Chase Freedom Bonus Categories Quarter 3 2022

Chase Freedom Flex is one of the more popular rewards credit cards. With 5X rotating bonus categories, 3X on dining and drugstores and points that convert to Ultimate Rewards when paired with a premium card, it is a product worth considering. And to make it all better, there’s no annual fee.

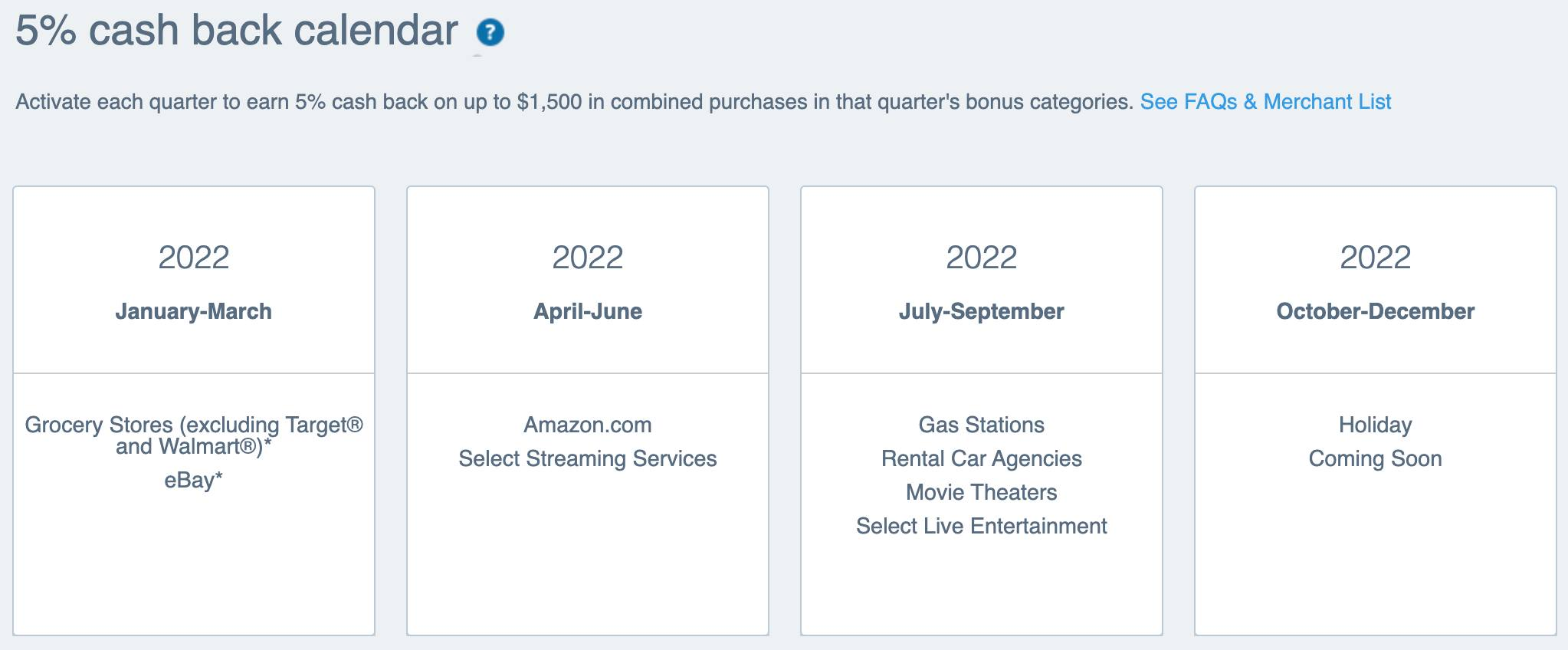

While some of their competitors like to release bonus categories well ahead of time, Chase only does so a few weeks before the start of the quarter. And today, Chase Freedom has revealed the new rotating quarterly categories for Freedom and Freedom Flex cardmembers for the third quarter of 2022.

The quarterly categories allow cardmembers to earn 5% cash back on up to $1,500 in combined purchases for three months. Let’s take a look at the details.

Chase Freedom July – September, 2022 Bonus Categories

Here are the just announced bonus categories for Chase Freedom Flex and the discontinued Chase Freedom card. Starting July 1 through September 30, 2022, Chase Freedom and Freedom Flex cardmembers can earn 5% cash back on up to $1,500 in combined purchases on the following:

- Gas Stations

- Rental Car Agencies

- Movie Theaters

- Select Live Entertainment

You can activate the bonus categories on this page starting tomorrow.

Chase Freedom Flex Welcome Offer

If you don’t currently have the Chase Freedom Flex card (and aren’t over 5/24), it can be a great first card to get with Chase and it has a decent bonus right now.

- The Offer: Earn a $200 bonus after you spend $500 on purchases in the first 3 months from account opening. You can also earn 5% back on gas on up to $6000 in purchases your first 12 months. There is no annual fee

- Link to Offer

More Info

Along with 5% rotating categories, Freedom Flex cardmembers can earn cash back on a variety of other purchases including: 5% cash back on travel purchased through Chase’s Ultimate Rewards, 3% cash back on dining and drugstores, and 1% cash back on all other purchases. In addition to these rewards, Freedom Flex cardmembers receive World Elite Mastercard Benefits, including cell phone protection and perks with Lyft, Shoprunner, and more, along with Priceless Experiences.

Conclusion

This quarter’s 5% categories are definitely not very exciting. Gas is probably the only category where you can maximize the full $1,500 in spending.

Also don’t forget to maximize this quarter’s categories that include Amazon.

What do you plan to do to max out your $1,500 in Chase Freedom Flex 5X spend?

“Conclusion – This quarter’s 5% categories are definitely not very exciting. Gas is probably the only category where you can maximize the full $1,500 in spending.”

With gas prices at all time highs, and many people road tripping this summer because flights are too expensive, I’m not sure who isn’t excited about these Q3 categories (maybe you have another good gas card like Amex Business Gold?). In fact, I’m thinking of having my wife sign up for the CFF so it earns 9% on gas this next quarter.

Looks like I’ll be buying VGC’s with my CIC for groceries. And even dining.

Only good thing is the Gas. And that’s in hopes of buying gift cards from there.

Just a reminder that in most cases, any gas station purchase will count as 5x, whether you’re purchasing gas, beer, cigarettes, burritos, etc.

The car rental bonus is not worth it since the car collision protection for Freedom is secondary coverage. Better off using the Sapphire card for primary coverage. The bonus points are not worth the potential insurance savings.

Anyone know if Sheetz allow credit card purchase on Amazon GCs? I tried in past, they insist on debit card only.