripe for abuse. Any small store owner could set one up with a 10% (or enev higher) fee and print themselves some money.

That is true

Out of curiosity, what is the largest bonus offer ever given on the Schwab Platinum?

I don’t think it ever moves from 60K

I am a happy Schwab account holder for 12+ years now. No complaints and no regrets. I have always preached the same story at my every work place that I had been and I made sure my co-workers go for that.

I was able to convince 90% of the people with whom I spoke about Schwab.

I just love to be a schwab customer.

It is a great product – thanks Nvtech

You state:

“But the real perk of this version of Platinum is that it allows you to cash out your MR points at 1.25 cents a piece”

But I do not find any mention of this in the T&C’s that are found here:

https://www.schwab.com/public/schwab/investing/accounts_products/credit_cards

Please point me to something that explains this officially.

Thanks.

Here is a good post about it

https://www.windbagmiles.com/2017/11/09/the-charles-schwab-platinum-amex-is-a-game-changer-or-at-least-a-game-somewhat-affecter/

There are plenty of banks who refund any and all ATM fees, First Republic for one (though it does require you to maintain a minimum balance in your checking account – $5k). I believe Chase offers a fee-free ATM account as well.

I do like that this doesn’t require any type of balance to get the perk though.

For those who don’t want a Schwab account for some reason there’s a new debit card from SoFi called SoFi Money that offers 2% APY and atm fee rebates too https://www.sofi.com/money/fees/ – I got this and now use this as my main debit card for ATM withdrawals.

Jason – excellent I will have to check this out for sure. Have you had the chance to charge any large ATM fees to it? I wonder if there is a cut off at all? Looks awesome at first glance though.

From SoFi’s website: SoFi doesn’t charge any ATM fees and will reimburse third-party ATM fees on accounts that meet one of the following monthly activity criteria: 1) direct deposits totaling $3,000 or more; OR, 2) qualifying debit card purchases totaling $500 or more.

Schwab doesn’t have any such requirements.