Discover Bank Savings Bonus 2017

Discover Bank is once again offering a $100 bonus for signing up for their online savings account. This offer doesn’t appear to be targeted and should be available to anyone who has never had a Discover Savings account.

The Offer

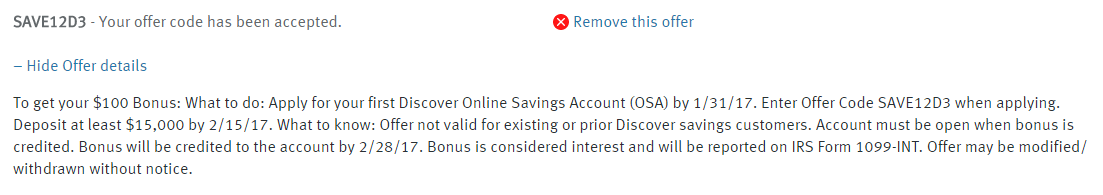

$100 bonus when you open a new account with at least $15,000.

Key Terms

- Apply by 1/31/17.

- Deposit at least $15,000 by 2/15/17.

- Offer not valid for existing or prior Discover savings customers.

- Account must be open when bonus is credited. Bonus will be credited to the account by 2/28/17.

- Bonus is considered interest and will be reported on IRS Form 1099-INT.

- Offer may be modified/ withdrawn without notice.

Related: Discover it Miles – Get 1.5% back on everything doubled the first year. (3% total cashback.)

Need to Know

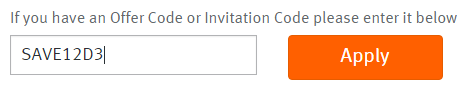

If you apply through this link, the promotion code (SAVE12D3) should auto-populate on the application. You will need to go through the screen where you enter your name, address, social security number, etc. Once you reach the funding page it should look like this:

If for some reason the code doesn’t auto-populate then fill it in. Once you click “Apply” you will see confirmation that the code has been added to your application.

Analysis

Discover has run this promotion in the past with a lower deposit requirement, but that hasn’t been for awhile. Yes, this money is taxable, but considering you have to keep it in the account for less than a month, the interest earned may be worth it. I like these Discover Bank promotions since they don’t require you to jump through any hoops. Simplicity has value.

Conclusion

If you have never had a Discover Savings account before and are looking for a way to put your liquid money to work, this new Discover Bank Savings Bonus 2017 may be the right deal for you. You may be able to hold out for a deal with a lesser deposit requirement, but of course there is no guarantee of that. Happy saving!

I applied the Discover savings account on Oct 27 using the promotional code. (The promotional code stated that account needed to be opened by Oct 31.) For an unknown reason, my application was selected for the manual review verification. a Discover bank’s representative contacted me for verification on Nov 2 and the application was approved on Nov 2. The Discover representative that approved my application told me that the promotional code still applied to my situation,. i.e., even though the application was approved on Nov 2 , the online application was submitted before Oct 31. I was assured that if I meet the deposit requirement, the bonus would be rewarded to my account by Nov 31. I also have a secure email message confirmation from another Discover representative. However, the bonus was not credited to my account as of Dec 2. When I contacted Discover that I did meet the deposit requirement (>$20k) by Nov 15 for the sign up bonus, I was told the bonus was not rewarded to me because the application was approved on Dec 2. I explained the situation to the rep and I also pointed out I had a secure message confirmation that stated the promotional code was applicable to my account. However, the rep told me that I was given incorrect information from previous representatives. Discover Bank has lost my trust.

[…] special thank you goes out to Miles to Memories for posting about this latest Discover Online Savings Account bonus […]

Correction. A bank does a Currency Transaction Report, not the 8300 (which is for non-bank businesses). They may report it, but, again, I’ve never had any problems come from transferring money between banks to get best rates. I do it a fair amount for amounts.

If you’re concerned because of the $10K aspect, the IRS web site says “a wire transfer does not constitute cash for Form 8300 reporting”. The same is true for a check. I know I’ve never had a problem.

I wouldn’t think an in and out a month apart would make any difference either.

Discover savings has a rate as good as any (about 1%), so I wouldn’t ne in a rush to clear the money out, unless you need it.

I’m a bit afraid of some of these deals, simply because I fear that moving $15K out of –and back into– my current checking account would raise a red flag. Anybody want to comment on this?

I have never had any issues.