Chase Business Ink Unlimited Launched

For weeks there have been rumors that Chase would launch a new “unlimited” Ink credit card. Now, it appears the application is live on their site. Let’s take a look at the card and it’s generous bonus offer.

RELATED: Are More Chase Shutdowns on the Horizon…Even Without Recent Applications?

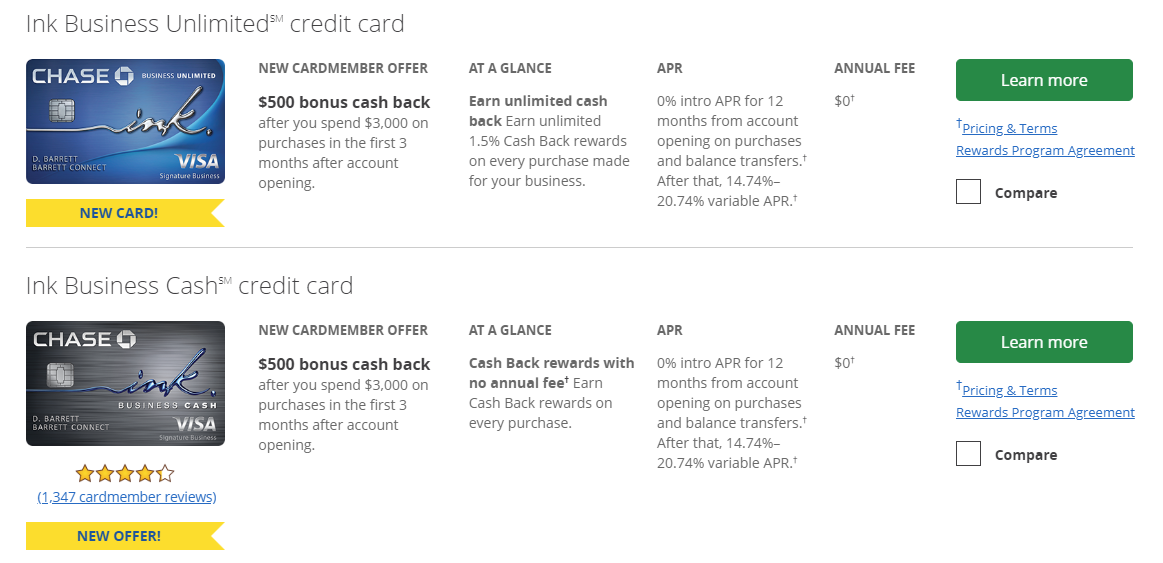

The Offer

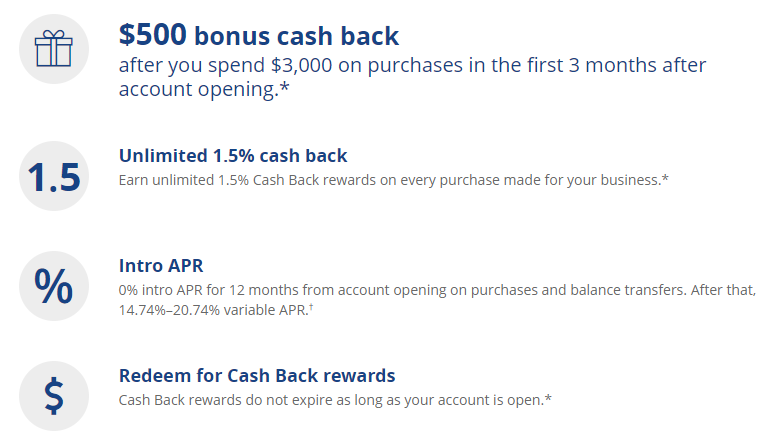

$500 bonus cash back after you spend $3,000 on purchases in the first 3 months after account opening.

Click here to compare this and other small business card offers!

Card Features

- Unlimited 1.5% cash back on every purchase for your business

- 0% Intro APR for 12 months from account opening on purchases and balance transfers

- $0 annual fee

Analysis

While it was speculated that the Ink Business Cash (which earns 5% back at office supply stores among other bonuses) would be eliminated, it still seems to be alive as of when this post is published. Both the Ink Business Cash & the new Ink Business Unlimited carry the same $500 bonus and $0 annual fee, so it really is up to you to decide which product fits you better. Either way this level of a bonus on a no annual fee card makes is a spectacular deal. Remember to be cautious with Chase applications; they have been a little shut down happy as of late.

We’ll have a full review of this card coming soon, but for now I would say this is a fantastic bonus on a card with great earning potential. For many the ability to earn 1.5X back on all business spend will be quite valuable, especially if those points are convertible to Ultimate Rewards like under the current system.

While we don’t know yet whether this card is subject to 5/24 (more info on 5/24 here), considering all other Chase branded products are, I would say it is 99% yes. We’ll report back with more information on this card as it becomes available.

I was just denied for having too many Chase cards. I have 4 personal and 1 business card, didnt think these were all the past two years though. I do have two additional cards as I am considered an employee of someone else’s business cards. Do these count towards 5/24?

Also I wonder if this attempted application will signal any moves for Chase to shut me down.

Ah I forgot 5/24 includes other cards besides Chase in which case I definitely hit the limit, either way I would be interested if this application triggers anyone from Chase looking at my account for shutdown

We recently took the Ink Preferred sign up bonus, but the card doesn’t do much for us on a daily basis. We called today and were approved for a product change to the Ink Unlimited. We’ll use it instead of our Starwood card for spend going forward.

[…] H/T: Miles to Memories […]

Looks like an awesome new card, but I definitely won’t be applying given Chase’s shutdown extravaganza. I also have a total of 9 cards with Chase, no reason to poke the bear.

It would be great if they give points instead of cash and if this can be paired with Chase Ink Preferred to make a killer combo.

It’s like they’re baiting us for shutdowns.