Chase Sapphire Reserve Application Experience

Yesterday was a crazy day. Many of us have been watching the leaked information about Chase’s new premium Sapphire Reserve card with amazement as it sort of seems to good to be true. Then yesterday an application link leaked out and finally a landing page. Eventually we got a peek at most of the terms and were able to confirm a lot of the benefits that we had questions about.

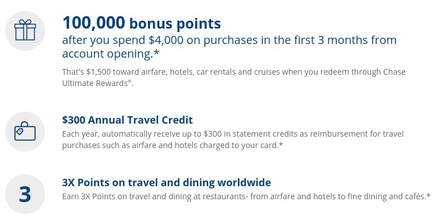

It turns out that the Sapphire Reserve is indeed as good as it seems. From a first year value perspective you get:

- $600 in automatic travel credits ($300 each calendar year)

- 100K Ultimate Rewards points (conservative estimate $1,500)

- Priority Pass Select Lounge access (guest policy unknown)

- $100 Global entry fee credit

- 3X points on dining and travel

- Primary auto insurance on car rentals

- Points worth 1.5 cents each when booking travel through Chase Ultimate Rewards

In other words, for a $450 annual fee, the first year you easily get $2K+ in value out of the card. Plus, with points now worth 1.5 cents towards travel, this card arguably makes your existing points more valuable. So, of course I applied.

Update: The Chase Sapphire Reserve has now been released to the public and online application links are available.

My Application Experience

I was excited to see the live application and decided to apply for a card in my name. Of course I was also writing a post about the app here on Miles to Memories and a Quick Deal on Frequent Miler, so I had a lot on my mind. After completing those posts, I went to the app, filled it out and hit submit. Many people on Reddit had reported instant approvals. I so wanted to get an instant approval, but unfortunately that didn’t happen.

My wife was also considering an app, but fairly soon after I applied, a link came out with the landing page and I was busy digging through the terms to understand this card better. Then, the application link died, the landing page died and it was all over. While my wife never got to apply, I am happy at least one of us was able to get the an app in.

Calling Chase

While I normally like to let my applications process with Chase, I knew this was not a time to wait. After the application was shutdown, I called in and spoke to a nice rep. She asked for my social security number to look up my app and informed me that no app existed. What?!? Then, she asked for my name and address and found it. I had used the wrong social. Yes, in the hurry to fill out the app, I had input my wife’s social security number. *Sigh

This has happened to me only once before with Barclaycard and it triggered an entire fraud investigation and a denied app. Obviously that could be disastrous in this case, so I was worried. Thankfully she asked me a series of questions and I explained that it was my wife’s social (and that I am stupid) and gave her my social. She then asked me to hold.

A few minutes later she came back with a stoic tone and said she was able to verify everything. My wife and I both have multiple cards with Chase and bank accounts as well, so I assume it wasn’t hard to verify the truth. Given her tone I was ready for some bad news, but thankfully the next words brought tears to my eyes. I was approved with a $10K limit!

Other Tidbits

The card showed up in my online account almost immediately, although without a logo or card art. Strangely it also made my Ultimate Rewards points balance disappear from the main login screen. I can go into the Ultimate Rewards site and see all of my cards though so everything seems to be fine there.

Speaking of the Ultimate Rewards site, the new Sapphire Reserve card shows up there, but if I click it then I get an error. At this time I can’t transfer points to it in order to book travel at 1.5 cents or to even search. I’m not sure if the IT is even ready. Again, this card wasn’t supposed to launch until Monday. I think it is clear that this wasn’t a purposeful soft launch.

The Bonus?

There was some speculation about whether people who applied yesterday would get the bonus. Yes they absolutely should. The first version of the app without the landing page had the same URL as the app that was linked to from the landing page. In other words, the app we saw first was also coded for the 100K bonus. We also have screenshots showing this and there are multiple data points of people having Chase confirm the bonus is on their accounts. I too have been able to confirm the bonus is linked to my account.

Conclusion

Yesterday was wild and crazy for some people and I know others were left out. It is clear that this first round of apps didn’t have the 5/24 switch flipped into the “on” position, so we’ll have to see how next Monday goes. If you are interested in getting this card, check Reddit and come back here on Monday as I’ll be checking and sharing what other are reporting regarding approvals, etc.

Did you get approved for the Sapphire Reserve yesterday? Have anything to share about the craziness? Let us know in the comments!

I got it last year. And was super excited to make use of the benefits. We had personal health issues in the family that did not allow us to travel 🙁

So we lost all the first year travel credits! Such a big bummer.

Our billing cycle starts April 1st. I need to travel to take care of a family member overseas. I’m trying to book now and feel so terrible that I just missed the benefits by couple of months. As a caution to everyone, when you have a family things can get out of hand with unexpected circumstances, so please make note of the AF billing cycle so you won’t lose the benefits like us. Otherwise this card can cost you than actually being worth.

