Does The Aspire Resort Credit Earn Points? Yes It Does!

This will be a quick post but I wanted to alert you guys to another nice little perk of the Aspire and American Express in general. When you use Amex Offers or airline incidental credits you have always been able to earn points on the full cost of the purchase. That adds another 1,000 Membership Rewards points to your stash when you use your $200 airline incidental credit on your Amex Platinum card. But does it work the same way for the Aspire card’s resort credit?

Data Point

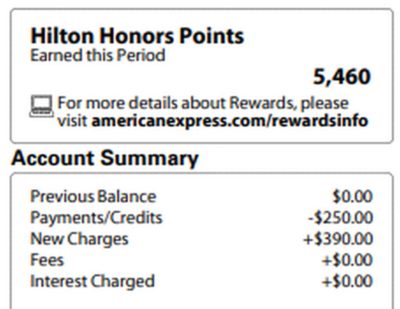

My wife recently went to San Juan, Puerto Rico and used her card’s resort credit while there. She ran up quite the food and beverage tab…

But when the points posted she earned the points for the full amount, not subtracting out the $250 credit amount (14X earning). She also earned the 20X points from her Diamond status that comes with the card. That is because the purchases are billed back to the room but you can also use it on your room rate which gets the same return. That is an additional 5,000 Hilton Honor points not including whatever promo they may have going on.

This is different than others like the Chase Sapphire Reserve where you don’t earn anything on the $300 incidental purchase each year, which is one of the reasons it should always be discounted.

That nets you an extra 3,500 Hilton Honors points each year from the resort credit. Not to mention the 1,750 you earn from the $250 airline incidental (which earns 7X). When you add that to the 5,000 points you earn for the cash charge at the hotel it totals over 10,000 points. I didn’t include these additional 10,000 points in my decision making process to keep or cancel the card. But it does net you another $50 or so in value each year which is a nice little extra perk.

Conclusion

This is one of the better under the radar perks of American Express cards, that their credits earn points. The nice thing about this resort credit is that you also earn points based on your status. And with the gifted Diamond status that can add up. If you max out the card’s perks you are assured an extra 10,000 Hilton Honor points each and every year. Talk about some value!

I am a little confused too. You mention MR points, but with Aspire is it not Hilton points ?

I was talking about how when you use the airline incidental credit on the Platinum card it earns Membership Rewards points for the purchase. And then asked the question on whether or not it works the same way with the Aspire card.

Trying to understand the math in your post.

I understand that the airline credit yields $250 x 7 points/dollar = 1,750 points. Which is totally separate from your wife’s Hilton stay.

With regard to the other points — are you simply referring to the 34x points that you earn for staying at a designated resort and paying the hotel bill with Aspire? In other words; $250 of the amount spent at that resort, regardless of whether it was F&B or room rate or anything else, would earn 34x if you it gets charged to the room and you settle your hotel bill with Aspire? (so $250 x 34 points/dollar = 8,500 points)? And it costs you nothing because you get a $250 resort credit on your Aspire bill?

Did I get that right??!!

Now that the Sapphire Reserve no longer earns points on purchases toward the travel credit, why not just purchase a refundable fare (e.g. Southwest Business Select) as soon as the credit is available each year, wait for the credit to post, then cancel the reservation? Seems like this would enable all true travel purchases to earn 3x for the rest of the year.

I believe some people do this but there is potential to upset Chase doing something like that. Gotta make a personal decision there.

I forgot to mention something above, what is about the Pro rated AF? If I upgrade today from the No fee Amex Hilton to the Aspire, I will be charged the $450 in first month or I will only be charged $225 AF this year and $225 in March 24th of year 2020?

Pls explain the pro rated AF thing. My wife had the aspire bonus upgrade offer from her Ascend card but now it disappeared and it is gone. Otherwise I would just do the upgrade for her and avoid her Ascend AF. Her ascend AF is coming in May 2019.

thank you

You will get charged a prorated cost on the $450 this year until your normal anniversary date for the card and then you will be billed $450 on that date for the next year. So if 6 months from your anniversary you would get charged $225 and then $450 6 months from now for the following year.

sorry, I didn’t understand, if I upgrade to this card in late March 2019, what’s the prorated AF I will be charged? How much in fees I will be paying until March 25th of 2020? prorated means i will be charged only some of the $450 until March 2020?

As I understand it:

It depends on the anniversary date of your no-AF Hilton card you upgrade from. If you signed up for your current card on January 1st you’d have about nine months until your anniversary date. You would pay $450 x (9 months / 12 months) ~= $337.50.

Come 1/1/2020 you will be charged the full $450 AF because upgrading/downgrading does not affect your anniversary date.

Exactly – everything depends on the date that you opened the no fee Hilton card.

I think you have to book a room first and pay for it with the Aspire card to trigger the Hilton resort credit.

Any know this? Can just go to any of those resort hotel with no room reservation and eat meals to get the credit?

Amex may just shut you down before you get the bonus for trying to meet the $4K big spend Req in just 3 months.

The moment they see big spend even of $500, they call and demand tax returns etc, lots of headache. Had to shut to my card cos it was too much of a hassle.

From the data points I have seen you have to charge the restaurant charges back to the room for it to trigger. Some have had luck purchasing a gift card at a property on the list though but not all resorts have gift cards.

I have upgrade offer to this but I am scared of the $450 AF. The resort credit only works for stays on resort hotel only that are very few right? Just can’t go to a Hyatt resort hotel to eat meal worth $250 for the resort credit? Airline gift card for $250 airline credit but do the airline GC have resale value? Where do you sell this for decent value? Thanks

You can use it at any property on this list:

https://www3.hilton.com/en/resorts/index.html?WT.mc_id=zkdCSAA0US1CI2REP4Resorts5US7BR840893

The airline credit works the same as the other airline incidentals. Southwest still works that way and you can sell them around 80% on resell sites.

https://www.giftcardwiki.com/gift-cards/Southwest

For the resort credit to work.,I have to book a room at Hyatt resort hotel or I don’t have to book room and can just go to those on the list above and eat meals or drinks to get the credit?

I don’t believe it does but some people have had luck buying a gift card at one of the properties which you could then use in the the restaurant. It is YMMV on that though.