Citi Miles Ahead Savings Account – 50K Bonus Miles & 1.01% Interest

The Citi Miles Ahead Savings account has a new targeted offer that can earn you an increased rate on a savings account and up to 50,000 AAdvantage miles. We have seen a few of these offers in the past, but this one gives you three options to choose from. Let’s take a look.

UPDATE 5/18/20 – More people targeted but the APY rates have changed.

The Offer

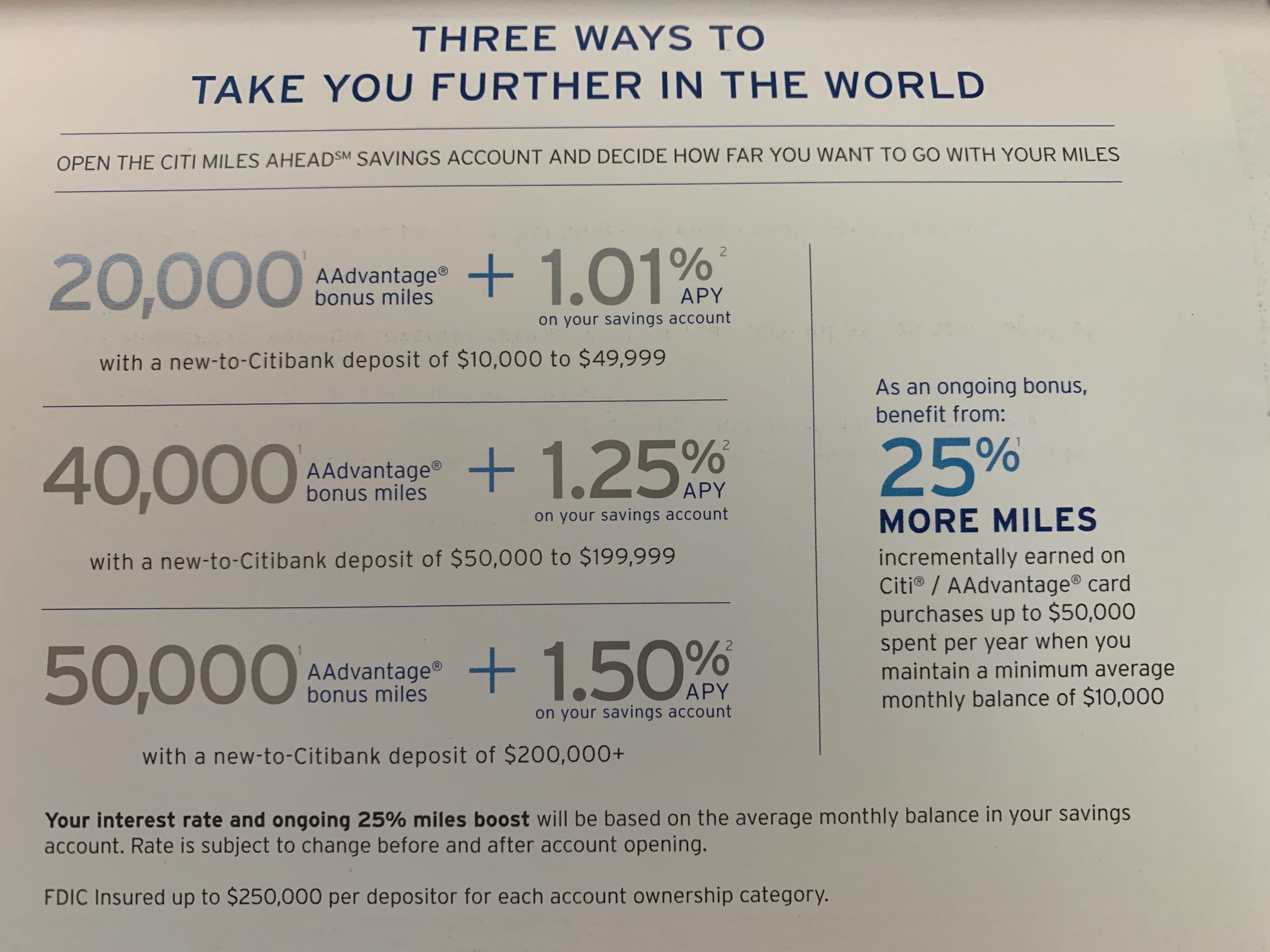

Open a Citi Miles Ahead Savings Account and decide how far you want to go with your miles. Deposit the following amounts within 30 days and keep it in the account for 60 days to earn the following bonuses and interest rates:

- Deposit $10,000 to $49,999

- 20,000 AAdvantage miles

- 0.50% APY

- Deposit $50,000 to $199,999

- 40,000 AAdvantage miles

- 0.75% APY

- Deposit $200,000+

- 50,000 AAdvantage miles

- 1.01% APY

The rates have dropped from the last offer. It is likely because the Fed has continued to lower the interest rates.

You will also earn 25% more miles on Citi AAdvantage Card purchases, up to $50,000 spent per year when you maintain a minimum balance of $10,000.

This offer was sent out by email and USPS to some credit card holders, but you can log in here to see if you are targeted.

Conclusion

The Citi Miles Ahead Savings account offers a good bonus that can earn you a decent rate and bonus of up to 50,000 miles. But the rate of 1.01% APY is not that close to the highest possible rates that you can earn right now. You can usually get around 2% with a few options. Remember that the miles offered will trigger a 1099 for your taxes, likely valued at 1 cent a piece.

This promotion is a fraud! I have have the Miles Ahead account open for 1.5 years and there is no miles from this promotion. Spike to a human robot just now that keeps saying there’s no promotion on the account so I will not be getting any Miles . Citi , you should be ashamed!

I have been told that my Citi Miles Ahead account was only able to receive miles if I can prove the offer included miles! What a bunch of malarkey. I have to prove my promotion was Ok for miles even though it is a miles ahead savings account.

