| Miles to Memories does not have a direct relationship with the card issuing bank(s) and this post does not include any affiliate links. If you wish to support the site by applying for credit cards or using other referral links, you can do so here. Before applying I highly suggest reading the following posts: Slow & Steady Doesn't Make You A Loser and A Mandatory Waiting Period to Apply for Credit Cards?. You can find all of our credit card reviews here. |

|---|

How to Check the Citi Prestige Airline Credit

About a month and a half ago I picked up the Citi Prestige card during my last round of applications. While the card does come with a $450 annual fee, it has several benefits that I value highly. In addition to Priority Pass and Admiral’s Club access, it also comes with a nice 50,000 bonus as well.

Still, that isn’t enough value justify me paying a $450 annual fee. The one feature that put it over the top for me is the $250 annual airline credit. Unlike the Amex Platinum, this credit applies to all airline purchases and it runs based on the calendar year meaning I can get $500 in credits during my first year with the card.

The one issue I have with airline credits is that I don’t tend to purchase tickets very often. What normally happens is I use miles to book a ticket and then pay the taxes/fees. For example, for my upcoming trip to Europe with my son, we each had about $40.40 in taxes on our business class tickets.

Tracking the Credit

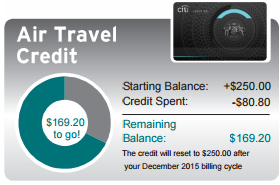

While the Prestige is useful in these situations, I know it can be hard to keep track of how much of the credit has been used, especially with a number of smaller transactions. Thankfully Citi has fixed that. Today I checked my statement and was surprised to see just how clearly Citi lays it out.

As shown above, they show you the amount of the credit, how much you have spent and your remaining balance. I put the taxes for both mine and my son’s tickets to Europe on the card and now I have $169.20 remaining. I love simplicity.

This is valuable to me as well since I can let the credit run through the end of the year and use it to pay various taxes and fees on award tickets. If at the end of the year I haven’t used it all up, then I can just purchase a gift card. With so much complexity in this hobby, I value the simple things that make my life easier.

Conclusion

I am still just getting to know the Prestige card, but I really like it so far. While I am not always the biggest fan of Citi, in this case I really need to commend them for making this feature easily accessible. Other banks might have wanted to hide this feature, but Citi seems to want you to take full advantage. (And I will!)

How do you actually check the credit left online? I’ve been unable to find it anywhere.

can you buy alaskair gift certificates to apply toward the prestige airline credit instead of booking a flight for now

Yes. As long as they are from the airline, they should count.

They mention 50K points can use for $800 AA or US Airways, do you have to book through them? Does it mean 1 points = 1.6 cents so if you have more points you can book ticket at this rate?

You book through the City ThankYou site for the 1.6 cents.

Charging taxes and fees on award tickets to this card is probably not a good idea if you have an annual fee Chase card. With Chase, you get full trip delay/cancellation protection if you just charge the taxes and fees for an award ticket. You do not get any of that coverage on award tickets with the Citi prestige.

This is really good info to have, I didn’t know that. I was actually pretty skeptical since this is a higher-level card, so i looked through the benefits guide. Sure enough, it says on page 5 (and 6 for trip delay) that to qualify for trip interruption/delay/cancellation reimbursement:

“The trip was paid for in full including taxes and fees with your Citi card, Citi reward points or a combination of both.”

I called in to a benefits expert, and she confirmed that booking an award ticket with an airline’s loyalty points and charing the taxes to your Citi Prestige card will not allow you to be covered. I guess i’ll stick with putting award tix taxes on my chase ink plus, since their benefits guide says that only a portion of a trip needs to be charged to the card to be covered.

I still think the most undervalued benefit is the 4th night free. I’ve just recently booked 3 different stays and my savings for the three wil be well over $1000.

Very good point. There is so much value in this card. On the low-end it is worth about $1,000, but on the high-end with the 4th night free and golf the value increases significantly.

You have to book through their travel agent, is the price reasonable?

Thank you.

Citi Prestige by far is the best card of the year… I’ve got one for my self and my wife and both of my parent. The signup bonus, 4th night free, $500 airline credits, several rounds of free golf… not to mention lounge memberships.. if you play golf and use the benefit well, you can get several thousands of benefit out of this card.