Citi Smart Savings Offers Review

Citi has rolled out an “Offers” program on some of their cards. Called “Smart Savings”, it is sort of a blend between Amex Offers and BankAmeriDeals in that the offers are targeted to specific cards, but generally pay a percentage back. Let’s take a look at how to access your offers and what is available.

How to Access Citi Smart Savings

The interface to access the offers varies for a regular login and Citigold. Let’s look at both versions.

Regular Log-In

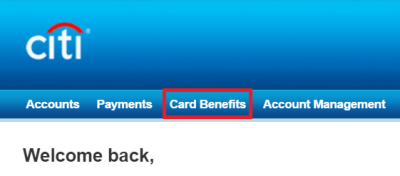

After logging in, click “Card Benefits” on the top menu.

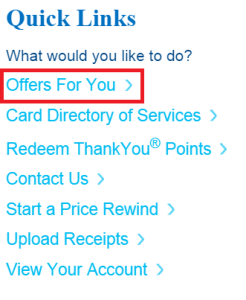

On the Card Benefits screen, click “Offers for You” on the Quick Links menu found on the right side of the screen.

Citigold Account

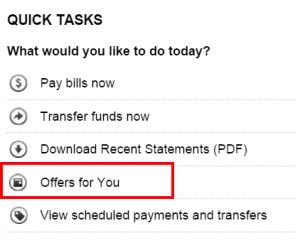

If you have a Citigold account the link appears to be easier to find. After logging in you should see the “Offers for You” link on the right side of the page under “Quick Tasks”.

Viewing the Offers

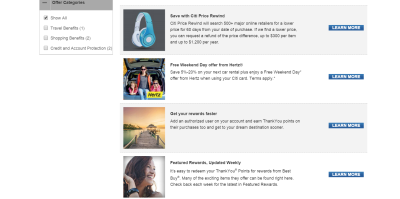

When you get to the offers page you should see a dropdown on the top left. This can be used to view offers available on each of your different cards linked to that login.

Most cards still do not have any offers available. If there aren’t offers for your card then the page will say “More Offers and Extras” and will show you a selection of your card benefits. Here is an example:

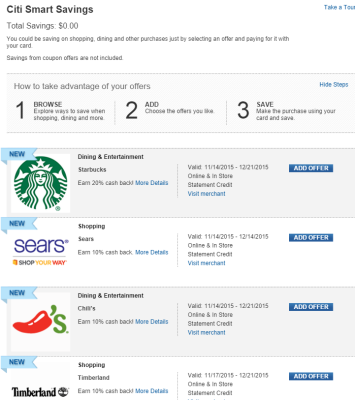

If you do have offers available on your card then the screen will say “Citi Smart Savings” and will show your savings to date along with a number of offers. Between my wife and I we only received offers on one card. All of the other cards show only the benefits as shown above. Here are some of the offers we received:

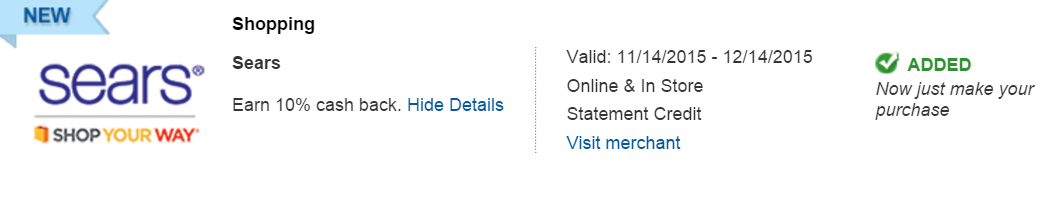

Once you have located an offer that you like, simply click “Add Offer” and the offer will be loaded to your card. You should see confirmation of this on the screen.

Offer Analysis

Most of the offers are decent, but aren’t at stores or restaurants where I go frequently. The Starbucks offer isn’t bad, but it is limited to $4 in cash back total. For me, the only offer that really sticks out is the Sears one.

The Sears offer gives 10% back for purchases in-store and online through 12/14/15. After digging through the terms I found that the cashback is limited at $35. So I could purchase 2 X $200 Visa gift cards in-store for $206.95 each and get $35 back in credit. That purchase would earn 414 points on this card plus a profit of $21.10. Not bad.

Conclusion

Right now Citi’s new Smart Savings Offers program is quite limited since it is not on all cards and the number of offers is small. With that said, it is better than nothing and there is some opportunity. I am hoping this rolls out to more cards soon with even better offers!

How many of your cards have offers available? Are they better or worse than mine? Let me know in the comments!

[…] Back in November of last year I covered Citi’s new Smart Savings cashback program. It works sort of like Amex Offers or Bank Amerideals. You load the offer, make a purchase and receive a credit back on your statement. You can find out how to search and load the offers here. […]

I don’t see Citi Smart Savings Offers in my Citi AAdvantage Executive. Looks like it is available for cards with Thank You points ONLY.

My Dividend had the same offers as yours. A little disappointed that my old Citi Forward didn’t have anything those restaurant offers plus 5x TYP would have been awesome. Infact the link to get there doesn’t even show up for my Forward card.

Give it time, perhaps the offers will improve.

Nothing for me. 🙁

Why are people complaining about this? Who cares if it’s nothing like AmEx offers.. it’s still a discount. My Citi Prestige offered, 10$ off at Dick’s Sportinggoods/Sports AUthority, McD, Starbucks, Hilton and Sears.. It helps to have options and yes I’ll be spending $$ at most of these locations.. I’m liking more choices for discounts.

Sears wont let me buy gift cards with a credit card. Also, wouldn’t you also earn SYW rewards points in addition to your CITI points?

I don’t believe Visas earn Shop Your Way points, but anything you buy that is SYW eligible will earn those points.

This is nothing like amex offers, its more like the bank of america deals one

It is a mixture, but is their answer or version of a cashback deal system. Bank of America’s system only allows one offer across all cards and this one has separate offers for each card like Amex. It is sort of a marriage of the two.