How to Combine Citi ThankYou Accounts

I’m a Citi fan, but I deal with more quirks with additional cards and how much I use their ThankYou points program. I enjoy their various ThankYou point-earning cards – the Premier bonus categories, Rewards+ roundup and points back features, Custom Cash 5x, and Double Cash consistency. But over time, I, and probably many of you, have unintentionally ended up with multiple ThankYou accounts. This can hurt us as cardholders. Luckily, we can correct this by combining ThankYou accounts online. I’ll explain how to do so below, but first, let’s discuss why you should care.

Why to Hold One ThankYou Account for All Citi Cards

Citi sometimes automatically creates multiple ThankYou accounts when a cardholder has more than one ThankYou point-earning card. It doesn’t always happen, though. There seems to be no rhyme or reason. How can this hurt us? Here’s an example to illustrate. Joe Cardholder has Premier and Rewards+ cards, and they have separate ThankYou accounts. After $4k of grocery spending on his Premier, Joe wants to redeem his 12k ThankYou points while also benefitting from the 10% points back feature of the Rewards+. But he doesn’t receive 1.2k ThankYou points back because he redeemed from the ThankYou account attached to his Premier, which is separate from the ThankYou account associated with his Rewards+. Combining ThankYou accounts solves this. Here’s how to do so.

Step-By-Step: How to Combine Citi ThankYou Accounts

Step #1 – Log into ThankYou.com

Step #2 – Once logged in, you’ll see your name on the right. Navigate to “Manage My Accounts” and click “My Citi Accounts” under your name.

Step #3 – Select “Combine My Accounts” as pictured below.

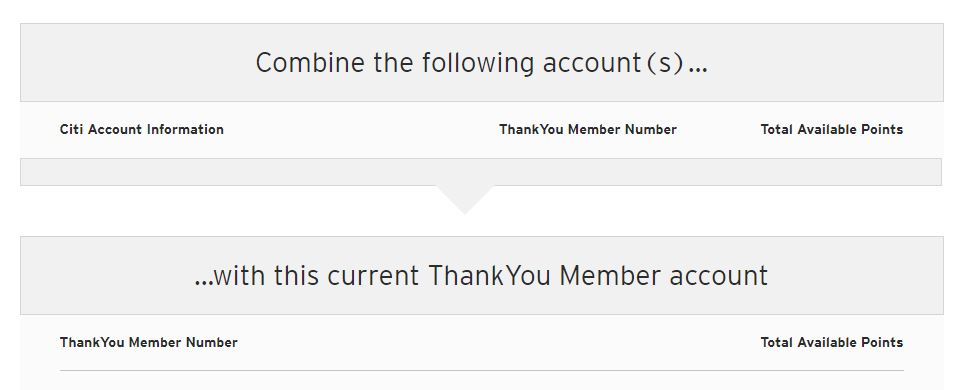

Step #4 – Select which ThankYou account to combine with your other current ThankYou account and click Continue. You’ll see something similar to below, except your various ThankYou accounts will also show up (I have none to combine currently).

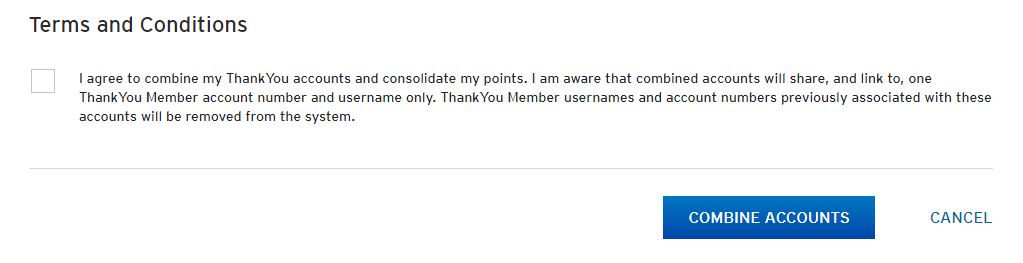

Step #5 – You’ll then be directed to a Review page. Take a look to ensure everything is correct. Review and check the Terms and Conditions box. Click Combine Accounts (see below). You’re done!

Conclusion

If your account profiles don’t exactly match (names, etc), this online combining process may not work. Many have had challenges combining online for other reasons, as well. Citi brings this up at the beginning of process, simply telling cardholders to call 800-THANKYOU if they have issues. But hopefully, the online process works for you, and you’ll be quickly on your way to receiving all your Citi ThankYou points benefits within one account. How has combining Citi ThankYou accounts worked out for you?

“Combining accounts is easy” -Citi

My three Citi cards all have different ThankYou member numbers and I’ll have to call to merge them, apparently. Citi IT strikes again!

Andrew P,

I hear you! Perhaps it’s recency bias, but I feel like this is happening now more than ever.

[…] are two instructive posts from Miles for Memories: on cashing out AmEx MR Points via Schwab and combining points from two Citi TY […]

As far as the Sears Citi what other Citi card should I get so I can combine those points to a Thank you account.

Brett,

The Sears Citi card which earns ThankYou points isn’t available for new apps or via product change. If you already hold it, though, great! Preferences vary, but I would recommend building your ThankYou point-earning card portfolio in the following order:

1. Premier

2. Double Cash

3. Rewards+

4. Custom Cash