A Better Citi Prestige Offer

As I have covered previously, the Citi Prestige card is undergoing massive changes in July, 2016. These changes are not good and they severely impact the value of the card. Luckily most of the changes are 11 months away so if you were to get the card today you could enjoy most of the benefits for almost a full year.

Additionally, Citi is going to be changing their bonus rules on August 28 (the language is already in place) to restrict bonuses to one per 24 month period per product line. That means if you have opened or closed another ThankYou card (Premier or Preferred) within the past 24 months then you won’t be able to get a Prestige bonus.

Citi Prestige 50K In Branch Bonus Offer

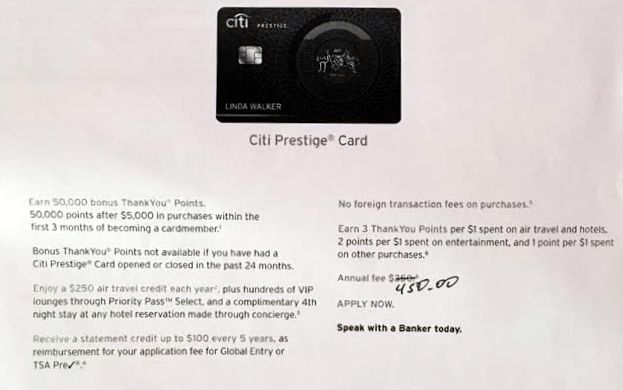

All of this makes now a compelling time to apply for the Prestige. While the current 40K online bonus isn’t terrible, it had previously been 50K. Now, it seems that the 50K offer may still be available in-branch. Jeff the Wanderer shared with Frequent Miler a photo of a brochure he found in-branch. It details the following offer:

- Earn 50,000 ThankYou points after $5K spend in three months!

Better yet, the annual fee is only $350. As you can see, the banker crossed out the $350 and put $450 since he is not a Citigold client, but in the past everyone who has applied in branch with this offer has received the lower annual fee despite what the banker says. The lower fee is definitely not a guarantee, but with the higher bonus anyway it may be worth a try.

The 9 Day Rule & A Strategy

Keep in mind you can only open one Citi card every 9 days. (And 2 in 65 days.) This means that if for some reason you want to open two cards before the 28th, then you’ll want to get that first one soon. I covered all of the best bonus offers and strategies for applications in a separate post.

Conclusion

With $500 in first year airfare credits ($250 per calendar year) and a 50K sign-up bonus along with Priority Pass and Admiral’s Club access for 11 months among other things, this offer is definitely one to look at. In my experience opening a credit card in-branch takes about an hour with Citibank, so factor that in too. Feel free to share your experiences and data points with this offer in the comments!

[…] I would strongly advise you checking a local Citi branch, however, as there have been reports of local bankers providing the old offer of 50,000 bonus points for completing a spend of $3,000 in the same period […]

AWESOME NEW LOGO BROTHA! NICE!

Thanks!

Does a denial count against the 2 applications per 65 days? I applied for a Citi card 45 days ago and was denied. I want to know if I could try applying for 2 over the next 8 days.

Yes it does. The application itself is what counts not whether it is approved or not unfortunately.

I dont have a branch in my state. Do they match the offer after applying online and SM them ?

You could try but I don’t believe others have been successful in the past.