[…] How I Got Approved for the Sapphire Reserve but Almost Completely Screwed It Up! (And Other Tidbits) […]

[…] How I Got Approved for the Sapphire Reserve but Almost Completely Screwed It Up! (And Other Tidbits) […]

[…] How I Got Approved for the Sapphire Reserve but Almost Completely Screwed It Up! (And Other Tidbits) […]

[…] though I was lucky enough to get the card during the leaked app, I was hoping the 5/24 guideline wouldn’t be enforced so my wife could get it too. At this […]

[…] How I Got Approved for the Sapphire Reserve but Almost Completely Screwed It Up! (And Other Tidbits) […]

I’m excited! Have a chase sapphire preferred now with a nice 50k limit! Would be nice not to have to apply for a new one. I play the credit card game but only once a year, so two CC in the past 24 mos are new, and I already closed the other one before the annual fee hit after spending the sign on bonus mileage. I keep sapphire always as that’s my loyal “to go to card” and my SPG Amex for everything else not travel and dining related. The rest are “cheap ho” cards depending on what airline works best for the trip I want to book that year.

Hopefully Chase puts something in the annual fee reimbursement disclosure like Amex did to weed out the gamers.

Good for you. yawn.

Ok, am I the only one that wants to know if it comes with status?? Like Amex plat gives Hilton gold, spg gold, etc.

No real status benefits that we know of at this time.

I wonder if there’s any great rush to apply once the CSR app goes live on Sun?

Normally there’s deadline for these offers, often several months away.

I’m thinking about timing after the 1st year, when the AF becomes due. At that point, you will already have claimed two $300 Travel expense reimbursements, so you’re now faced with the choice of a $450 AF and only one $300 reimbursement (at the end of Year 2). So your Year 2 net cost would be $150, instead of $0.

So other than bragging rights, can anyone tell me if there is any good reason to jump on this right away?

In that context, the word is “peek”, not “peak”.

Thanks. Fixed.

I thought you had to get a $15K credit line to be approved for this card. Maybe that only applies when it really goes live on Sunday?

That seemed to be the initial thoughts, but plenty of people were approved with $10K limits. $10K did seem to be the lowest though.

I’m HOPING it’s $10K, as I’m pretty sure I could get approved for that, but $15K might be pushing it 😀

FYI, TPG posted an update to their announcement article that the CSR will NOT have the $100 Visa Infinite perk for domestic coach tickets. Still an amazing card though! Can’t wait to apply–unless 5/24 is in effect!

Congratulation! I guess the most important question of all – What’s your 5/24 status?

I am waaay over 5/24. Many people who applied and were approved yesterday are as well.

How does the companion airfare work? (Sorry, question from a newbie!)

It is a Visa Infinite benefit. You book through a special Visa site and it automatically gives a $100 discount.

might be smart to convert the CSP to a Freedom Unlimited or a Freedom (depending on what you don’t have in your wallet)

THIS MAN IS A GENIUS! ^^^^

I wanted the freedom unlimited really really bad but im over the 5/24. I missed this window for the reserve and hope round 2 that they ignore the rule so i can get apply for it then upon getting approved, I will downgrade to Unlimited!

Thank you Antonio!

Are you saying it would be smart to convert the CSP to a Freedom (unlimited) before or after applying for the CSR?

Be careful about this. Sounds great but if your plan is to only keep the CSR for a year then cancel you might want to keep the CSP around so you still have options with your UR after than, unless you have an Ink Plus in which case you should have already done this…

Hey Shawn.

Really happy for you brotha. congrats man. I wet my pants on this but in a bad way. Hope your wife gets it next week!

Could you also look in your terms and check out the deal with 3X points on dining and travel? Everyone else is busy talking about the sexy benefits but I ask because I want to know whats included vs CSP 2X.

Does the CSR totally replace CSP? Sounds like it. But that also seems strange to me. No other 1-2 punch CC combo does that with other banks. Citi Prestige/Premier and Amex Plat/PRG have different value props. So it would be strange for Chase to just bust out the ultimate replacement. Makes CSP useless.

Yeah it is pretty much the same earnings structure. From the terms: “3 points: You’ll earn 3 points for each $1 spent when your card is used for purchases in the travel category or the dining at restaurants category.”

thanks man. this card is ridiculous.

got approved yday & the the displays in my chase acct are similar; last checked earlier today still shows the CSR acct’s last 4#…on reddit, some folks said the approved acct just disappeared; crossed my fingers & hope my acct will still be around til next week. in fact, called after the approval to inquire about the card benefits & sign-up bonus & was told to check back later as the the card is too new; asked for rush delivery so will see if the card will be arriving soon in 2 days as told.

shawn, were u able to confirm the 100k pts sign-up bonus with the rep. when u called in?

I confirmed the bonus via secure message.

So with the visa infinite 100 discount and the fact that chase lets you select how many points to use when you book with them…if you use their booking system to book using points at the 1.5 except for $100 – would it post as airfare tickets and kick in that visa infinite discount to cover the last 100?

I m interested too. Who knows..since purchase goes through chase and not airline it might not code properly like Google Fi charges do not trigger 5x with Ink+ as they r not coded as telecommunications .. Gotta wait some data points on this

That’s interesting. I am about to switch to Google Fi. Thanks for the heads up regarding Chase Ink. On a side note, are you happy with it?

lol no.

$100 benefit for 2-5 tickets only applied when booking through visa infinite’s portal. Not through Chase.

Kudos to Pioneers. Hope it works out and it will. Here ready for Aug 21, 00:01 (or sooner?)