Credit Card News

This afternoon there are a couple of small credit card tidbits that are worth passing along. Let’s take a look.

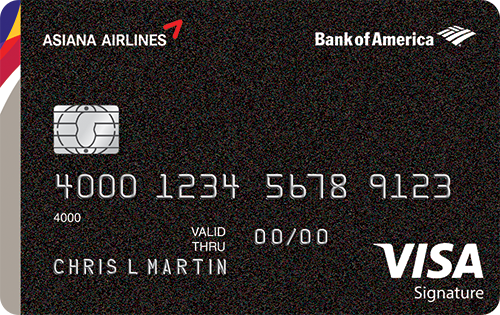

Bank of America Asiana Visa

Bank of America has launched a new Visa version of their co-branded Asiana credit card. What is notable is that this new card (previously they issued an Amex) comes with a 30K sign-up bonus. Here is a quick rundown of the benefits:

- 3 miles for every $1 spent on purchases with Asiana Airlines

- 2 miles for every $1 spent on gas and at grocery stores

- 1 mile for every $1 spent on all other purchases

- 10,000 Bonus Miles Certificate awarded annually (Good for Asiana flights only)

- Automatic $100 annual rebate on Asiana Airlines ticket purchases

- 2 lounge invitations each year on the card anniversary date

There is a $99 annual fee which is not waived the first year. Direct Link

Analysis

So why would you want this card? Well, Bank of America is a bit more generous these days than other banks and Asiana is a Star Alliance carrier as well. I am not an expert in this program, but Rapid Travel Chai does a good job of listing the pros and cons. There are some quirks but some sweet spots as well.

HT: Doctor of Credit

Ink Cash 50K Offer

In addition to last week’s Ink Plus 100K targeted offer, now it seems that Chase is also sending out 50K offers on their no annual fee Ink Cash card. Marketed as $500, this is a very good offer, but one you need to be targeted for in order to get. Unless you have a valid offer code tied to your name then don’t expect to get Chase to match it.

Still, this is another example of what Chase can do with tighter approval rules. Some say they are flooding the market with points while I assert that they are just being more picky with who they award them to. Who is right? Only time will tell. If you are over 5/24 and targeted, Doctor of Credit has some good advice for how to best get an approval.

Conclusion

As you progress in the credit card hobbyist space (sure let’s call it that), you’ll see cards and bonuses come and go. I think it is important to track these things not only so you can develop the occasional case of envy, but so you can broaden your horizons beyond the big cards, banks and loyalty programs. In a time where Chase is becoming much more narrow, there are other options for some, but they don’t always come in the prettiest packaging.

I have a very soft spot in my heart for Asiana First Suite even after flying Emirates, and definitely better than CX. Their award chart and YQs are very reasonable, too. If these are churnable and the bonus stays around… almost tempting.