| Miles to Memories does not have a direct relationship with the card issuing bank(s) and this post does not include any affiliate links. If you wish to support the site by applying for credit cards or using other referral links, you can do so here. Before applying I highly suggest reading the following posts: Slow & Steady Doesn't Make You A Loser and A Mandatory Waiting Period to Apply for Credit Cards?. You can find all of our credit card reviews here. |

|---|

Citibank HHonors Visa Signature 75K Offer

Citibank has two cards that earn HHonors points. The first one (The HHonors Reserve) is generally the one I recommend since it comes with a very nice sign-up bonus of 2 free weekend nights at almost any Hilton property and Gold status. In fact my wife just picked up one of these to test Citi’s 18 month rule.

The other card is called the HHonors Visa Signature and really isn’t the best card for earning HHonors points and it only gives you the lowly Silver status as well. Normally the bonus on this card is officially 40,000 points, however there has been a link around for awhile giving 50K + a $50 Hilton statement credit.

Card Benefits

- No annual fee

- 6 points per dollar spent at Hilton properties

- 3 points per dollar spent at supermarkets, drug stores & gas stations.

- 2 points per dollar spent everywhere else.

- Silver status

A New Offer

While the 50K + $50 was alright, today Citi has finally released a new offer that really justifies its own post. The offer is: Earn 75,000 HHonors points after spending $2k within the first 3 months.

Analysis

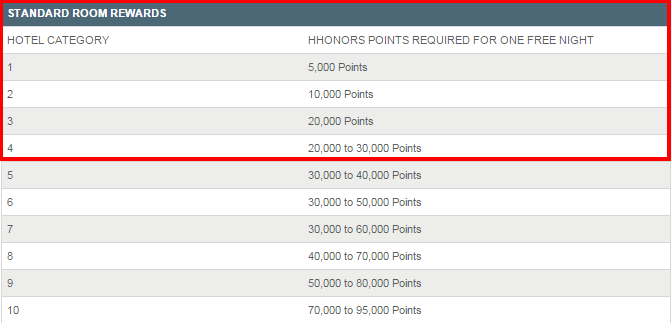

Now you may be thinking that 75,000 HHonors points won’t even get you a room at a high-end Hilton property during the busy season. Well you’re right, but that doesn’t matter. Hilton’s chart starts at 5,000 points per night. Lets take a look.

So look at the part in red. Those hotels often represent an incredible value. While many of the hotels within those categories are Hampton Inns, a lot of them are Hilton Garden Inns, Doubletrees and regular Hiltons. In other words, there are a lot of nice properties within those bottom categories. After meeting the minimum spend you will have about 80,000 points. That is enough for:

- 16 nights in a category 1

- 8 nights in a category 2

- 4 nights in a category 3 or 4 (low season)

Update: As Nick pointed out in the comments, since this card also gives you Silver status, you would qualify for the 5th night free on award bookings of 5 or more nights as well!

If you want to get this card, then that should be your aim. This card is for the person who tries to squeeze every last hotel night from their points and not someone who is looking to stay in $600 per night hotels. If fancy is your aim, then apply for the Reserve. In fact, I think the Reserve is a better card, but that doesn’t stop someone with that card from padding their account balance with this one.

No Annual Fee

This is also a no annual fee card, which means you can keep it for a long time and help to build your average age of accounts. I have this card from a couple of years ago and have been recently thinking of converting it to another product. Before I do, I think I might apply for this and get the 75k, since the 18 month language applies to this new application.

Conclusion

This isn’t the absolute best offer around, but HHonors points are useful to have in your arsenal when booking hotels since Hilton’s footprint is so vast. Very few cards give you the ability to earn so many free nights off of a sign-up bonus, so as long as your goals match up with what this card provides, then it may be and probably is a good value.

[…] and that is why I keep a stash around for when I find a good deal. Just a few months ago I applied for Citi’s no annual free HHonors card when it had a 75K bonus just to pad my balance. This bonus seems like a very good deal if you have […]

[…] Visa Signature card has historically come with a 40K sign-up bonus, but a couple of months ago Citi increased the bonus the 75K and slapped an expiration date on the offer of September 30. I have seen several sites write about […]

Although I love staying at really nice properties in nice rooms, I enjoy value. I usually scout out the 20k rooms. For me, this bonus would yield me 3 nights in a 20k room and short fall away from a 4th night then get the 5th night free. All depends on what type of room/property that you like to stay in. 🙂

I had two of these from 2012. I never put any spend on them and Citi just shut both of them down. I may still try for another one as I am actually looking at a very specific hotel/suite for a trip next year and I need some more points. Have the Amex for Gold status.

Shawn, you could have more nights if taken in a row (5th night free for HHonors).

Great point! Yes since this card gives you Silver status, you definitely qualify for the 5th night free.