Did you ever get the miles? I’m in the same situation.

Finally got a 50k miles credit in AA show up on 2/23/2022. Instead of “within 90 days of completing required activities” it took 113 days and I had to open a dispute case. The other issue I found is with setting up a beneficiary. No where to do that online – I had to call them. Then they mail you forms and require you to get a notary stamp to certify the signatures and mail in the paperwork. I have never been asked to go to this kind of trouble with any other online account. Just glad I didn’t get hit by a bus before closing the account….

Same problem as R. Clayton. They make it SO hard to close the account. Reaching someone on the phone to explain this is very hard. Spent over 90 minutes with a Citibank agent at an overseas call center, and they still didn’t give me a straight answer.

Beware with Citi and any of their savings accounts with large deposits – they make it difficult or costly to get your money transferred out. They restrict ACH transfers to $25k/day and $50k/month. OR if you want to pay a $25/transfer wire fee, they restrict those to $50k/day. I guess I should have read the fine print when I signed up. I have had many online savings accounts in the past and have had no restrictions on ACHing funds. So either this will take me 4 months to move the initial deposit out of the account or I can pay 4x$25=100 in wire fees and still have to wait 4 days.

“The Bonus Miles will be paid within 90 calendar days from the date you complete all Required Activities” Otherwise I would call them up, close the account and have them send me a check.

I had 10100. Dollars in this account for over 100 days and still haven’t received my 20,000 aa miles. Who should I contact to get my missing miles?

Says you must maintain that balance for an additional 60 days after the initial 30 day deposit period.

Did you ever get your miles?

Is my understanding correct in that the Bonus Miles at initial sign-up are taxable, but the 25% more miles on the American Airlines AAdvantage MileUp Mastercard are not?

I recall years ago I got a 1099 for miles. I called regarding this promo and was told they were not taxed. So not really sure.

Bank bonuses they send them out.