Why You Need to Check What Amex Cards You’ve Had In The Past

American Express is a generous bank, both with approvals and bonuses. Unfortunately, you can only get one sign-up bonus per product per lifetime on personal and business cards. Here is the language they use on card applications:

WELCOME BONUS OFFER NOT AVAILABLE TO APPLICANTS WHO HAVE OR HAVE HAD THIS PRODUCT.

So if you’ve had a card in the past, even if you didn’t receive a bonus on it, you are not eligible for a signup bonus. The past usually applied only to the last 7 years, but you should make sure first before applying.

How To Check

First of all, you should keep track of all your cards. Note application dates, when bonus was received, when card was closed etc.. But not everyone is so organized or maybe you already had a few Amex cards before getting into churning.

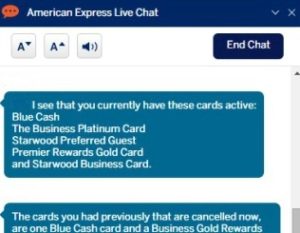

To check what cards you’ve had in the past, or more exactly, what Amex considers the past, all you need to do is ask them. This can be done through the chat feature in your account. They will give you a list of active cards and also card you had previously that are canceled now.

Here’s an example:

Whatever cards are mentioned, are the cards that you will not get a signup bonus on. If a card is not mentioned, it means that it is not considered a card you’ve had in the past. Another benefit of this list, is that you can use it as a proof in case it’s needed later on.

Conclusion

This has been possible for a while and it is still a very quick and easy way to figure out what cards you’ve had in the past, or if a very old card is still in the Amex system. Also keep in mind that just because you’ve had a card, it doesn’t strictly mean that you can’t get a bonus for 7 ore more years. See how to Avoid the “One Bonus Per Lifetime” rule.

[…] There really isn’t much wiggle room in that. If you have had a card before, you will not receive the bonus. Sometimes you’re able able to get a bonus again if you’ve had a card many years ago, but best way to be sure would be to check with Amex what cards you have and had in the past. […]

[…] There really isn’t much wiggle room in that. If you have had a card before, you will not receive the bonus. Sometimes you’re able able to get a bonus again if you’ve had a card many years ago, but best way to be sure would be to check with Amex what cards you have and had in the past. […]

[…] There really isn’t much wiggle room in that. If you have had a card before, you will not receive the bonus. Sometimes you’re able able to get a bonus again if you’ve had a card many years ago, but best way to be sure would be to check with Amex what cards you have and had in the past. […]

[…] There really isn’t much wiggle room in that. If you have had a card before, you will not receive the bonus. Sometimes you’re able able to get a bonus again if you’ve had a card many years ago, but best way to be sure would be to check with Amex what cards you have and had in the past. […]

[…] If you have had a card before, you will not receive the bonus. Sometimes you’re able able to get a bonus again if you’ve had a card many years ago, but best way to be sure would be to check with Amex what cards you have and had in the past. […]

[…] There really isn’t much wiggle room in that. If you have had a card before, you will not receive the bonus. Sometimes you’re able able to get a bonus again if you’ve had a card many years ago, but best way to be sure would be to check with Amex what cards you have and had in the past. […]

[…] Pumping bloggers conveniently “forget” to inform their readers that Amex will not give a sign up bonus if you had the same card before. They get paid per approval so they could care less if you get the signup bonus! Don’t fall for it. Here is one simple way to check what Amex cards you have had in the past. […]

… or that I have tons of AUs in my account for some reason?

Anyway, did this with the SO and was sort of unclear. There was one list, then a dribble of others. At least one of the cards she’s never had. Mostly correct but not as definitive as your chat shown above. For example they said she’d had the “Platinum” when in fact it was the Ameriprise Platinum, never the Platinum straight. Mentioned SPG Personal twice for some reason.

Am I the only one who doesn’t want ANY Amex rep seeing that I have opened and closed ten cards in the last three years? Am I paranoid?

If you have a screenshot of Amex stating that you’ve never had a card before, and they subsequently try to deny you a signup bonus based upon a claim that you’ve had the card before, the worst case scenario is a very easy CFPB claim that you will win.

If the CFPB still exists when you file the claim.

Do you seriously think that Amex will allow you to rely on a chat, as some sort of dispositive proof, if you apply for a card and Amex denies you the bonus? Good luck with that! Amex is pretty rigid and difficult to deal with, in my experience.

A lot of us are now probably wondering the same thing: if a card you’ve had in the past isn’t on the list that AMEX provides, then can we apply for that card and assume the signup bonus will be awarded? Just asking your opinion, as data points will be needed. Thanks.

I believe so. Personally I would apply for a card if it was omitted on the list that Amex gives me.