Data Point: You Can Double Dip Bank Of America Secured Business Cards

Yes, Virginia, there is a Santa Claus–and in this case it means you can double dip Bank of America secured business credit cards. Here’s what I learned from my own recent experience (obviously hoping it would work out this way). This is obviously just one data point, but it’s a quality data point to share for those wondering about this.

My Previous Bank of America Business Card Application

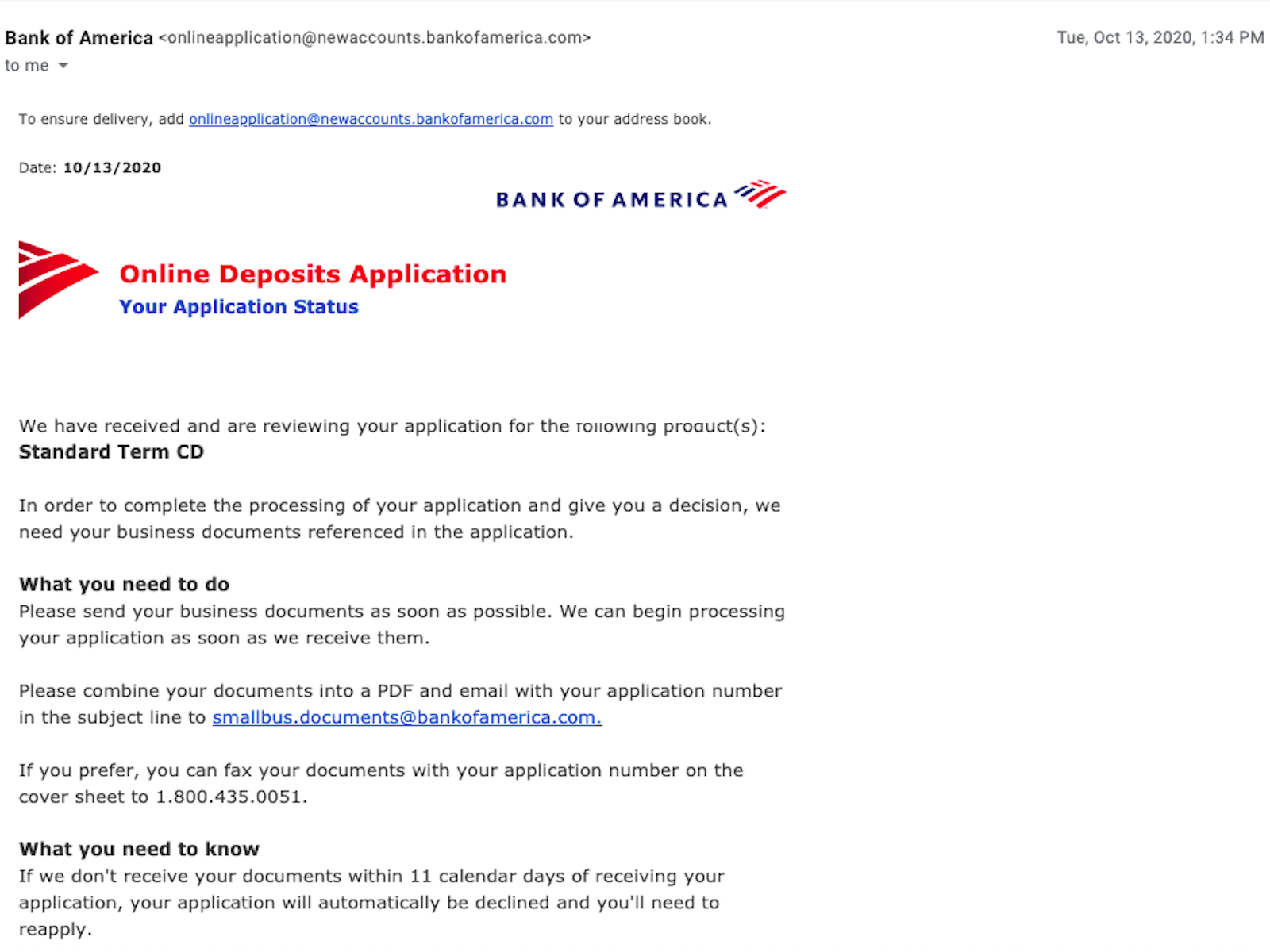

Back in October 2020, I applied for the Bank of America Alaska Airlines Visa Business Credit Card (card details are here). I wrote in this article about the experience of applying for it, being instantly rejected, and then getting the card. Here are the ‘need to know’ elements:

1 – Denial

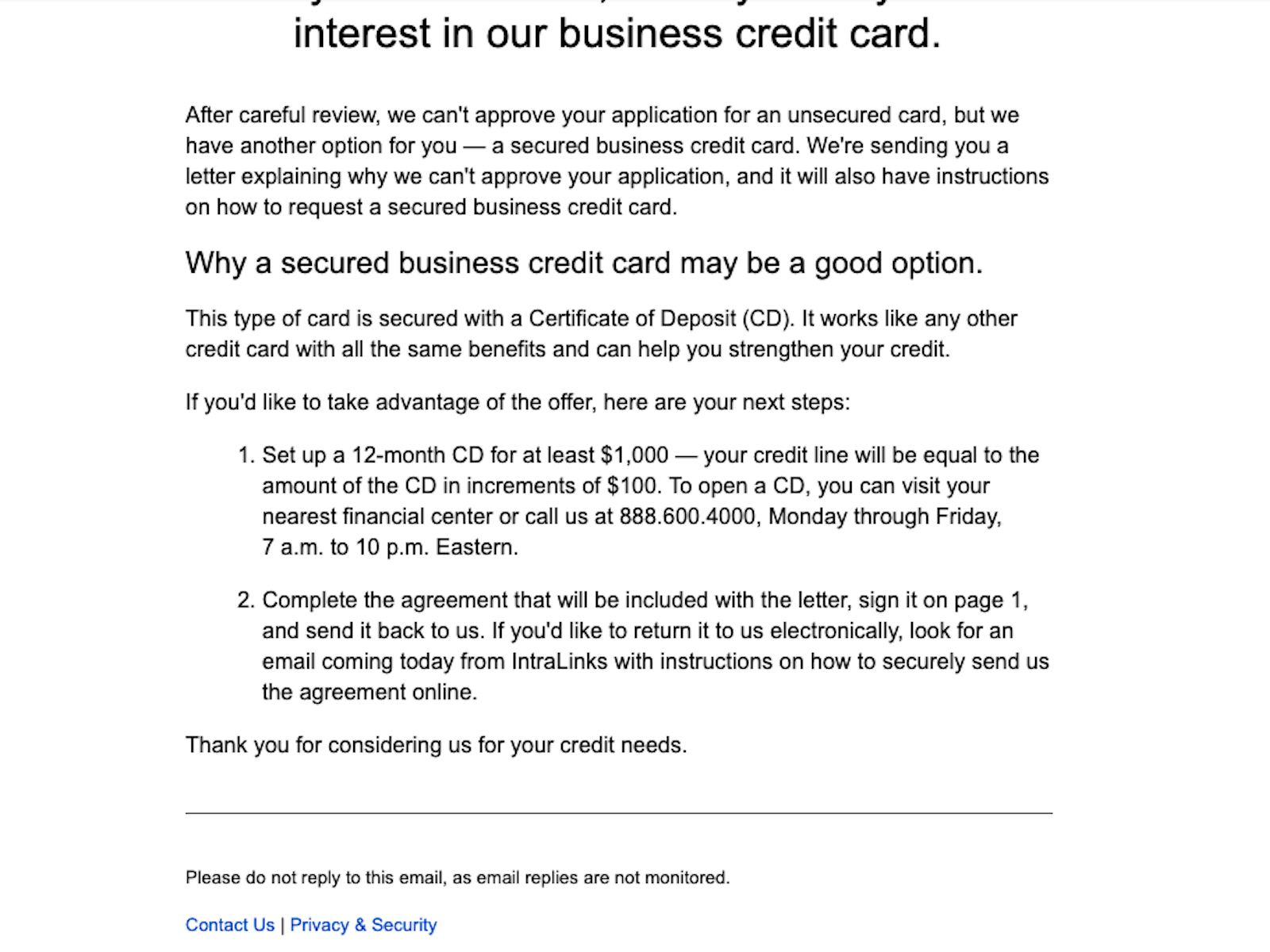

Bank of America denied my application for the card but said I could get a secured credit card. At first, I wasn’t sure if this would be the same card I applied for (earning Alaska miles, the welcome offer). I called and spoke with a business representative at the number in the email. He assured me I could still get the SAME card with the SAME welcome offer from my original application. I just needed to secure the card.

