Citi Merchant Offers

I’m a Citi fan overall. Their quirks are a net positive for me. Citi Merchant Offers is a feature that’s been around for a good while, but it does have wrinkles. I’ve sporadically used this capability in the past, but I find myself increasingly doing so in the past few weeks. The feature can be an acquired taste, but it’s quite literally paying off for me at a higher level after a bit more time and effort. Here’s why Citi Merchant Offers are worthy of your attention.

More Are Eligible

Historically, Citi has targeted the Merchant Offers capability to certain users and card accounts. For instance, I previously only had Citi offers on one account (my Premier, as I recall). But more recently, all of my Citi card accounts have received offers. If you’ve come up empty in the past on your Citi accounts, check again to see if your cards are now eligible.

More Useful Offers

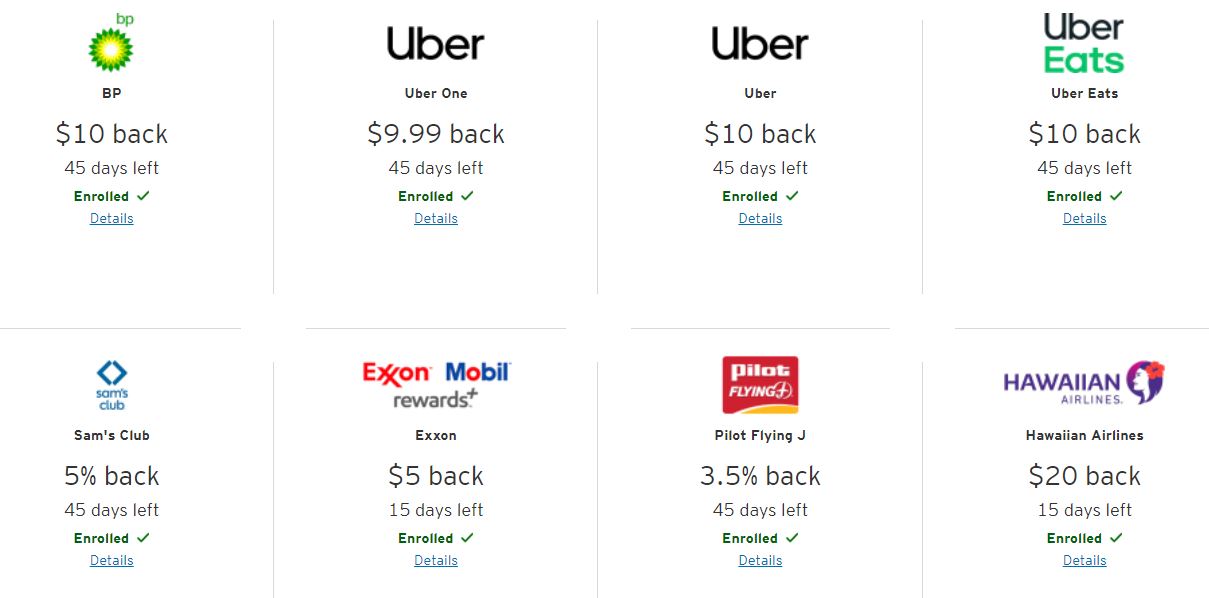

Everyone’s situation is different, but I’ve noticed more useful offers on a more frequent basis recently. Don’t get me wrong, there’s plenty of filler and distraction in there – I have no need for a Helzberg Diamonds or Men’s Wearhouse discount. But like Amex Offers, it only takes a few to make the feature worth a cardholder’s time. And increasingly, I’ve received more than a few of those. Here are recent favorites I’ve already used:

- BP: Receive $10 off a minimum $20 fuel purchase made with the BPMe app. Sign me up for 50% off gas!

- Uber: Receive $9.99 back when you enroll in Uber One. This is essentially a free month of Uber One benefits. I like stacking this benefit with my Amex Uber credits.

- Sam’s Club: Receive 5% back on Sam’s Club purchases. This is basically free money for us, since we normally shop at Sam’s, anyway.

As pictured above, even more solid offers are available, and I look forward to using some others soon.

Repeating Offers

Some solid offers return after previous availability. For instance, I used the BP offer a few weeks ago, and a new one appeared in the last week or so – it’s available to use within the next 45 days. Also, one offer can allow repeated redemptions. For example, the Uber One offer can be redeemed twice in a 45 day period. That’s two free months!

Flexibility

Those who tinker may find increased utility with Citi Merchant Offers. I’ve found some consumer aspects of Citi Merchant Offers superior to Amex Offers. I’m still experimenting, and I won’t get into specifics here. I encourage you to play around with Citi Merchant Offers to see what’s feasible!

Good Stuff To Know

Log in here, and you’ll be immediately directed to Citi Merchant Offers. Adding offers is relatively simple – just click on the offers you want to use and enroll prior to the purchase.

Shocker – quirks exist! I’ve found the site a bit clunky and slow to load and refresh offers. Trying to navigate to offers from the Citi homepage can be a wild ride, as well. I recommend using the above link or adding from Citi’s phone app.

As with Amex Offers, check back often for new ones with Citi. Their list routinely updates, and you don’t want to miss out on any easy wins. And speaking of easy wins, ensure to stack these offers with other benefits, apps, and programs, like Amex’s Uber credits, Upside, and fuel points. And, of course, add offers to the cards with the best bonus categories; add dining, fuel, grocery, and some travel offers to the Premier, for instance. And always, read the fine print on offers – Citi’s have plenty.

Citi Merchant Offers – Conclusion

I now see Citi Merchant Offers as a practical feature I can more routinely benefit from, and I like that Amex is getting more competition here. While I don’t always love more options, I do with these offers. So, Citi, you keep doing you, wrinkles and all. I’ll be along for the ride, and I’m betting many others will be, too.

What have been your favorite Citi Merchant Offers recently?

I tried using the app and found out it did not work after the gas was pumped. Not only did I not get the discount, but the gas station attendant apparently put it on his card and made me pay cash so I believe I paid a higher rate. I complained to BP and got pennies back. I tried again and got it, but the attendant said I had to fill my tank when I use the app. Very disappointed.

Another time Citi said that I never signed up for the bonus for BestBuy when I had. I even sent them a screenshot, of the app showing I had loaded it (very lucky I had the screenshot). It took a while and eventually got the bonus, but they were very difficult to deal with.

Unfortunately Citi customer service agents seem to have no ability to assist if an offer doesn’t post – nor do they even know that merchant offers exist

Jason,

I’m not surprised to hear this at all. I’ll take what I can get, but I don’t plan to put extended effort in if/when I have offer issues.

I’ve always had the worst experiences with my Citi cards: their algorithms do not like my spending habits, and I am frequently locked out of my account.

Courtney,

Fraud alerts, eh? You’re not alone. Don’t give up!

The BP offer is great, if only the BPme app wasn’t so buggy. I can’t tell you how many times it has failed to work (it’s a BP problem not a Citi problem), and the customer service is pretty weak. They’ve been “working on it” for a couple of weeks.

ABC,

I’m sorry to hear that! Fingers crossed, BP offers and the BPMe app have worked out fine for us so far. Keep grinding!