Citi $700 Bonus

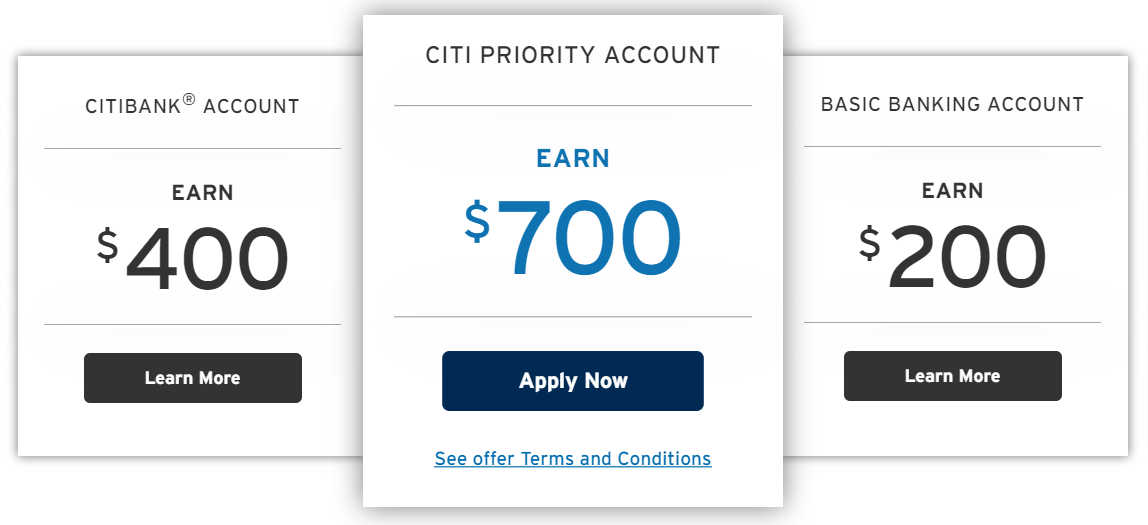

Citi is offering three new bonuses for checking accounts that are available nationwide. You can earn either $200, $400, or $700 with these new offers. Let’s take a look.

The Offers

$200 Offer

- Open a new eligible checking account in the Basic Banking Package during the offer period 10/01/2019 to 12/31/2019.

- Within 30 days of opening your account, deposit $5,000 in New-to-Citibank funds into the new checking account.

- Maintain a minimum balance of $5,000 for 60 consecutive calendar days.

$400 Offer

- Open new eligible checking and savings accounts in the Citibank Account Package during the offer period 10/01/2019 to 12/31/2019.

- Within 30 days of opening your account, deposit $15,000 in New-to-Citibank funds between the new checking and savings accounts.

- Maintain a minimum balance of $15,000 between the checking and savings accounts for 60 consecutive calendar days.

$600 Offer

- Open new eligible checking and savings accounts in the Citi Priority Account Package during the offer period 10/01/2019 to 12/31/2019.

- Within 30 days of opening your account, deposit $50,000 in New-to-Citibank funds between the new checking and savings accounts.

- Maintain a minimum balance of $50,000 between the checking and savings accounts for 60 consecutive calendar days.

Offer Terms

- Must have not been an owner of a Citibank checking or savings account within the last 180 calendar days

- Open account before 09/30/2019

Fees

All three accounts come with monthly fees and all can be waived:

- The Citi Basic Account Package – $12 monthly service fee waived when you maintain a balance of $1,500 or more in your eligible deposits, retirement accounts, and investments.

- The Citi Priority Account Package – $25 monthly service fee waived when you maintain a balance of $10,000 or more in your eligible deposits, retirement accounts, and investments.

- The Citi Priority Account Package – $30 monthly service fee waived when you maintain a balance of $50,000 or more in your eligible deposits, retirement accounts, and investments.

Analysis

All offers are similar, expect for the deposit requirement. The first offer gives you $200 and requires a $5,000 deposit within the first 30 days. You need to keep that balance for 60 days. You need to keep $1,500 in the account to avoid a $12 monthly fee.

The second offer gives you $400 and requires a deposit of $15,000 within the first 30 days. You need to keep the money in the account for at least 60 days. You then need to keep $10,000 in your account to waive a $25 monthly fee.

The third offer gives you more, a $700 bonus, but requires a larger deposit of $50,000 within the first 30 days. Again you need to keep the money in the account for at least 60 days. You then need to have that same balance of $50,000 in your account to waive a $30 monthly fee.

If you’re looking at the best interest rate, then the $400 bonus is the best choice. You need a deposit of $15K instead of $50K to get the bonus and also $10K instead of $50K to waive the annual fee. But even the $700 bonus give you about 5% in interest for those 3-4 months that you need to keep the money in the account. That’s much better than any other bank out there.

Keep in mind that Citi is often difficult with giving out bonuses, so you might have your money tied up longer than expected.

Conclusion

If you have the money for the deposits, this is a great bonus. It’s better than the previous bonus that was up to $600 and it doesn’t require a direct deposit. It’s also available online and nationwide.

Lower Spend - Chase Ink Business Preferred® 100K!

Learn more about this card and its features!

Opinions, reviews, analyses & recommendations are the author’s alone, and have not been reviewed, endorsed or approved by any of these entities.

I signed up for the $700 promotion for the priority package on March 31st. Be aware that this opens a Citi Savings account with standard interest of 0.10% and not the Accelerate Savings account (1.55%). It is really not that clear in the terms and conditions that the Accelerate account is not eligible for the promotion. The terms just say to you need to open a “Citi Savings Account” which is generic and seems like it would encompass all savings accounts at Citi. It is also not obvious during the account opening process that you are opening a standard Citi Savings account with the lower interest. I may have thought twice about opening an account package if I understood that at the time.

If you decide to go with this promotion you can transfer the balance from the Citi Savings to an Accelerate Savings once you meet the bonus requirements (maintain minimum balance across eligible accounts for 60 days). The other bonus programs likely work the same way in that the savings account will be a Citi Savings account and not an Accelerate Savings account. I should have known better and in the future I will take a screenshot of every screen during the application process.

Note: The difference between 1.55% and 0.10% on 50k over 60 days is about $120.

Now it is October 2. Can one open the account still?

Also can a person fund some of the account with a credit card? That would be great for my minimum spend.

[…] VP Weekly 22nd Sept ’19 | Swan's Venture Pulse on Mobile value-added services firm OnMobile to sell minority stake to Jump Networks – VCCircle […]

Open account before 09/30/2019

On a blog post for 10/1/2019.

Gee, thanks!