Consumer Debt Hits All-Time High of $16.9 Trillion

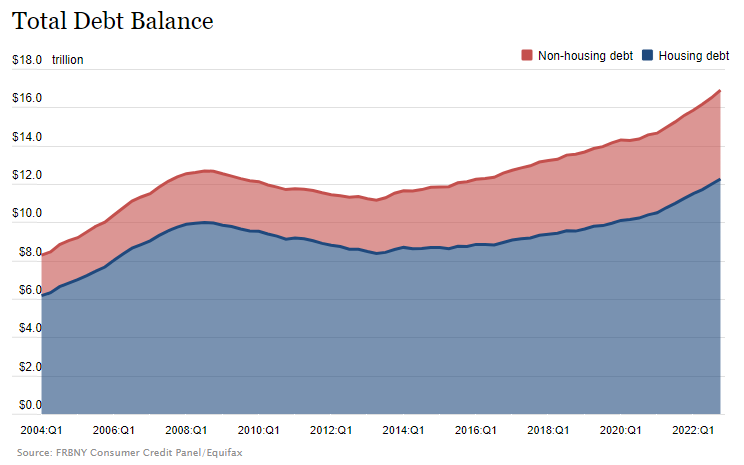

Today’s report from the New York Federal Reserve shows that consumer debt hit a new record at the end of 2022 and delinquency rates rose for most types of loans.

The report shows an increase in total household debt in the fourth quarter of 2022, increasing by $394 billion (2.4%) to $16.90 trillion. Balances now stand $2.75 trillion higher than at the end of 2019, before the pandemic recession.

Credit card balances increased by $61 billion to reach $986 billion, surpassing the pre-pandemic high of $927 billion. Mortgage balances also went up to $11.92 trillion, auto loan balances to $1.55 trillion, and student loan balances to $1.60 trillion.

The share of current debt becoming delinquent increased again in the fourth quarter for nearly all debt types, following two years of historically low delinquency transitions. The delinquency transition rate for credit cards and auto loans increased by 0.6 and 0.4 percentage points, respectively.

“Credit card balances grew robustly in the 4th quarter, while mortgage and auto loan balances grew at a more moderate pace, reflecting activity consistent with pre-pandemic levels,” said Wilbert van der Klaauw, economic research advisor at the New York Fed.

“Although historically low unemployment has kept consumer’s financial footing generally strong, stubbornly high prices and climbing interest rates may be testing some borrowers’ ability to repay their debts.”

Household Debt and Credit Developments as of Q4 2022

| CATEGORY | QUARTERLY CHANGE * (BILLIONS $) | ANNUAL CHANGE** (BILLIONS $) | TOTAL AS OF Q4 2022 (TRILLIONS $) |

| MORTGAGE DEBT | (+) $254 | (+) $993 | $11.92 |

| HOME EQUITY LINE OF CREDIT | (+) $14 | (+) $18 | $0.34 |

| STUDENT DEBT | (+) $21 | (+) $19 | $1.60 |

| AUTO DEBT | (+) $28 | (+) $94 | $1.55 |

| CREDIT CARD DEBT | (+) $61 | (+) $130 | $0.99 |

| OTHER | (+) $16 | (+) $69 | $0.51 |

| TOTAL DEBT | (+) $394 | (+) $1323 | $16.90 |