Citigold Miles Posting & Downgrade Options

I have written about the generous Citigold checking account bonuses many times including about the most recent deal and a step by step about how to apply online. Despite the fact that you can no longer fund the account with a credit card, these deals are still very appealing.

My Citigold Experience

Back in October I applied for a Citigold checking account under an offer giving 50,000 AAdvantage miles after $1K in debit card charges and a qualifying bill pay in two months. I funded the bank account with a credit card, used Serve (RIP) to do online debit loads which counted towards the $1K in transactions and paid the funding credit card off over two months. (One big payment up front and a second small payment in month two.)

Once all of the requirements were satisfied, I sent Citi a secure message asking them to confirm I had done my part. While they were a little wishy washy, they did confirm I had met the requirements and that the miles would post after March 1. I added a reminder to my calendar and went merrily on my way.

March 1

On March 1 there were no miles, so I sent a secure message asking what was going on. It took a few days, but I eventually received this letter back:

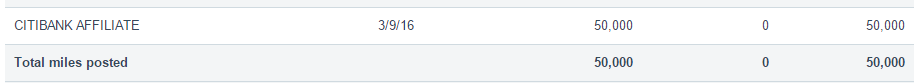

Thank you for your inquiry on 03/09/2016 regarding your Checking account number ending in —-. We have completed our research and the results are as follows: You have met the terms and conditions for Promotion 42ERCWNQU6, so we are delighted to tell you that a credit of 50,000 AAdvantage miles has been processed to your AAdvantage account. It may take up to 10 days for the miles to reflect on your AAdvantage account.

Apparently this person had manually triggered the miles to post, because this is what happened with my account. Success!

Paying Fees

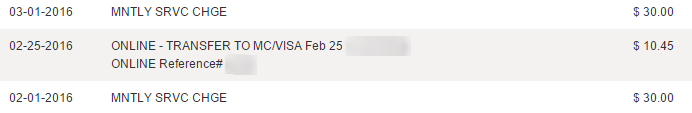

My one regret is that I didn’t send the secure message mid-way through February. I was charged my first monthly fee on February 1st and a second on March 1st. Perhaps if I had sent the secure message a bit sooner I could have avoided the second $30 monthly fee. Still, $60 in fees is definitely worth 50,000 AAdvantage miles plus the rewards I earned from funding the account with a credit card.

Downgrading

I will be downgrading my Citigold to a Basic Checking account sometime soon. Doctor of Credit has a good post about how to do that. Even if you are planning to close the account, it can be good to downgrade it first since apparently Citi sometimes goes back and charges another $30 fee which overdrafts your account. Read DoC’s post for details.

After downgrading I am hoping to get the monthly fee waived with a small direct deposit and bill pay. I am also hoping that keeping the account open will keep the annual fee on my Prestige card at $350. That $100 savings would be huge since I don’t think I will be giving up my Prestige card given its overall value.

Conclusion

It took just over five months for me to get the 50,000 mile bonus on my Citigold checking account. While that is quite awhile, it was definitely worth doing and I have no regrets other than not checking up before the 2nd monthly fee hit. Hopefully those of you who are still waiting can avoid more fees by sending a secure message to Citi. If you qualified, the miles should be posting soon.

Shawn did you receive a W9 form from Citi after receiving the Citigold 50K aadvantage miles bonus? If you did get one, did you turn it back in?

I didn’t, but my wife was required to fill one out for her 50K TYP bonus on her Citigold.

[…] couple of months ago I wrote about receiving my miles. It wasn’t too much of a hassle, except I had to pay the monthly fee two times before the […]

Late to this, but after the same issues as everyone had above, I finally got my miles posted last month. However, now it’s time to have my husband’s post and they’ve informed me that since there was no offer sent to him, he doesn’t qualify. This is AFTER I confirmed in January he did. So, wasted money and nothing to show for it 🙁 AT least I got the miles from CC funding, I guess.

Hi Shawn,

May I know your Citigold Checking Account opening date? I opened mine on 12/30/2015 and the recent SM reply from Citi informed me that it will be 90 days after I fulfilled the requirements to post 50K bonus AAdvantage miles and it is going to be 5/31/2016. Looks like at least two month service fee of $30 is a must for my case.

