New Chase $600 Bonus for Checking and Savings Account

Chase is one of the most generous banks out there when it comes to checking and savings account bonuses. Now they are once again offering their best ever bonus of $600, and it’s available online once again.

This is the last day for the offer (10/1/20) but it does come around semi regularly.

Update: There is now a public link for this offer.

The Offer

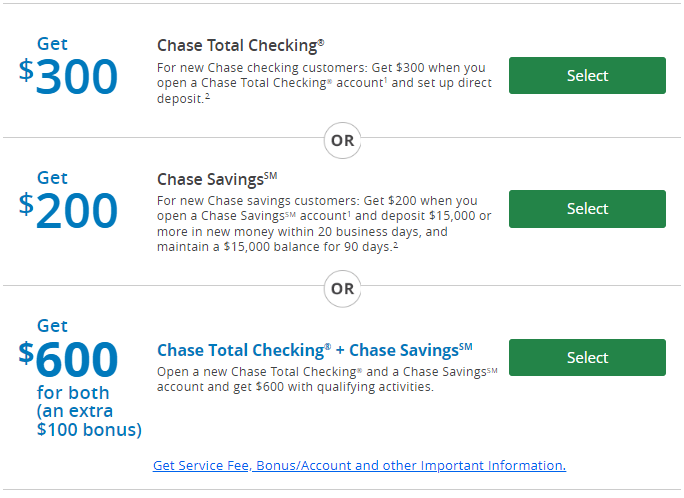

- GET $300 for new Chase checking customers who open a CHASE TOTAL CHECKING® account and set up Direct Deposit.

- GET $200 for opening a new CHASE SAVINGS account, depositing a total of $15,000 or more in new money within 10 business days, and maintaining a $15,000 balance for 90 days. (not the best offer)

- OR get $600 for both (an extra $100)

Promotion Link

Key Terms

- Expires 7/2/20

- Checking offer is not available to existing Chase checking customers. Savings offer is not available to existing Chase savings customers. Both offers are not available to those with fiduciary accounts, or those whose accounts have been closed within 90 days or closed with a negative balance.

- For checking bonus, make a direct deposit within 60 days of account opening. Your direct deposit needs to be an electronic deposit of your paycheck, pension or government benefits (such as Social Security) from your employer or the government.

- For savings bonus, deposit a total of $15,000 or more in new money into the new savings account within 10 business days of account opening and maintain at least a $15,000 balance for 90 days from the date of deposit. The new money cannot be funds held by Chase or its affiliates.

- If either the checking or savings account is closed by the customer or Chase within six months after opening, we will deduct the bonus amount for that account at closing.

Avoiding Fees

Chase Savings has a $5 fee per month. You can avoid the fee in the following ways:

- $300 or more minimum daily balance

- or at least one repeating automatic transfer of $25 or more from your personal Chase checking account (available only through Chase Online Banking)

- or when linked to a Chase Premier Plus Checking, Chase Premier Platinum Checking or Chase Private Client Checking account

Chase Total Checking has a $12 fee per month. You can avoid the fee in the following ways:

- Direct deposit totaling $500 or more made to this account.

- or a $1,500 or more minimum daily balance in this account

- or an average daily balance of $5,000 or more in any combination of qualifying linked deposits.

Analysis

Usually you need to have a branch nearby to complete the account opening process, but now it’s much easier since it can be done online as well and you get $600, the highest bonus ever. Most likely you will need to have a Chase branch in your state to be eligible though.

This bonus can be done only once every two years now and you have to wait at least 90 days since the last personal accounts bonus from Chase. Keep in mind that you WILL receive a 1099-INT for these bank bonuses and thus you will be taxed.

Conclusion

If you aren’t a current Chase checking/savings customer then this Chase bonus is about as good as it gets when it comes to bank bonuses. While the savings deposit amount is a bit high, I think it’s still worth it if you have $15,000 to leave in the savings account for three months. The total of $600 is the highest we have seen from Chase.

You can do this bonus once every two years, and you must not have had a Chase account in last 90 days. It’s even easier now that it’s online.

HT: Doctor of Credit

The banks (CHASE) who want you to have high credit scores, are THE PEOPLE who are tearing them down. I failed to use my Chase Slate Card for a year, because I was not getting any incentive (points) to use it. So the day it hit one year of non-usage, they cancelled my card and took my $5500 credit line with it. I called and asked to have the $5500 moved over and added to my Chase Freedom card and they said that they would have to pull a hard INQUIRY in order to do that. She pulled a hard inquiry and gave me only $1500, of the $5500 to my Freedom Card. I had 800 plus credit scores and a long spotless history with CHASE, but that didn’t matter. My credit scores fell by 43 POINTS because of the loss of $4,000 credit line and the hard inquiry. I am NOT a happy camper! I feel that CHASE has become too big to care about regular customers and I will be slowly closing my accounts with them. But they don’t CARE! They made $33 billion in profit last year, paid Jamie Diamond $31 million as President, so you can see, they couldn’t care less about the little guy who works diligently to pay his bills on time and strive for high credit scores.

[…] 4. Get $600 Bonus With New Chase Checking and Savings … […]

I got this in the mail, but I can’t do it because they want a direct deposit and I am freelancing and get personal money funded to PayPal, etc. Why are they restricting where the money comes from?

But also.. the fine print says you have to leave the account open for six months – so be sure not to close after 90 days.

Is this link still working? Can you repost?

My “offer” was $1000 for opening Chase Sapphire bank acct.

Can you tell about this acct where 1,000.00 was the bonus?

Well, Chase closed both of my accounts (“after internal review”) and restricted my online access even though I have a bunch of credit cards with them. WTF.

Did you have a lot of spend with them or just recently open up any new Chase cards?

No new recently opened Chase cards. I put a decent amount of spending on their cards. I read DoC, it seems that my ACH request of $15,000 triggered this action.

Do you have a theory, or did they give you a reason on why they closed both your accounts?

No reason plus they are quite rude when you call their line and they find out why you are calling.

You might want to change the Savings req to 20 days, thx

Thanks, signed up.