2 – Offered me the card as a secured card

The minimum, as shown in the email, to secure a card is a $1,000 CD. You must leave the CD in tact for a minimum of 12 months. If you close the CD or take out money, they’ll close your secured credit card that’s backed by the CD. You can’t use the CD to pay the balance on the card, either.

I saw the future opportunity that perhaps my wife could get instantly approved for this card in the future, so I did the CD route. Given that my wife isn’t very happy when making recon or retention calls, I saw the silver lining as getting ‘2 for 1’ if it worked out.

3 – Got a Bank of America secured business card

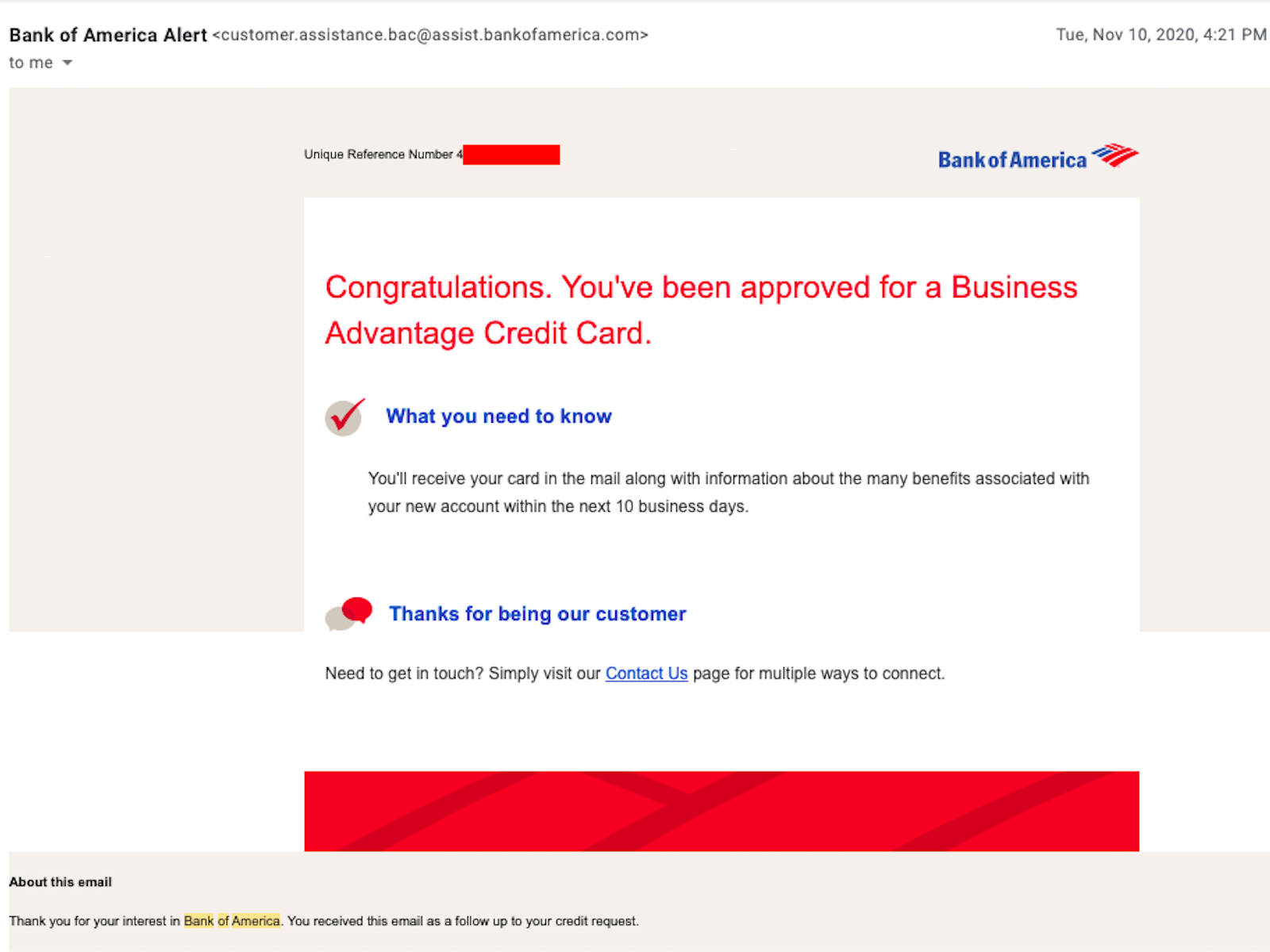

It took a few weeks to set up everything, resolve my questions, and then submit the application. I was approved for the card 4 days after submitting the finished Bank of America secured business card application through their online platform. Though the email shows the verbiage below, it was the exact Alaska Airlines card I originally applied for.

Wife Gets The Same Thing

As I said, the reason I was willing to do this is because I thought parking $1,000 in a Bank of America CD was worth it if it could turn into “2 for 1”. But, could I use the same CD to secure 2 cards at the same time?

It turns out that you can!

My wife applied for the very same Bank of America Alaska Airlines Visa Business Credit Card last month. That is an interval of 6 months from when I got the card. It could be possible with less waiting time, this was just what worked for us on timing with other things going on.

She received the very same denial email / email offering a secured card application.

And she received the same form to fill out via their online platform.

Best part: she was approved! To be clear: we didn’t add any money to the CD from the time I did my application until now. We didn’t open another CD or do anything special. Her approval time was 5 days from submitting the secured application documents.

We used the same CD with the same minimum amount required, and we were able to open 2 separate Bank of America secured business credit cards with it.

Final Thoughts

