Citibank Proactively Sending Out Product Change Emails

I have had my issues with Citi’s customer service in the past, including not honoring an advertised offer, but they recently did something I applaud. They proactively sent an email to my wife offering to product change one of her no annual fee cards to a better no annual fee card.

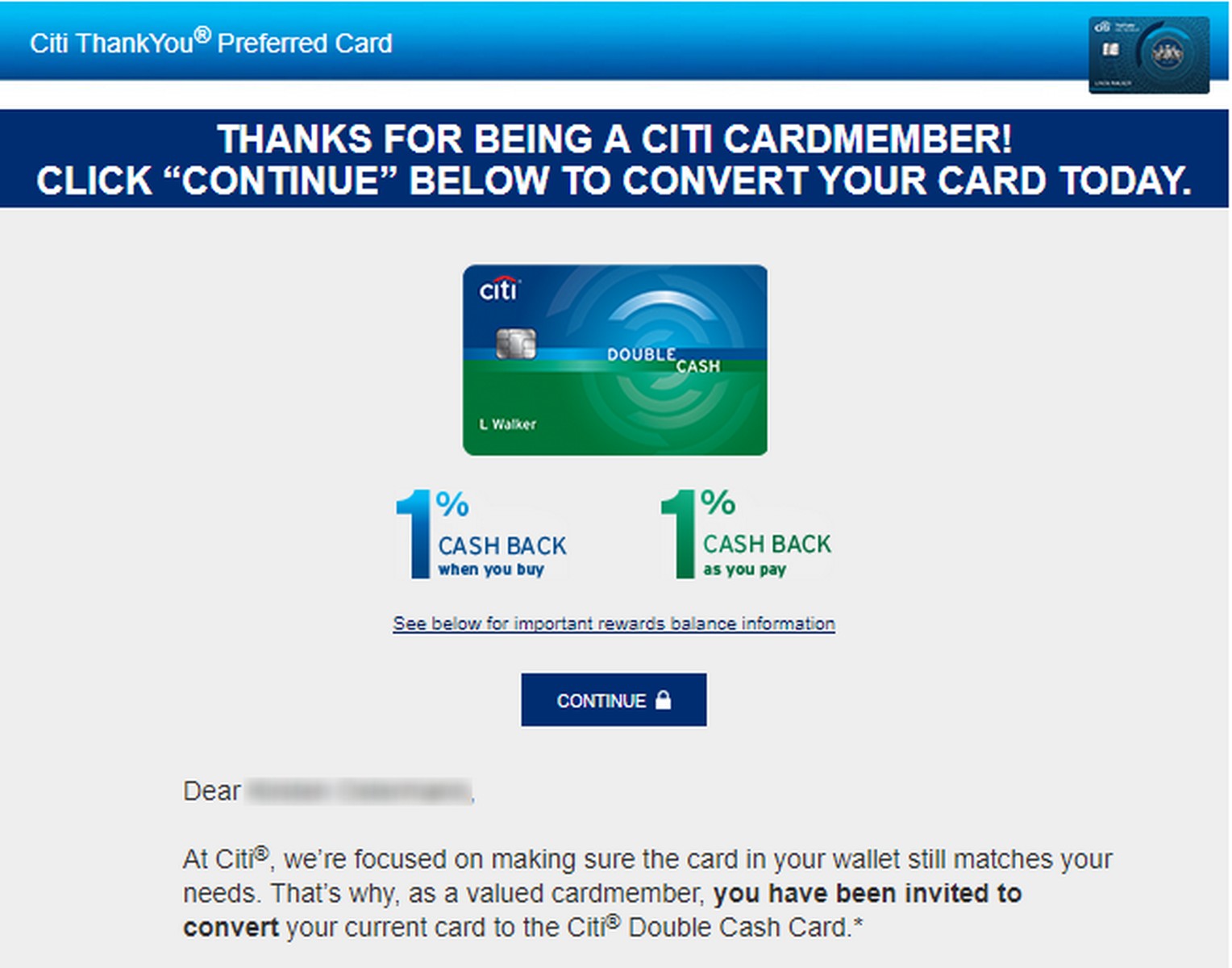

Citi Double Cash Offered to Replace the ThankYou Preferred

They sent an email to my wife offering to change her ThankYou Preferred card to a Double Cash card. This makes perfect sense for both parties.

Citi noticed she had not been using the card and offered her something else that may entice her to use a Citibank card going forward. A win for Citi.

My wife got the option to switch her card to a superior product without having to call in or research it. A win for my wife.

I think proactive customer service is very rare these days and that it is something that can take a company’s service to the next level. I wish more companies would do something like this. It can only help their bottom line at a very low cost to them. And it increases customer loyalty and satisfaction.

One thing to remember is that switching from a ThankYou card to the Citi Double Cash may reset my wife’s ThankYou card 24 month clock. Luckily my wife applied for Citi Premier 50,000 point offer a few weeks ago so her clock has already been reset. That means this was perfect timing!

Conclusion

I was planning on switching my wife over to the Citi Double Cash anyway since her ThankYou 24 month clock has just been reset. I can always use some more 2% bandwidth in the house. Plus she was never going to use the ThankYou Preferred card. By Citibank being proactive I didn’t need to jump through the hoops to make that happen.

This is truly a win win situation. We get a card that we are more likely to use and Citi will get some more coin in their pocket. This is nothing new and I could have called at any time to perform the product change. But, by Citibank doing it this way I save that 10 minutes or so calling in. And I don’t have to remember to call, I can knock it out in a few minutes.

I wish banks would allow product changes online without the need of an invitation code. Then we would really be getting somewhere!

What do you think? Smart move by Citibank or not that big of a deal?

Does anyone know if Citi Thank You points are worth less for travel if earned from a bank account versus those earned from a credit card? or did I just look at the wrong prices?

Don’t forget that if you product change from the ThankYou Preferred to the Citi Double cash you will have 60 days to redeem/transfer any points associated with the Preferred, assuming you also have a Citi Premier and/or Prestige.

Good point RG. I burned all of her points but a couple hundred so it doesn’t come into play for us but for sure it is something to think about for others!

“One thing to remember is that switching from a ThankYou card to the Citi Double Cash may reset my wife’s ThankYou card 24 month clock. Luckily my wife applied for Citi Premier 50,000 point offer a few weeks ago so her clock has already been reset. That means this was perfect timing!”

I was under the impression that your wife’s bonus for her new card had to post prior to you downgrading or cancelling her card. Not just APPLYING for the new card. Citi’s language states:

“… bonus miles are not available if you have had any Citi® …. opened or closed in the past 24 months.”

It seems a little gray to me. So does her bonus have to post prior to her resetting her 24 month period? Or does she just have to apply for that new card prior to her resetting her 24 month period? I’m wondering if you’re sure she’ll get the bonus? I’m in a similar situation, which is why I ask.

Interesting point PJ – I think once you are approved it would be fine. I am pretty sure I remember people signing up for the same card they already had and then downgrading the old one the next day and still getting the bonus. I don’t think it would be a problem after the fact – just not before.

I keep getting this on my Dividend card. No thank you

Yeah that would be a hard pass lol!