I got this promotional offer in email because of my Citi Platinum Select Mastercard. Due to annual fee is coming up, if I close or downgrade this credit card account between now and the AA miles posting date, 5/31/2016, will it hurt my change of receiving these bonus miles? Thanks.

Follow the “trick” Shawn has suggested.

Qualify with the debit card $1000 charges, 2 bill payments and send a secure email asking for confirmation

of completing 50K requirements. Then send/ or call in a 2nd email asking for when points post since you have been confirmed. This accelerates the 90 day waiting period for some.

Hi Shawn,

I also sent secure message RE: 50K AA promo but see part of reply message below;

“Our records indicate you have qualified for the above offer. But Unfortunately, the above

account is not W8/W9 certified. Once your account is certified, please contact CitiPhone

Customer Service at the number listed below and place a follow up investigation. At that time

we can credit your account for the incentive.”

Not sure why am I required the W9 form? Do you have any idea?

Thanks,

JR

W9 Form – is between employee/contract employee and employer.

Banks use this form to confirm tax payer ID number.

Digital Signature Form is usually required by BANKS to confirm an authorized signature of

all approved names on checking account.

Speaking of avoiding fees, I just had a friendly chat rep give back $60 in fees during my request to downgrade to basic checking package. Was pretty shocked, as all I did was ask if it would be possible to have the $30 for march waived or pro rated as a SM from someone a week ago had mentioned they would place a one month fee waiver on my account.

Other thing I’d note is that in my experience, you’re better off contacting Citi during U.S. business hours. Between poor service in the evening and/or running into weekend maintenance blocks (they waited 25 minutes into the session to tell me) I’m quickly learning to stick to business hours when contacting any support. It makes it more challenging as the best hours are off-hours but hey, have to work with what they give me.

I am in a similar boat. I was also told after the Feb statement closed I would receive my miles shortly on or after March 1st. I was charged the $30 service fee on March 1st and I secured messaged them asking about the bonus miles and was told that they would get posted on April 1st (90 days after meeting the requirements)! They couldn’t expedite the miles to post to my account. However, they did waive the $30 since I was told I would receive my bonus miles on March 1st. Maybe I will try SM now to see if they can get the points posted so I don’t have to incur the $30 on April 1.

What month did you complete your second billpay? Not including this second month, how many months have passed since? My second billpay was completed first week of November. I had to wait three full months thereafter and thus was supposed to receive it by March 1st. I had to SM them on 3/4 to push it along. Received the points about a week later.

Chuck,

Longtime lurker here :-)…if you call them up and ask politely for refund of fees explaining that you were pondering about downgrading and were late by a couple of weeks, they refund the fees. At least they did for me.

Can anyone confirm downgrading to basic with direct deposit and bill pay monthly results in CitiGOLD no monthly fees?

I was told this would cancel the $350 Prestige offer which Shawn claims can be done.

Hi Yul. I am not claiming that downgrading will preserve the Prestige $350. I know others in the past had success doing it and keeping the Prestige AF low, however I am going to try and see what happens. I’ll definitely report back.

Shawn,

Good idea to explore the Basic downgrade to eliminate maintenance fees.

Direct deposit – what is the minimum accepted? I was thinking g for linking my bank to CITI and depositing $10-$20 per month plus the bill payment to follow you’re lead on downgrading.

Hi Shawn,

I am planning to downgrade from Citigold to basic. same as you, I would like to keep my Prestidge with USD350 AF, just curious if your AF is still 350?

Hubby and I applied for the CitiGold accounts, for under the 50k TYP offer.

The points finally posted this month, after 2x $30 fees.

My question is, CAN I/we downgrade the accounts to Citi Basic checking accounts, AND not lose the 50k TYP….

OR do we need to 1st transfer the 50k TYP to our Citi Premier MC accounts, and THEN downgrade??

Sure dont want to lose 100k (2x 50k) TYP by downgrading the accounts, only to learn that we would lose the TYP if we do….

After you downgrade you’ll have 90 days to use the points before they expire. Same goes for transferring/combining TYP with other accounts. The only way to keep the points from expiring would be to not downgrade and to not move the points elsewhere. Note, I don’t know this from experience (yet) but from DoC and data points we have a pretty clear picture. Relevant link:

http://www.doctorofcredit.com/do-you-lose-points-when-downgrading-from-citigold-to-basic/

I just received my points as well. I’m cashing them out and downgrading using the same instructions here/DoC link.

