Citi ThankYou Preferred $0 Spending Update

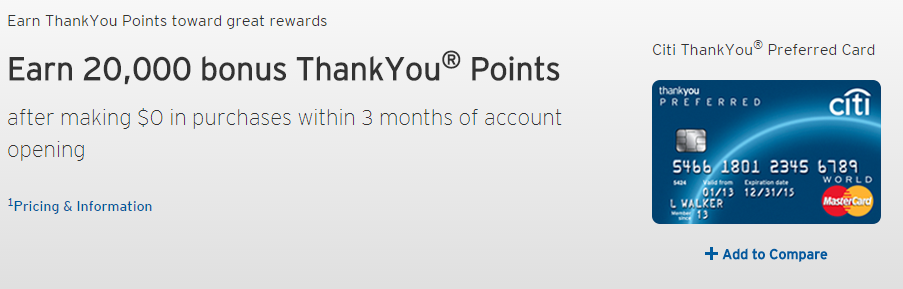

A few weeks ago I covered a seemingly awesome deal from Citi for the ThankYou Preferred card. During the “deal” the 20K bonus on the card remained the same, however the minimum spend requirement was reduced from the normal $1,500 in three months to $0.

Well, that appears to have been too good to be true. Apparently the $0 spending requirement was a glitch and Citi’s computers still coded the apps as requiring $1,500 in spend. In my original post a few readers have commented that they are being given a hard time by Citi, but Doctor of Credit is reporting that they may be backtracking a bit and honoring the terms.

Apparently Citi has told some people that they will honor the $0 spending requirement if the applicant can provide a screenshot showing the $0 spending requirement on Citi’s website. I didn’t take a screenshot of the application itself, but do have a screenshot of the landing page showing the $0 bonus. You can find that screenshot above.

Is Citi Right? NO!

The first reaction for some might be to applaud Citi for honoring this, but I don’t think they are doing anything good here. Citi KNOWS that their website displayed the $0 spending requirement and KNOWS who applied during that time. They should just honor this deal as displayed and advertised and not make people jump through hoops. Of course I am not a lawyer, but I do personally believe they are obligated to honor the deal as advertised so they really are doing the minimum here in my opinion.

Conclusion

If you applied during the time that Citi’s website was showing a $0 spending requirement for the ThankYou Preferred card, then I suggest sending the company a secured message with a screenshot showing the $0 spending requirement. I am glad they are honoring this, but also think they are being very customer unfriendly by requiring people to follow up. How many people will not get this bonus now because they don’t pay attention until after the three months have passed?

Just to follow up, Citi has still not given me the points. I am in contact with 7 on Your Side for help getting this resolved. This is terrible customer service. On the phone they gave me a timeframe of “sometime in late May”. It’s absolutely ridiculous. Has anyone had this offer honored? I am disgusted with Citibank.

I’m still waiting for the points to post. It’s been more than a week since I got the letter. I have been spending on the card but will be getting a United CC in the mail any day that I will need to focus my spending on so I will discontinue spending on the TY card until I finish. When I spoke to them they sounded as if I should have known there is no such thing as an offer with no spend. I told them there have been other offers by other card issuers, such as Alaska Visa, US Airways MC, so it’s not unprecedented. Has anyone had this resolved yet? Has anyone received the points without the $1500 spend?

I just got a letter from Citi today. It says:

“This letter is in response to an inquiry concerning your Citi Thank You Preferred Mastercard account with us. We are aware of a possible issue regarding your introductory promotional offer for Bonus Thank You points. Once we resolve this issue we will add the bonus points to your account Unfortunately we are unable to provide a time frame for a resolution at this time. If you have any questions please cal us at …….. blah, blah, blah.

What do you think, does it sound like I am getting the points? Maybe I’ll get them in a year or maybe 2, who knows. I know I should just do the $1500 but it’s just the principal. They advertised an offer, I applied for the offer, then they changed the offer. It’s so annoying!

EXACTLY!!! My experience was an offer of 60,000 points if I spent a certain amount within three statements. I complied, they gave me 50,000 points, not 60,000. I complained on the telephone, they offered me 1,000 additional points as a gesture. I said, “No, I want those 10,000 extra points. They said, “we never offered 60,000 points and we do not honour a third party offering. Eventually they sent me a letter telling me NO, we did not offer 60,000 points blah blah blah. I STOPPED using their card. Now, that is what I call Stupid customer service.