Now that I’ve seen this is possible for myself, I may keep the CD open. It could help for the future, possibly with more business credit cards from Bank of America. We know BOA’s credit card application rules give preference to those with an existing relationship already. The fact we can do this online and use the same pool of money to secure more than one card makes keeping the CD open for “double dip” purposes worth it.

Did they do another hard pull on the secured card application after the pull they did for the denied application?

How did you accomplish the required spending with a 1,000 secured credit limit?

Thank you, Dee

Yes, another pull because it was in the name of a different person. Have to spend & pay the balance quickly, since the limit was $1k but needs $2k of spend in 90 days. Almost like a debit card, if you think of it that way.

Thanks for the great article/datapoint! I understand the CD was in the LLC’s name, which you are both member of. But what about the credit cards? The first one is in that same LLC’s name and in your name (and your SSN)? And the second card is in that same LLC’s name and in your wife’s name (and her SSN)?

JR – yes. First card in my name, as a business card for the LLC. 2nd in my wife’s. Yes to your question about SSN.

[…] Data Point: You Can Double Dip Bank Of America Secured Business Cards by MtM. […]

[…] Data Point: You Can Double Dip Bank Of America Secured Business Cards by MtM. […]

Is this a joint CD, in both your names? Thanks for the datapoint.

Yes, since we are both listed as the 2 joint members of the LLC on the business paperwork submitted when opening the CD last year. So it’s in the name of the LLC, but our names are attached to that.

What biz documents did they want?

For me, they asked for proof of relationship to business.

For my wife, they asked for proof of business registration with some type of government agency.

1 page of documents was all we needed for either person.

It’s a no-coffee day for me so I’m a little thick but I wanted to be sure of my facts before possibly trying this at home: This is a legit business and you’re both officers or something similar in the company?

Yes, 50/50 members in an LLC

So just to be clear, you were able to get two secured credit cards using ONE CD of $1k in deposits?

Yes

$1k is the minimum you can do for the CD, I did the minimum, and I used it to secure 2 cards, about 6mo apart. It’s still securing card 1 (the minimum 1yr hasn’t finished) while my wife used that same CD to secure card 2.