I don’t know why, but I got lucky. I signed up for the account in October. I didn’t finish the requirements until December and sent a SM then to ensure I completed them. The 50k AA didn’t post until February. Then I asked to downgrade to a basic checking.

I didn’t get hit with any fees at all! And my account is still showing up with a Citigold banner.

I’m thinking I might keep the account open just in case I decide to apply for a TY Prestige.

I completed my second bill pay on 10-7 and got the points about a week ago. I had sooo many issues trying to grt this to post. Literally 7 diff communications with them and everyone would tell me it will post in 3-5 days or whatever and then that would pass. Nothing got done til i filed a cfpb complaint.

Now i al working on trying to get my airline credit to post from prestige card. Made purchase on 1-5 on allegiant and still in this fiasco.

Citi is horrible about posting within their stated times. Soo frustrated with them. But then again i am nit a profitable customer for them.

I got my points within 3 months of opening account and had no account fees charged.

One tip (from DOC, I think) was to open at end of month, do one bill pay right away and at the beginning of the next month do the 2nd one…that’s what I did.

So DOC is reporting that people are being hit for an overdraft fee if there is not enough money in there account to cover monthly fees? I am not an expert on CFPB’s overdraft rules but (1) these people must have opted into the service and (2) charging an overdraft fee to the same bank seems to be unconsicionable. Citi is not expending money to others on behalf of you. Reading this makes me angry and I truly hope Citi stops this practice – otherwise people need to start complaining to regulatory officers.

I agree it is terrible and probably not legal. Sometimes it is just best to avoid the headache in the first place so you don’t have to fight later on.

Aren’t you supposed to receive the bonus miles when 3 billing cycles have elapsed? If you opened (and presumably met the requirements) in Oct, why would it take until March 1 to post? That’s 4+ months!

I met the requirements in early Jan…when do you think i should SM them to ask for manual transfer?

It is 3 statement cycles after the closing of the statement during which you met the requirements. In other words, They add in another month since you have to wait until month 2 to hit the bill pay requirement.

Woof, ok thank you. I’ve already asked them a few times about expediting the miles, hoping i’ll get them before AA deval. But i think that’s a pipe dream :-/

At least you’re getting the miles before March 22nd. I signed up in December and was told I should be getting my bonus miles no later than April 30th. Luckily, the AA redemption I have in mind is only going up by 5k miles. Still would have been nice to get them sooner.

I had much the same experience with Citi, but it took a lot of effort to get them to actually post the points. Is Basic Checking free with any account balance? I thought it requires an account balance of $1500 to avoid fees.

You can either have $1,500 or a qualifying direct deposit and bill pay.

“Complete 1 qualifying Direct Deposit Footnote 7 AND 1 qualifying Bill Payment Footnote 2 during the statement period and pay no monthly service fee

OR

Keep $1,500 or more in prior calendar month combined average balances in either your Basic Checking or with a linked Citibank® Savings Plus account and pay no monthly service fee”

I signed up the same time you did. Sent a message in Feb asking about the miles…said I would receive them on 3/1. Never did and had to send another secure message and ended up getting the miles on 3/7.

Sending a message in Feb wouldn’t have done anything. Had to pay the same $60 you did.

Well that makes me feel better then. 🙂

Same exact story and timeline as yours. I wondered why my points didn’t post in Feb so I SM and was told I had to wait until 3/1. Around 3/4 I sent a SM and was told the points would post soon. Received them 1-2 days ago.

Going to cash out the points at 1:1 ratio using mortgage/student loan route and then downgrade and close a month later. Before I can use the points though I’m going to call them to merge all TYP since their online system wouldn’t allow it.

On another note, anyone have any recent data points on what triggers DD requirement for Citi? DoC has some pretty outdated ones. Fidelity looks to work, PayPal is wish-washy.

mine should have posted march 1 also. when I sent the secure message they told me that they were missing the W9 and therefore my account was not enrolled in the thank you Program. I had to download the form and mail it in and that extra 7-10 business days is going to cause me to pay that second monthly fee 🙁

That stinks! I think perhaps they have this figured out so we have to pay two monthly fees.

I agree. They told me my points will come in the first week of April, exactly when I have to pay my second monthly fee.