I’m still waiting for a response. I mailed in a hard copy of the screen shots of their website last week. Does it always take this long to get a straight anwer? I even called again and the CSR spoke to her supervisor, who said they would only honor the offer if I was targeted for it, which I wasn’t even though it was on their very own website. Bait and switch!

I honestly am shocked they are making you jump through these hoops. At this point I would personally consider either completing the spend (to avoid the hassle) or send them one last message asking to hear back and letting them know that you’ll pursue this with the proper governmental organizations if you don’t.

I sent a message to Citi and here is their response. I am thinking about mailing it as well with the screen shots.

“We want to make sure your questions are handled appropriately and in a timely manner. However, in order to accomplish this, your account will require additional review. I am forwarding your ThankYou bonus points inquiry to the proper department for handling and you will receive a response within the next 7-10 business days.”

I will be using the card in the meantime here and there for restaurants and entertainment, since I get double points anyway, and wait to see what happens.

As I wrote to you about Citi’s offering of 60,000 points with qualified spending. Yes, I did it, I applied, they took their time getting me my card and yes, I spent the required amount and they only gave me 50,000 points. I complained and they sent me a letter saying they never offered that, nor if they had I did not apply during any offering that was not the 50,000 points. Citi stinks and should be called on the carpet for these offerings that they find are a mistake. For crying out loud, good customer service would just credit card holders to keep them using the card. I have switched now to using another card because I am mad.

Ah, I wish I saw this deal when it was live. Man, I need to keep up with these e-mails!

Shouldn’t you/we count ourselves lucky we aren’t in the DOJ’s crosshairs for promoting fraud with the Bluebird Serve shutdowns and stop while we’re ahead. I have it on good authority that folks are starting to monitor this stuff.

What system is being gamed? Citi advertised $0 in spending for the bonus. It was on their landing page and the application. I didn’t apply personally but people are only asking for them to honor it.

After the Bluebird Serve shutdowns, can’t we maybe stop trying to game the system for a minute and do things the way they were intended? I think we should count ourselves lucky for not being charged with promoting fraud by the amex folks and find ourselves in the DOJ’s crosshairs.

On what planet was fraud being committed with Bluebird and Serve?

You’re of course right, in principle, but… it’s only $1500, I’d find better battles to pick.

I think if I were on the Citi side of this my temptation would be to say, “here’s your 20K points, enjoy, you have 30 days to use them because we’re closing your account — you’re too annoying for us to fuss over considering how small your contribution is to our bottom line.” They of course won’t say/do that, but people wasting their time and Citi’s should consider that perspective…

While I tend to agree that it is probably easier to just do the $1,500 in spend and not worry about it (which is probably what I would do personally), that isn’t possible for everyone. (Especially with Bluebird/Serve being shutdown.) Citi advertised no spend requirement and they should honor it. I don’t know why asking them to honor something as advertised makes you annoying. Also, Citi spends a great deal of money on acquiring each customer. At this point they have you with a new account. They aren’t going to shut you down simply for asking for what they advertised.

It is more on principal…what is to stop people from changing terms of bonus after they get you to sign up in the future. From a business standpoint it builds trust and loyalty. And $200 is cheap to get someone hooked into your product. It is becoming negative press for them too. If I knew there would be spend requirements I would have just signed up for the Premiere…wouldn’t have wasted a pull on it.

I sent a secure message. Their reply:

We are aware of a possible issue regarding your introductory promotional

offer for Bonus ThankYou Points. This issue is currently being

investigated. Unfortunately, we are unable to provide a time frame for a

resolution at this time.

If there is any way we can be of further assistance, please feel free to

contact us.

I had a large purchase to make today anyway, so I used this card for $1500 of it.

Citi’s been a real bummer since the whole 60k premier fiasco (or maybe even before then). They more or less soured my impression of them because I subsciously find myself searching for the CSP more than than the Premier card when they’re just about identical in benefits.

Hi, You can upload the screenshot to a photo hosting site (like picasa or drop box) and then send the URL in your message.

Can people file a complaint against them with the Consumer Financial Protection Bureau (CFPB)? That might get them to honor it?

I personally would start with trying to get them to honor it without escalation, but that is most likely an option.

Agreed. Just throwing that out as a last resort.

Is there a way to attach a image to the secure message…I did not see that offered when I sent my initial message.

Mark I thought you could, but after checking you are correct. There is no way to attach a file. I would just send them a message and they will tell you how to proceed from there.